Answered step by step

Verified Expert Solution

Question

1 Approved Answer

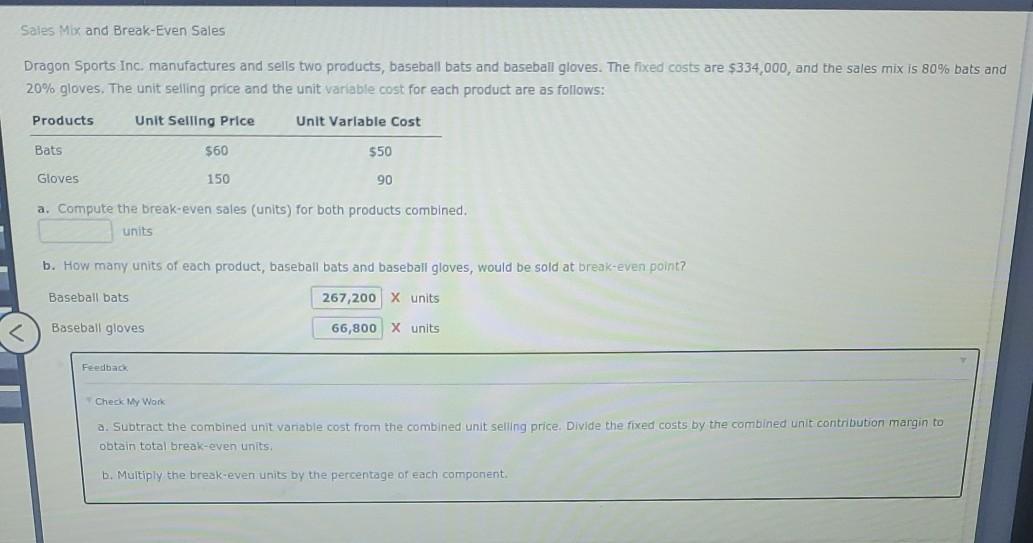

Sales Mix and Break-Even Sales Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $334,000, and the

Sales Mix and Break-Even Sales Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $334,000, and the sales mix is 80% bats and 20% gloves. The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Bats $60 550 Gloves 150 90 a. Compute the break-even sales (units) for both products combined. units b. How many units of each product, baseball bats and baseball gloves, would be sold at break-even point? Baseball bats 267,200 X units Baseball gloves 66,800 X units Feedbac Check My Work a. Subtract the combined unit variable cost from the combined unit selling price Divide the fixed costs by the combined unit contribution margin to obtain total break-even units b. Multiply the break-even units by the percentage of each component

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started