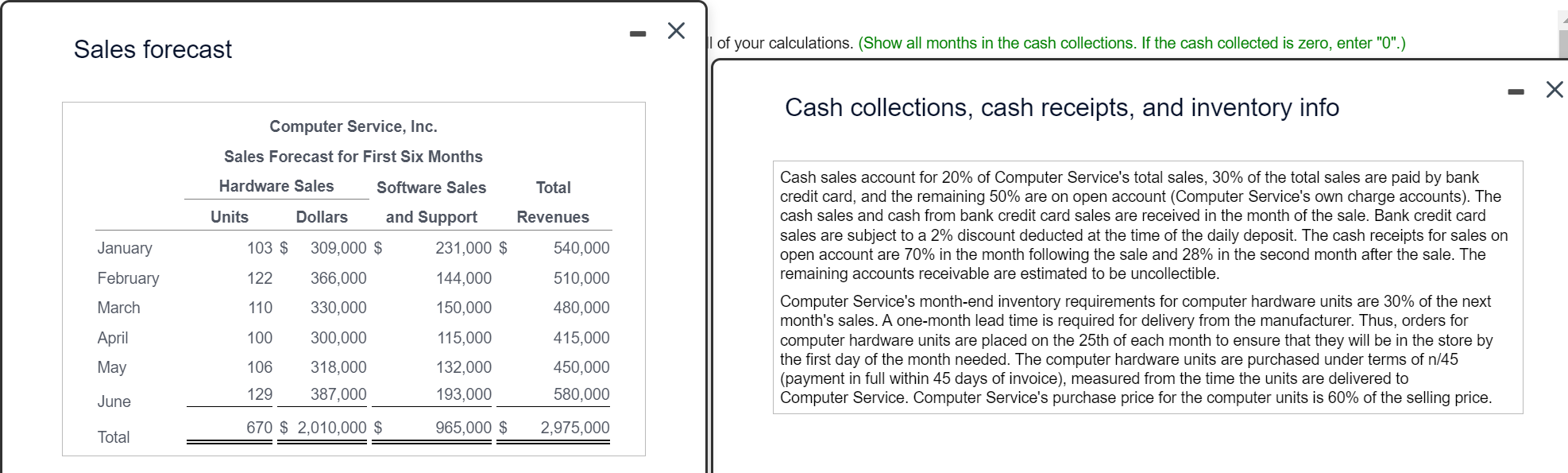

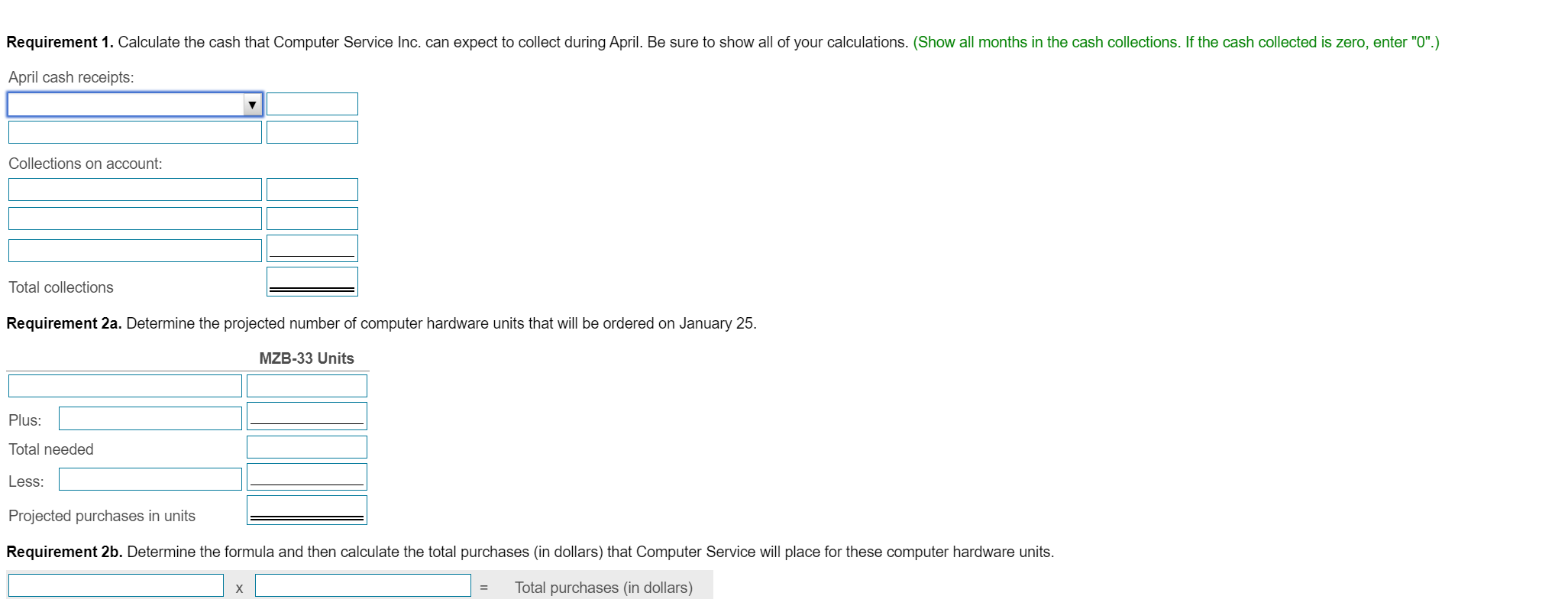

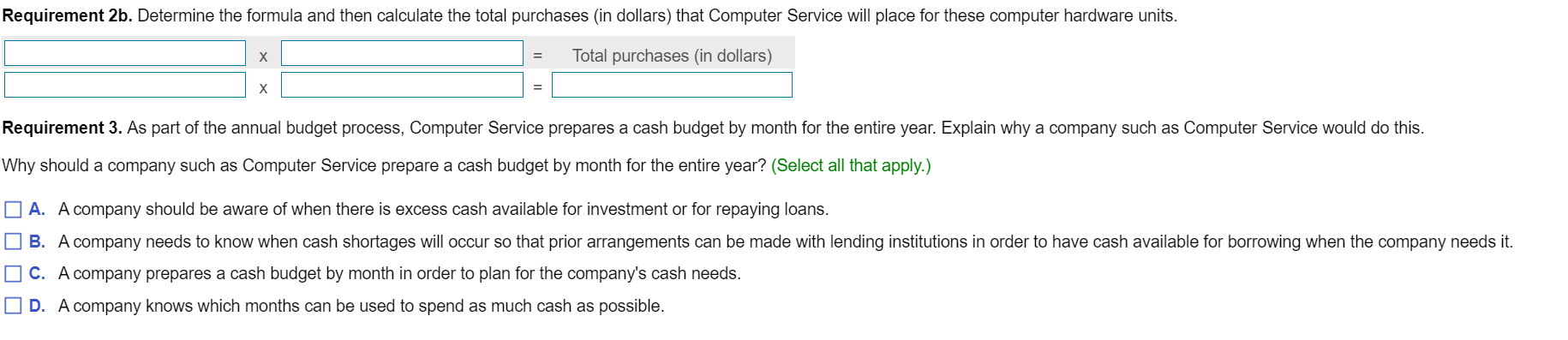

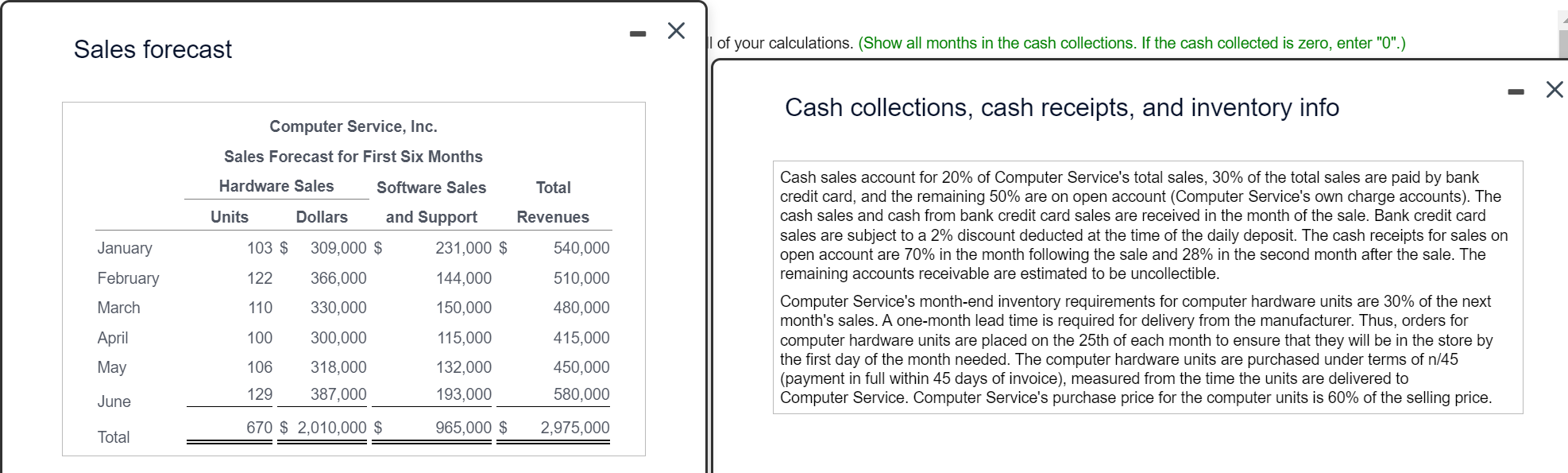

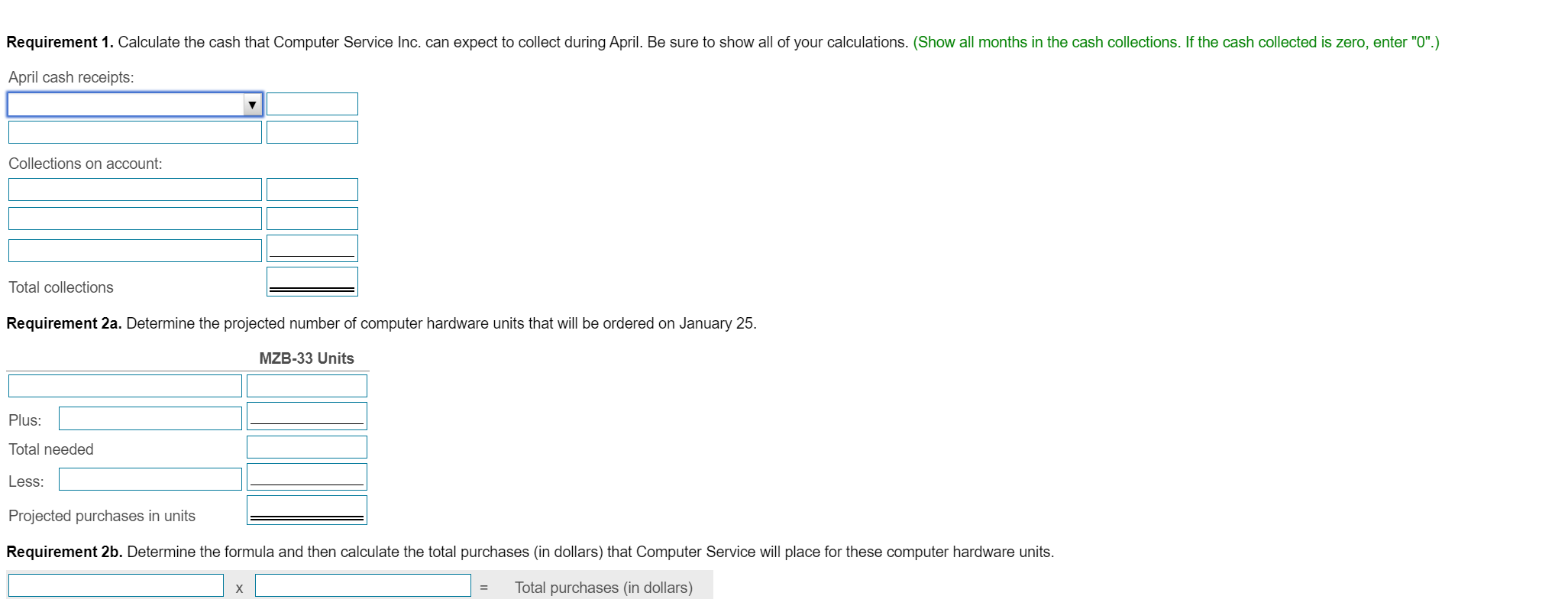

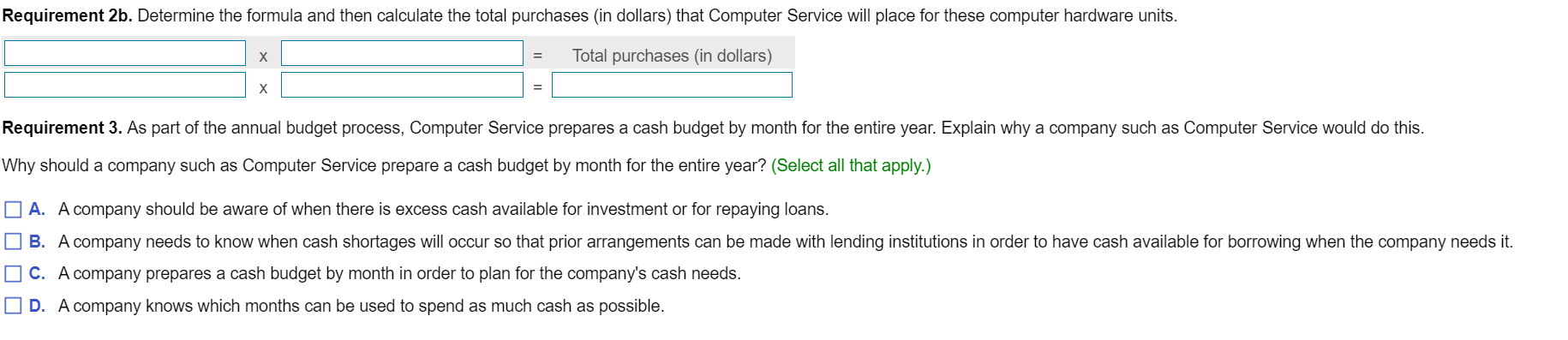

Sales forecast I of your calculations. (Show all months in the cash collections. If the cash collected is zero, enter "0".) Cash collections, cash receipts, and inventory info Cash sales account for 20% of Computer Service's total sales, 30% of the total sales are paid by bank credit card, and the remaining 50% are on open account (Computer Service's own charge accounts). The cash sales and cash from bank credit card sales are received in the month of the sale. Bank credit card sales are subject to a 2% discount deducted at the time of the daily deposit. The cash receipts for sales on open account are 70% in the month following the sale and 28% in the second month after the sale. The remaining accounts receivable are estimated to be uncollectible. Computer Service's month-end inventory requirements for computer hardware units are 30% of the nex month's sales. A one-month lead time is required for delivery from the manufacturer. Thus, orders for the first day of the month needed. The computer hardware units are purchased under terms of n/45 (payment in full within 45 days of invoice), measured from the time the units are delivered to Computer Service. Computer Service's purchase price for the computer units is 60% of the selling price. Requirement 2a. Determine the projected number of computer hardware units that will be ordered on January 25. Requirement 2b. Determine the formula and then calculate the total purchases (in dollars) that Computer Service will place for these computer hardware units. xx=Totalpurchases(indollars)=[ Why should a company such as Computer Service prepare a cash budget by month for the entire year? (Select all that apply.) A. A company should be aware of when there is excess cash available for investment or for repaying loans. C. A company prepares a cash budget by month in order to plan for the company's cash needs. D. A company knows which months can be used to spend as much cash as possible. Sales forecast I of your calculations. (Show all months in the cash collections. If the cash collected is zero, enter "0".) Cash collections, cash receipts, and inventory info Cash sales account for 20% of Computer Service's total sales, 30% of the total sales are paid by bank credit card, and the remaining 50% are on open account (Computer Service's own charge accounts). The cash sales and cash from bank credit card sales are received in the month of the sale. Bank credit card sales are subject to a 2% discount deducted at the time of the daily deposit. The cash receipts for sales on open account are 70% in the month following the sale and 28% in the second month after the sale. The remaining accounts receivable are estimated to be uncollectible. Computer Service's month-end inventory requirements for computer hardware units are 30% of the nex month's sales. A one-month lead time is required for delivery from the manufacturer. Thus, orders for the first day of the month needed. The computer hardware units are purchased under terms of n/45 (payment in full within 45 days of invoice), measured from the time the units are delivered to Computer Service. Computer Service's purchase price for the computer units is 60% of the selling price. Requirement 2a. Determine the projected number of computer hardware units that will be ordered on January 25. Requirement 2b. Determine the formula and then calculate the total purchases (in dollars) that Computer Service will place for these computer hardware units. xx=Totalpurchases(indollars)=[ Why should a company such as Computer Service prepare a cash budget by month for the entire year? (Select all that apply.) A. A company should be aware of when there is excess cash available for investment or for repaying loans. C. A company prepares a cash budget by month in order to plan for the company's cash needs. D. A company knows which months can be used to spend as much cash as possible