Question

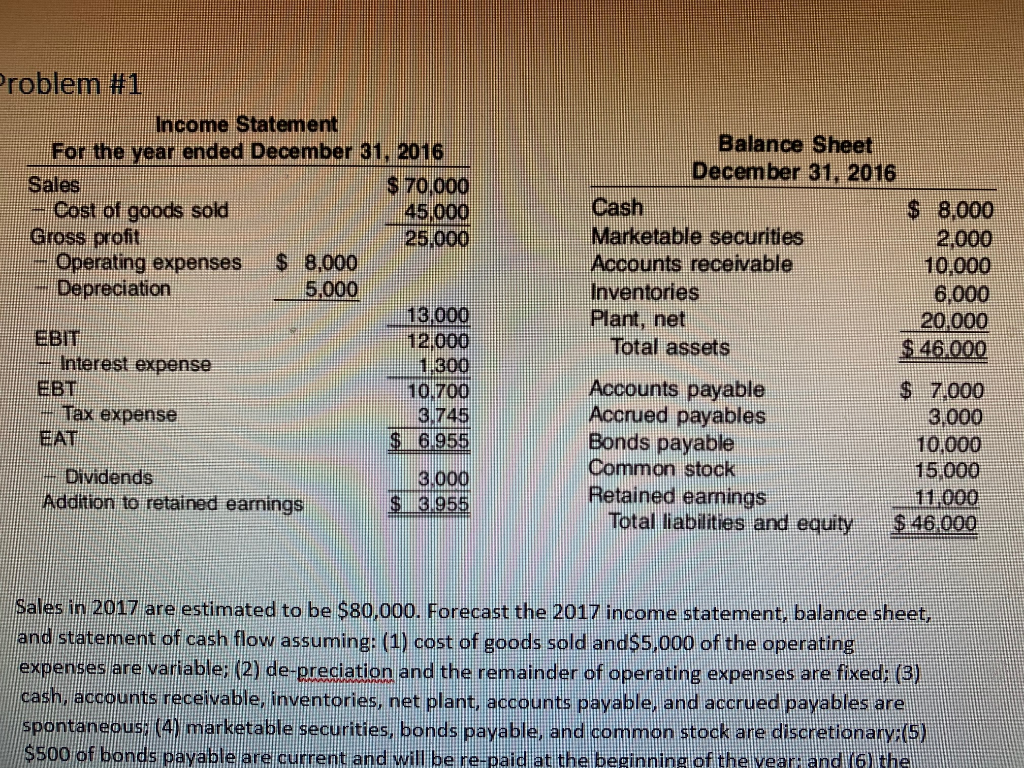

Sales in 2017 are estimated to be $80,000. Forecast the 2017 income statement, balance sheet, and statement of cash flow assuming: (1) cost of goods

Sales in 2017 are estimated to be $80,000. Forecast the 2017 income statement, balance sheet, and statement of cash flow assuming: (1) cost of goods sold and$5,000 of the operating expenses are variable; (2) de-preciation and the remainder of operating expenses are fixed; (3) cash, accounts receivable, inventories, net plant, accounts payable, and accrued payables are spontaneous; (4) marketable securities, bonds payable, and common stock are discretionary;(5) $500 of bonds payable are current and will be re-paid at the beginning of the year; and (6) the firm will maintain its 2016 dividend payout ratio in year 2017.

Analyze the pro-forma statements you prepared for the firm above. Special note: when calculating the ratios that require an average, do not calculate the average. For example, Return on Assets formula is EAT/Average Total Assets. For this test, you will do EAT/Total Assets instead. This will apply to ROE as well.

- Calculate the financial ratios listed below from the 2016 statements

- Time interest earned

- Net profit margin

- Return on assets

- Current ratio

- Quick ratio

- Debt ratio

- Return on equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started