Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Energas plc is a shipping company, which specialises in transportation of crude oil using tankers. The company is constantly exanding and it currently considers

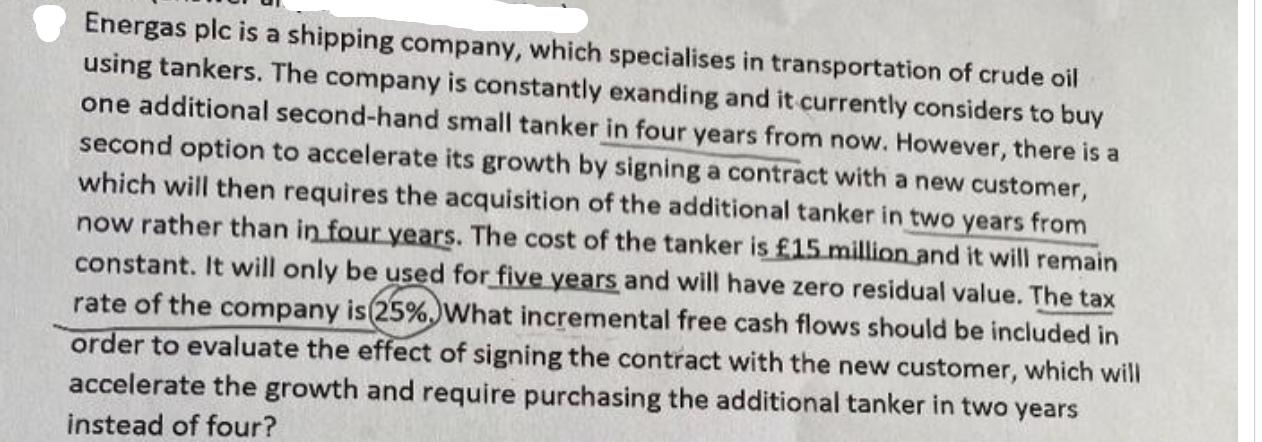

Energas plc is a shipping company, which specialises in transportation of crude oil using tankers. The company is constantly exanding and it currently considers to buy one additional second-hand small tanker in four years from now. However, there is a second option to accelerate its growth by signing a contract with a new customer, which will then requires the acquisition of the additional tanker in two years from now rather than in four years. The cost of the tanker is 15 million and it will remain constant. It will only be used for five years and will have zero residual value. The tax rate of the company is (25%. What incremental free cash flows should be included in order to evaluate the effect of signing the contract with the new customer, which will accelerate the growth and require purchasing the additional tanker in two years instead of four?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate the effect of signing the contract with the new customer and accelerating the purchase of the additional tanker we need to calculate the i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started