Question

Sales: November, 2022 Actual Sales were $1,500,000 and December, 2022 Actual Sales were $2,100,000 Budgeted Sales for the first 5 months of 2023 are:

Sales: November, 2022 Actual Sales were

$1,500,000and December, 2022 Actual Sales were

$2,100,000\ Budgeted Sales for the first 5 months of 2023 are:\ January 30,000 units\ February 40,000 units\ March 50,000 units\ April 45,000 units\ May 35,000 units\ Budgeted selling price is

$(60)/()unit\ The company wants to maintain a finished goods inventory equal to

40%of next month's budgeted units of sales.\ All purchases of materials are made on account.

30%of the month's purchases are paid in the month of purchase and the remaining

70%are paid the following month.\ Each unit of production requires 2 direct labor hours. The direct labor rate per hour is

$(6)/()hour and all labor costs are paid by the end of the month.\ Variable manufacturing overhead per direct labor hour is

$2. The budgeted monthly fixed manufacturing overhead is

$200,000which includes monthly depreciation of

$25,000.The company will be acquiring some additional equipment in the first quarter of the year. They will purchase equipment for

$300,000in cash in January.\ Dividends of

$150,000will be paid out in March.\ repayment of the principal and interest will occur at the end of the month. Borrowings and repayments are done in increments of

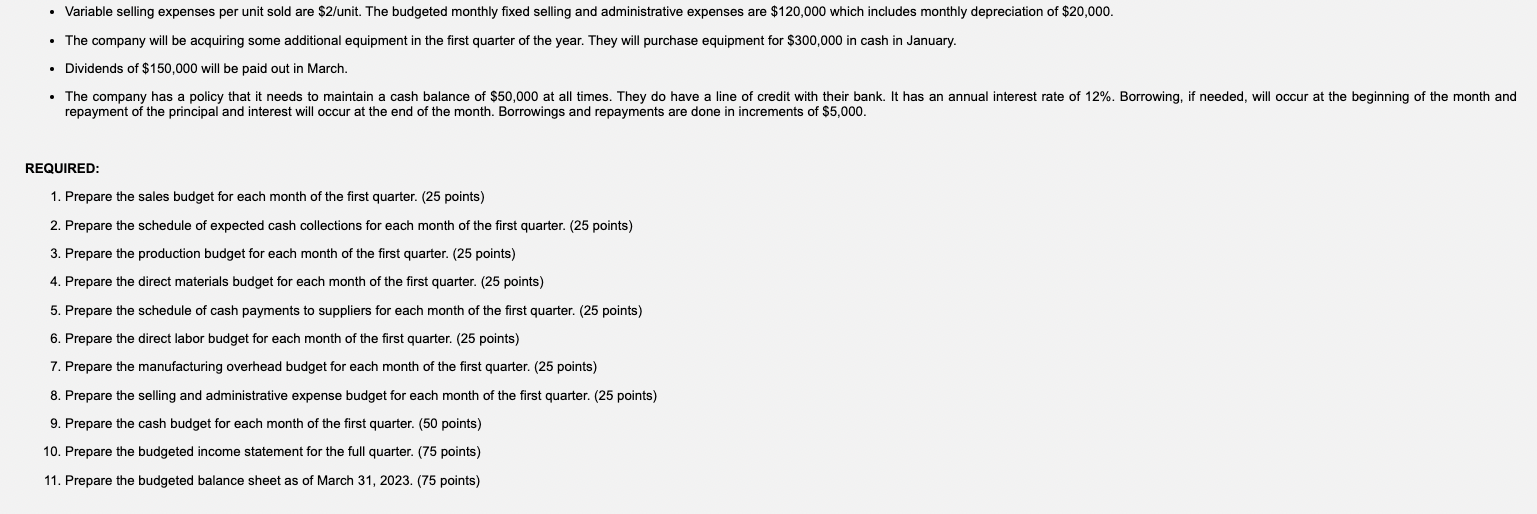

$5,000.\ REQUIRED:\ Prepare the sales budget for each month of the first quarter. \ Prepare the schedule of expected cash collections for each month of the first quarter. \ Prepare the production budget for each month of the first quarter. \ Prepare the direct materials budget for each month of the first quarter.\ Prepare the schedule of cash payments to suppliers for each month of the first quarter. \ Prepare the direct labor budget for each month of the first quarter. \ Prepare the manufacturing overhead budget for each month of the first quarter. \ Prepare the selling and administrative expense budget for each month of the first quarter. \ Prepare the cash budget for each month of the first quarter. \ Prepare the budgeted income statement for the full quarter. \ Prepare the budgeted balance sheet as of March 31 , 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started