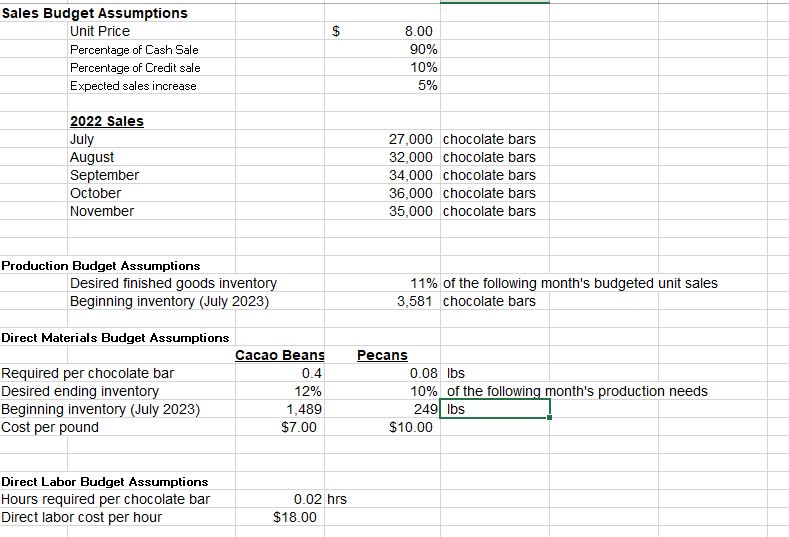

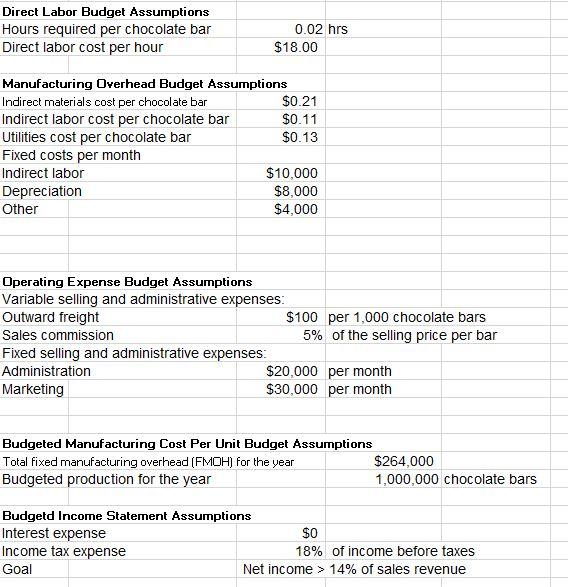

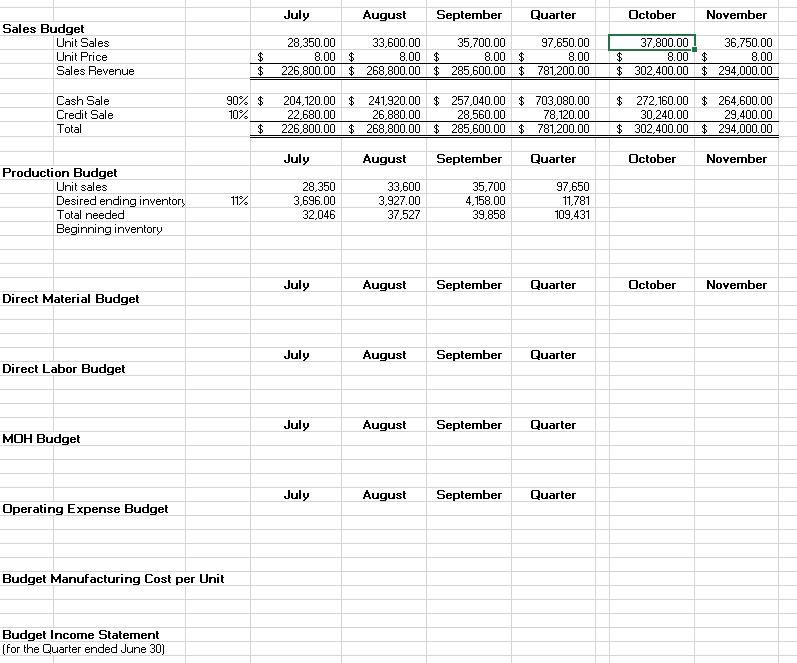

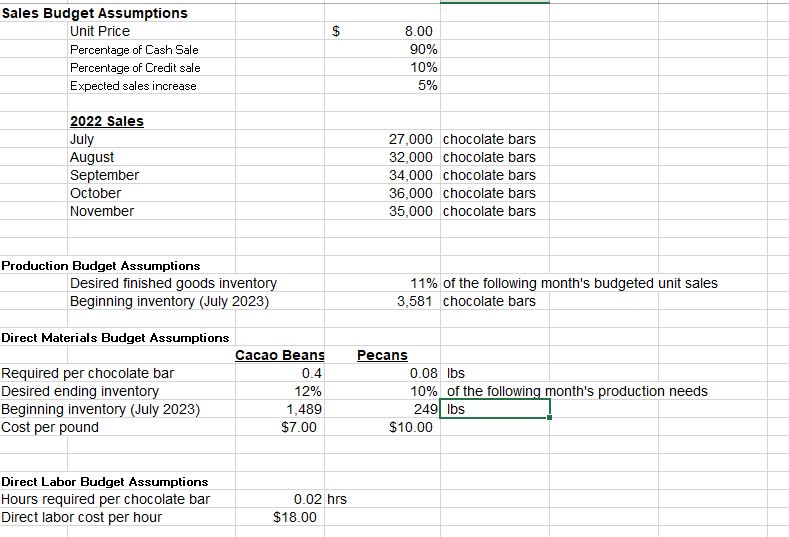

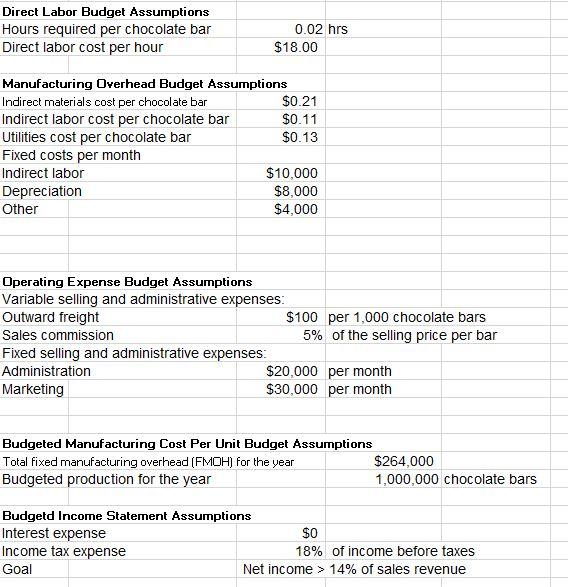

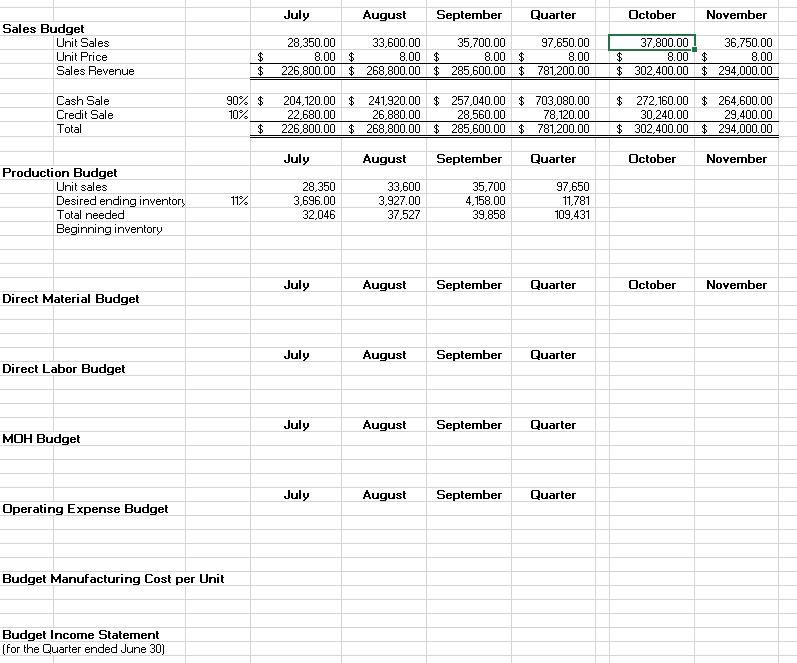

Sales Budget Assumptions 2022 Sales July 27,000 chocolate bars August 32,000 chocolate bars September 34,000 chocolate bars October 36,000 chocolate bars November 35,000 chocolate bars Production Budget Assumptions Desired finished goods inventory 11% of the following month's budgeted unit sales Beginning inventory (July 2023) 3,581 chocolate bars Direct Materials Budget Assumptions Cacao Beans Pecans Required per chocolate bar 0.40.08 lbs Desired ending inventory 10% of the following month's production needs Beginning inventory (July 2023) Cost per pound Direct Labor Budget Assumptions Hours required per chocolate bar 0.02hrs Direct labor cost per hour $18.00 Direct Labor Budget Assumptions Hours required per chocolate bar Direct labor cost per hour $18.00 Manufacturing Qverhead Budget Assumptions \begin{tabular}{l|r} \hline Indirect materials cost per chocolate bar & $0.21 \\ \hline Indirect labor cost per chocolate bar & $0.11 \\ \hline Utilities cost per chocolate bar & $0.13 \\ \hline Fixed costs per month & $10,000 \\ \hline Indirect labor & $8,000 \\ \hline Depreciation & $4,000 \end{tabular} Dperating Expense Budget Assumptions Variable selling and administrative expenses: Outward freight $100 per 1,000 chocolate bars Sales commission 5% of the selling price per bar Fixed selling and administrative expenses: Administration $20,000 per month Marketing $30,000 per month Budgeted Manufacturing Cost Per Unit Budget Assumptions Total fixed manufacturing overhead (FMIOH) for the year $264,000 Budgeted production for the year 1,000,000 chocolate bars Budgetd Income Statement Assumptions Interest expense $0 Income tax expense 18% of income before taxes Goal Net income >14% of sales revenue Dperating Expense Budget Budget Manufacturing Cost per Unit Budget Income Statement (for the Quarter ended June 30) Sales Budget Assumptions 2022 Sales July 27,000 chocolate bars August 32,000 chocolate bars September 34,000 chocolate bars October 36,000 chocolate bars November 35,000 chocolate bars Production Budget Assumptions Desired finished goods inventory 11% of the following month's budgeted unit sales Beginning inventory (July 2023) 3,581 chocolate bars Direct Materials Budget Assumptions Cacao Beans Pecans Required per chocolate bar 0.40.08 lbs Desired ending inventory 10% of the following month's production needs Beginning inventory (July 2023) Cost per pound Direct Labor Budget Assumptions Hours required per chocolate bar 0.02hrs Direct labor cost per hour $18.00 Direct Labor Budget Assumptions Hours required per chocolate bar Direct labor cost per hour $18.00 Manufacturing Qverhead Budget Assumptions \begin{tabular}{l|r} \hline Indirect materials cost per chocolate bar & $0.21 \\ \hline Indirect labor cost per chocolate bar & $0.11 \\ \hline Utilities cost per chocolate bar & $0.13 \\ \hline Fixed costs per month & $10,000 \\ \hline Indirect labor & $8,000 \\ \hline Depreciation & $4,000 \end{tabular} Dperating Expense Budget Assumptions Variable selling and administrative expenses: Outward freight $100 per 1,000 chocolate bars Sales commission 5% of the selling price per bar Fixed selling and administrative expenses: Administration $20,000 per month Marketing $30,000 per month Budgeted Manufacturing Cost Per Unit Budget Assumptions Total fixed manufacturing overhead (FMIOH) for the year $264,000 Budgeted production for the year 1,000,000 chocolate bars Budgetd Income Statement Assumptions Interest expense $0 Income tax expense 18% of income before taxes Goal Net income >14% of sales revenue Dperating Expense Budget Budget Manufacturing Cost per Unit Budget Income Statement (for the Quarter ended June 30)