Answered step by step

Verified Expert Solution

Question

1 Approved Answer

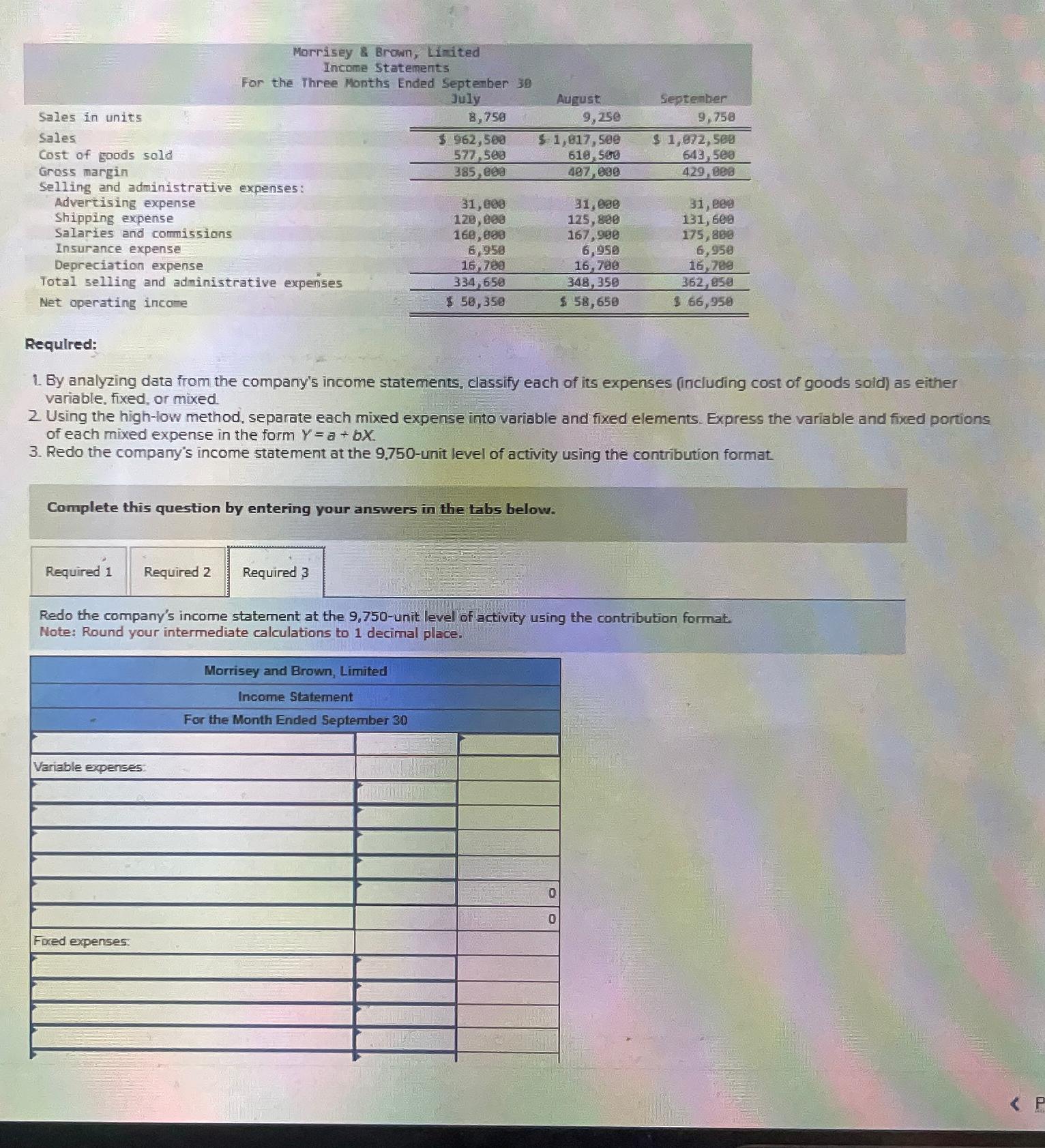

Sales in units Sales Cost of goods sold Gross margin Selling and administrative expenses: Advertising expense Shipping expense Salaries and commissions Insurance expense Morrisey

Sales in units Sales Cost of goods sold Gross margin Selling and administrative expenses: Advertising expense Shipping expense Salaries and commissions Insurance expense Morrisey & Brown, Limited Income Statements For the Three Months Ended September 30 July Depreciation expense Total selling and administrative expenses Net operating income Required 1 Required 2 Required 3 8,750 $ 962,500 577,500 385,000 Variable expenses: 31,000 120,000 160,000 Fixed expenses: 6,958 16,780 334,650 $ 50,350 Complete this question by entering your answers in the tabs below. Morrisey and Brown, Limited Income Statement For the Month Ended September 30 August $1,817,500 610,500 487,099 Required: 1. By analyzing data from the company's income statements, classify each of its expenses (including cost of goods sold) as either variable, fixed, or mixed. 9,250 2. Using the high-low method, separate each mixed expense into variable and fixed elements. Express the variable and fixed portions of each mixed expense in the form Y = a + bx. 3. Redo the company's income statement at the 9,750-unit level of activity using the contribution format. 31,000 125,880 167,998 6,950 16,709 348,350 $ 58,650 September 9,758 $ 1,072,500 643,500 429,098 Redo the company's income statement at the 9,750-unit level of activity using the contribution format. Note: Round your intermediate calculations to 1 decimal place. 0 0 31, 809 131,609 175,808 6,950 16,789 362,850 $ 66,958

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Required 1 Classifying expenses as variable fixed or mixed Cost of goods sold Variable directly rela...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started