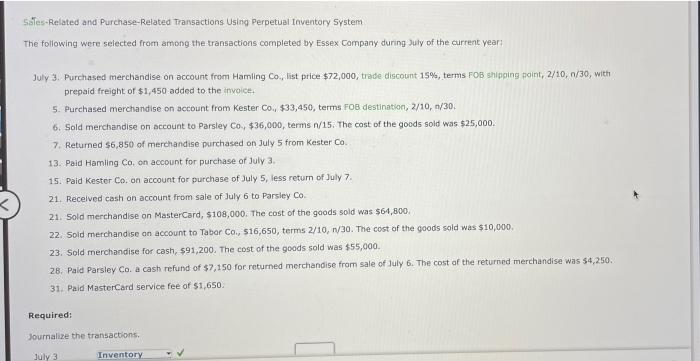

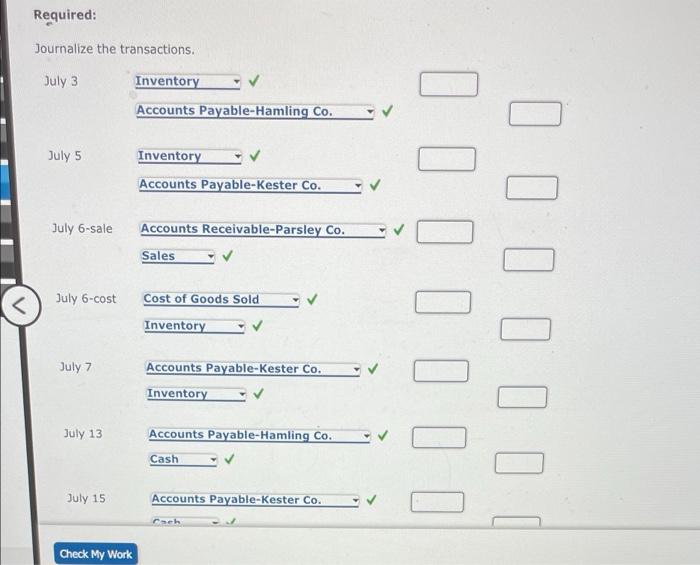

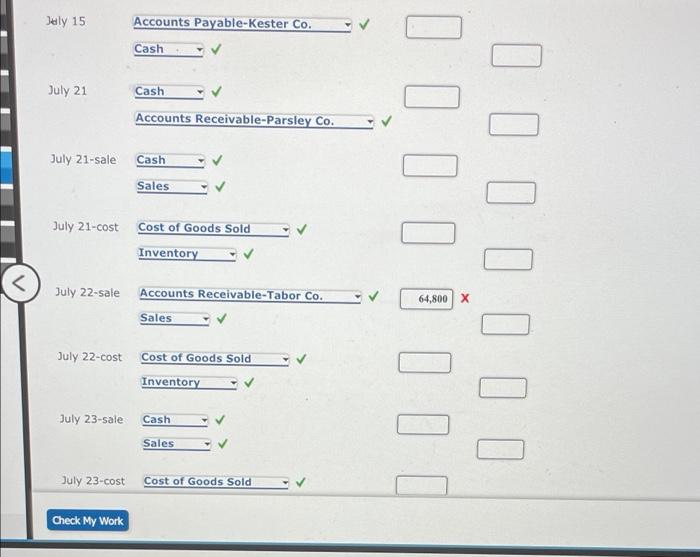

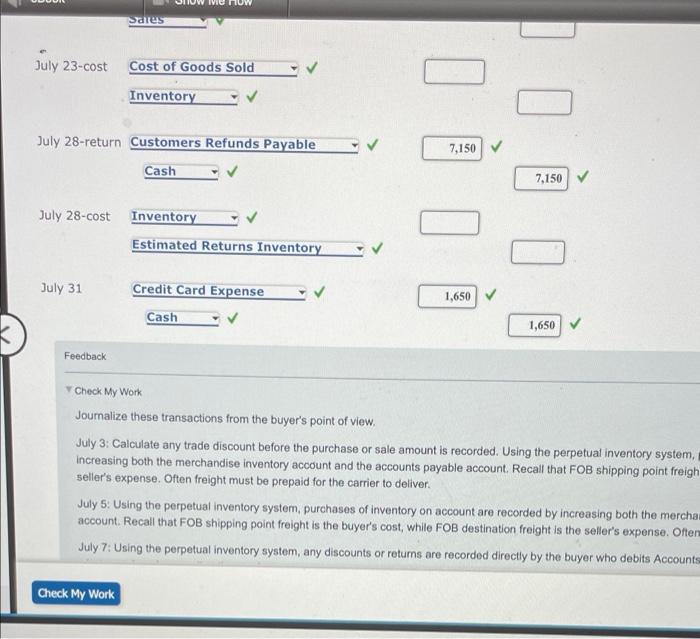

Sales Related and Purchase-Related Transactions Using Perpetual taventory System The following were selected from among the transactions completed by Essex Company during July of the current year July 3. Purchased merchandise on account from Hamling Co., list price $72,000, trade discount 15%, terms FOB shipping point, 2/10, n/30, with prepaid freight of $1,450 added to the invoice 5. Purchased merchandise on account from Kester Co. $33,450, terms FOB destination, 2/10, 1/30. 6. Sold merchandise on account to Parsley Co., $36,000, terms /15. The cost of the goods sold was $25,000 7. Returned $6,850 of merchandise purchased on July 5 from Kester Co. 13. Paid Hamling Co, on account for purchase of July 3 15. Pald Kester Co. on account for purchase of July 5, less return of July 7 21. Received cash on account from sale of July 6 to Parsley Co 21. Sold merchandise on MasterCard, $108,000. The cost of the goods sold was $64,800 22. Sold merchandise on account to Tabor Co., 516,650, terms 2/10, 1/30. The cost of the goods sold was $10,000. 23. Sold merchandise for cash, 591,200. The cost of the goods sold was $55,000 28. Paid Parsley Co, a cash refund of $7,150 for returned merchandise from sale of July 6. The cost of the returned merchandise was $4,250. 31. Paid MasterCard service fee of $1,650. Required: Journalize the transactions. July 3 Inventory Required: Journalize the transactions. July 3 Inventory Accounts Payable-Hamling Co. July 5 Inventory Accounts Payable-Kester Co. July 6-sale Accounts Receivable-Parsley Co. Sales July 6-cost Cost of Goods Sold Inventory ] 0 0 0 0 July 7 Accounts Payable-Kester Co. Inventory 1 July 13 Accounts Payable-Hamling Co. Cash July 15 Accounts Payable-Kester Co. seh Check My Work July 15 Accounts Payable-Kester Co. Cash July 21 Cash Accounts Receivable-Parsley Co. July 21-sale Cash Sales July 21-cost Cost of Goods Sold Inventory I DIO July 22-sale Accounts Receivable-Tabor Co. Sales 64,800 X July 22-cost Cost of Goods Sold Inventory July 23-sale Cash Sales July 23-cost Cost of Goods Sold Check My Work Sales July 23-cost Cost of Goods Sold Inventory July 28-return Customers Refunds Payable 7,150 Cash 7,150 July 28-cost Inventory Estimated Returns Inventory July 31 1,650 Credit Card Expense Cash 1,650 Feedback Check My Work Joumalize these transactions from the buyer's point of view, July 3: Calculate any trade discount before the purchase or sale amount is recorded. Using the perpetual inventory system, increasing both the merchandise inventory account and the accounts payable account. Recall that FOB shipping point freigh seller's expense. Often freight must be prepaid for the carrier to deliver July 6: Using the perpetual inventory system, purchases of inventory on account are recorded by increasing both the merchan account. Recall that FOB shipping point freight is the buyer's cost, while FOB destination freight is the seller's expense. Often July 7: Using the perpetual inventory system, any discounts or returns are recorded directly by the buyer who debits Accounts Check My Work