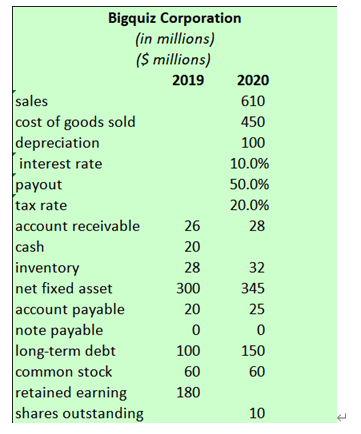

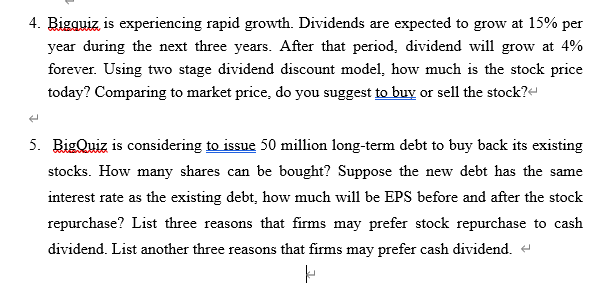

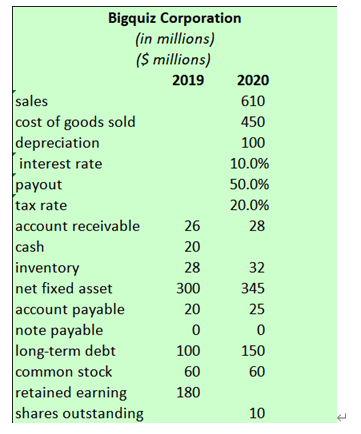

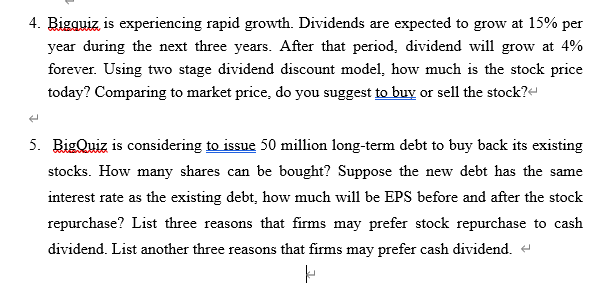

sales Bigquiz Corporation (in millions) ($ millions) 2019 2020 610 cost of goods sold 450 depreciation 100 interest rate 10.0% payout 50.0% tax rate 20.0% account receivable 26 28 cash 20 inventory 28 32 net fixed asset 300 345 account payable 20 25 note payable 0 0 0 long-term debt 100 150 common stock 60 60 retained earning 180 shares outstanding 10 C 4. Biggyiz is experiencing rapid growth. Dividends are expected to grow at 15% per year during the next three years. After that period, dividend will grow at 4% forever. Using two stage dividend discount model, how much is the stock price today? Comparing to market price, do you suggest to buy or sell the stock?' 5. BigQuiz is considering to issue 50 million long-term debt to buy back its existing stocks. How many shares can be bought? Suppose the new debt has the same interest rate as the existing debt, how much will be EPS before and after the stock repurchase? List three reasons that firms may prefer stock repurchase to cash dividend. List another three reasons that firms may prefer cash dividend. 4 k sales Bigquiz Corporation (in millions) ($ millions) 2019 2020 610 cost of goods sold 450 depreciation 100 interest rate 10.0% payout 50.0% tax rate 20.0% account receivable 26 28 cash 20 inventory 28 32 net fixed asset 300 345 account payable 20 25 note payable 0 0 0 long-term debt 100 150 common stock 60 60 retained earning 180 shares outstanding 10 C 4. Biggyiz is experiencing rapid growth. Dividends are expected to grow at 15% per year during the next three years. After that period, dividend will grow at 4% forever. Using two stage dividend discount model, how much is the stock price today? Comparing to market price, do you suggest to buy or sell the stock?' 5. BigQuiz is considering to issue 50 million long-term debt to buy back its existing stocks. How many shares can be bought? Suppose the new debt has the same interest rate as the existing debt, how much will be EPS before and after the stock repurchase? List three reasons that firms may prefer stock repurchase to cash dividend. List another three reasons that firms may prefer cash dividend. 4 k