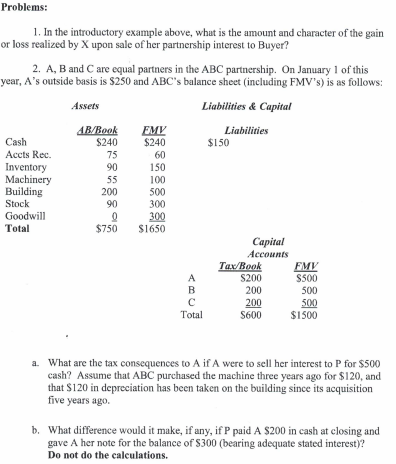

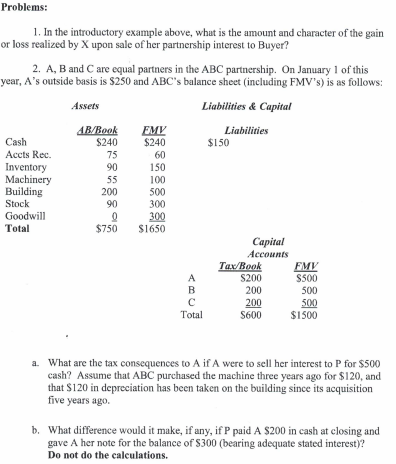

Sales of Partnership Interests Introductory Example: Consider the following simple, three person general partnership: Assets Liabilities & Capital Liabilities SO Cash Accts Rec. Land AB/Book S30 0 30 S60 FMV $30 60 60 $150 Y Z Total Capital Accounts Tax/Book EMV $20 $50 20 50 20 50 $60 $150 X sells her interest in the partnership to Buyer for $50 cash. A number of important tax consequences will result from the sale. First, what is the amount and character of X's gain from the sale? Second, what is Buyer's outside basis in his newly acquired partnership interest, and what are the balances in his book and tax capital accounts? And finally, how much income must Buyer report if the partnership collects the accounts receivable, or sells the land? Before moving to the more complicated facts of the problems below, you will be first asked to answer these questions with respect to these simple facts. Part A: Consequences to Sellers Problems: 1. In the introductory example above, what is the amount and character of the gain or loss realized by X upon sale of her partnership interest to Buyer? 2. A, B and Care equal partners in the ABC partnership. On January 1 of this year, A's outside basis is $250 and ABC's balance sheet (including FMV's) is as follows: Assets Liabilities & Capital Liabilities $150 Cash Accts Rec. Inventory Machinery Building Stock Goodwill Total AB/Rook $240 75 90 55 200 90 0 $750 EMV $240 60 150 100 500 300 300 $1650 B Capital Accounts Tax/Book FMV S200 $500 200 500 200 500 S600 $1500 Total a. What are the tax consequences to A if A were to sell her interest to P for $500 cash? Assume that ABC purchased the machine three years ago for $120, and that $120 in depreciation has been taken on the building since its acquisition five years ago. b. What difference would it make, if any, if p paid A $200 in cash at closing and gave A her note for the balance of $300 (bearing adequate stated interest)? Do not do the calculations. Sales of Partnership Interests Introductory Example: Consider the following simple, three person general partnership: Assets Liabilities & Capital Liabilities SO Cash Accts Rec. Land AB/Book S30 0 30 S60 FMV $30 60 60 $150 Y Z Total Capital Accounts Tax/Book EMV $20 $50 20 50 20 50 $60 $150 X sells her interest in the partnership to Buyer for $50 cash. A number of important tax consequences will result from the sale. First, what is the amount and character of X's gain from the sale? Second, what is Buyer's outside basis in his newly acquired partnership interest, and what are the balances in his book and tax capital accounts? And finally, how much income must Buyer report if the partnership collects the accounts receivable, or sells the land? Before moving to the more complicated facts of the problems below, you will be first asked to answer these questions with respect to these simple facts. Part A: Consequences to Sellers Problems: 1. In the introductory example above, what is the amount and character of the gain or loss realized by X upon sale of her partnership interest to Buyer? 2. A, B and Care equal partners in the ABC partnership. On January 1 of this year, A's outside basis is $250 and ABC's balance sheet (including FMV's) is as follows: Assets Liabilities & Capital Liabilities $150 Cash Accts Rec. Inventory Machinery Building Stock Goodwill Total AB/Rook $240 75 90 55 200 90 0 $750 EMV $240 60 150 100 500 300 300 $1650 B Capital Accounts Tax/Book FMV S200 $500 200 500 200 500 S600 $1500 Total a. What are the tax consequences to A if A were to sell her interest to P for $500 cash? Assume that ABC purchased the machine three years ago for $120, and that $120 in depreciation has been taken on the building since its acquisition five years ago. b. What difference would it make, if any, if p paid A $200 in cash at closing and gave A her note for the balance of $300 (bearing adequate stated interest)? Do not do the calculations