Question

Sales are expected to ride by 22 percent in the coming year, and the components of the income statement and balance sheet that are expected

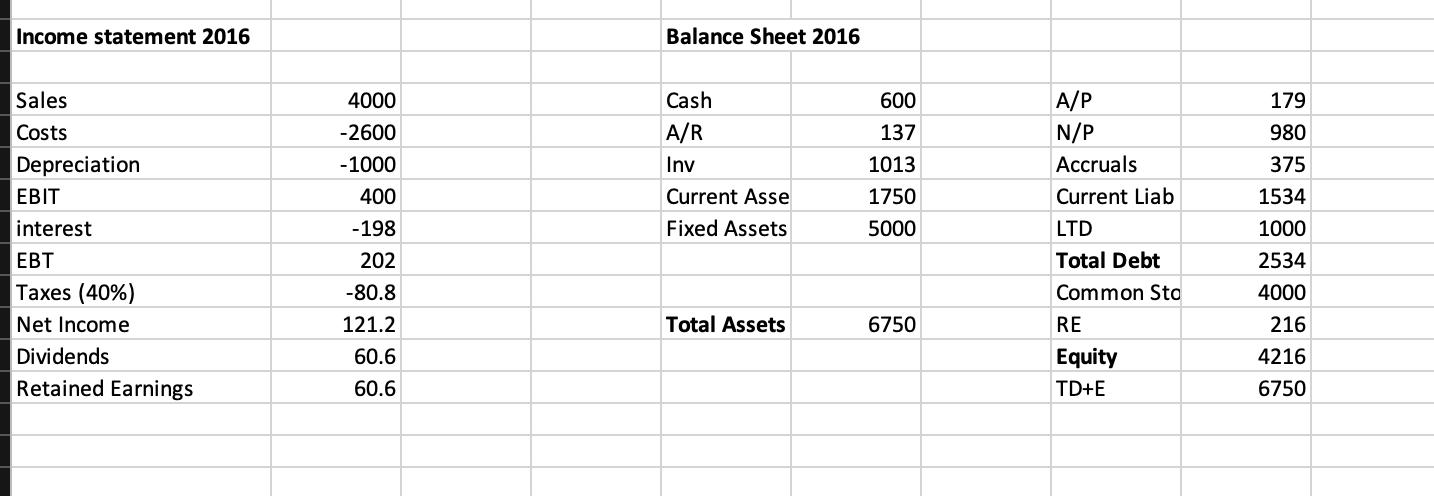

Sales are expected to ride by 22 percent in the coming year, and the components of the income statement and balance sheet that are expected to increase at the same 22 percent rate as sales, assuming a constant dividend payment. Fixed assets were being operated at 40 percent of capacity in 2016, but all other assets were used to full capacity. Under-utilized fixed assets cannot be sold. Assuming that the firm wants to cover external funding with half equity, 25 percent long-term debt and the remainder from notes payable. What is the external funding requirements and ROE using the percentage of sales method?

Income statement 2016 Balance Sheet 2016 Sales Costs 4000 Cash 600 A/P 179 -2600 A/R 137 N/P 980 Depreciation EBIT interest -1000 400 -198 Inv 1013 Accruals 375 Current Asse 1750 Current Liab 1534 Fixed Assets 5000 LTD 1000 EBT 202 Total Debt 2534 Taxes (40%) -80.8 Common Sto 4000 Net Income 121.2 Total Assets 6750 RE 216 Dividends 60.6 Equity 4216 Retained Earnings 60.6 TD+E 6750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started