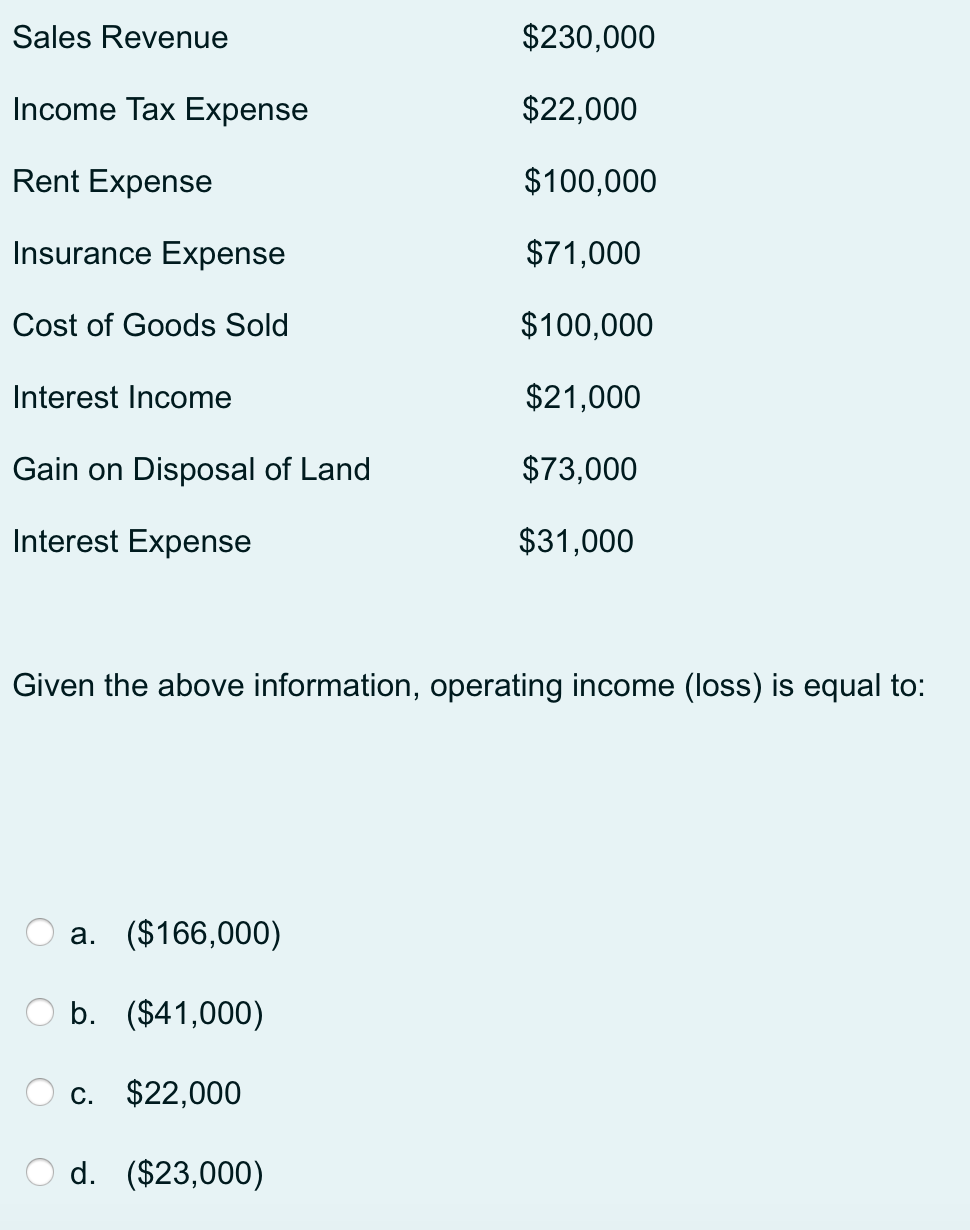

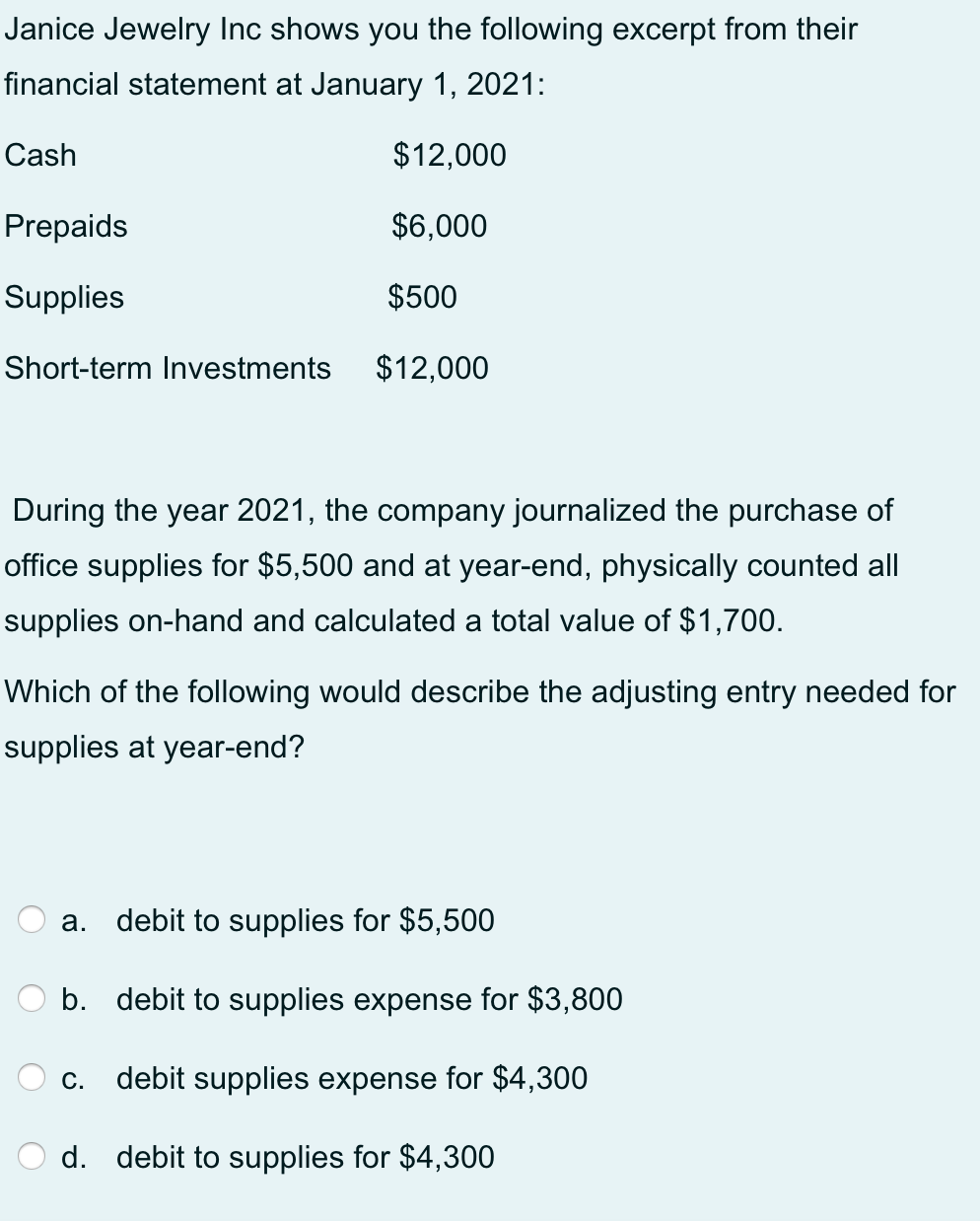

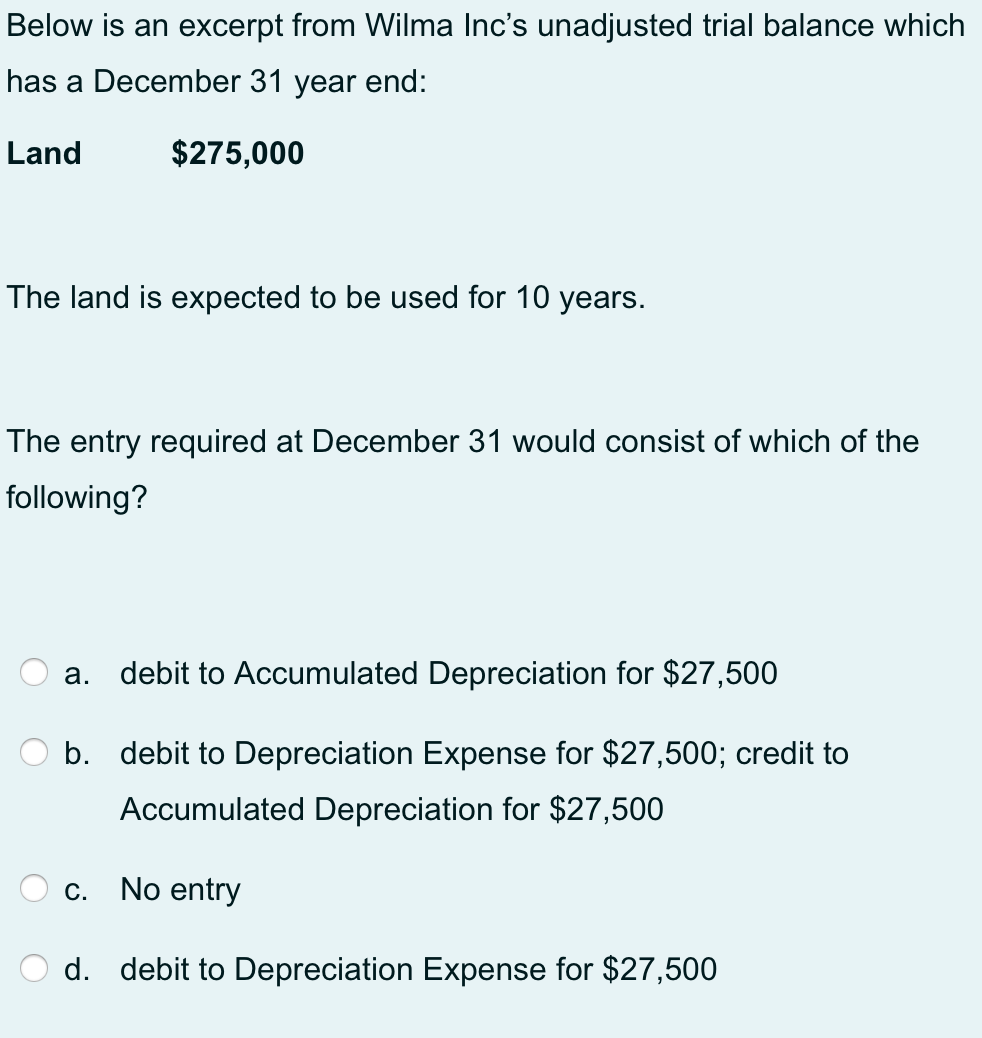

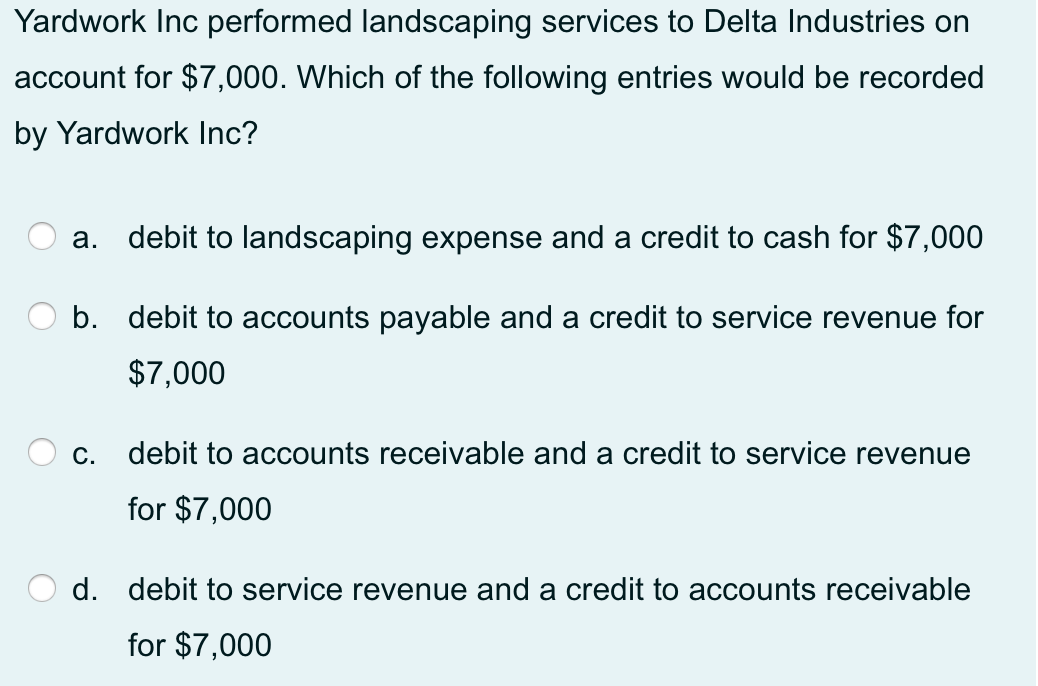

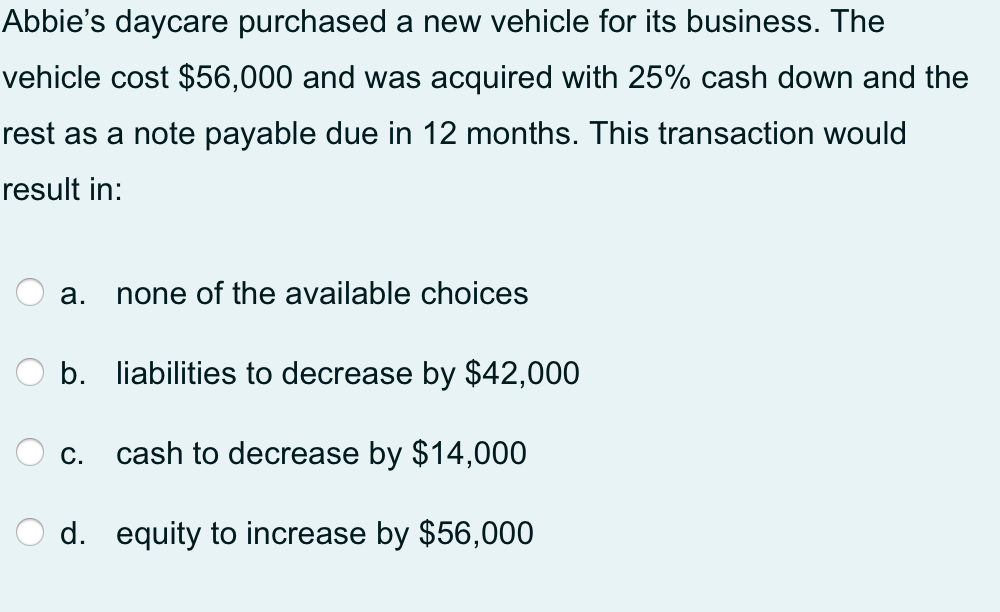

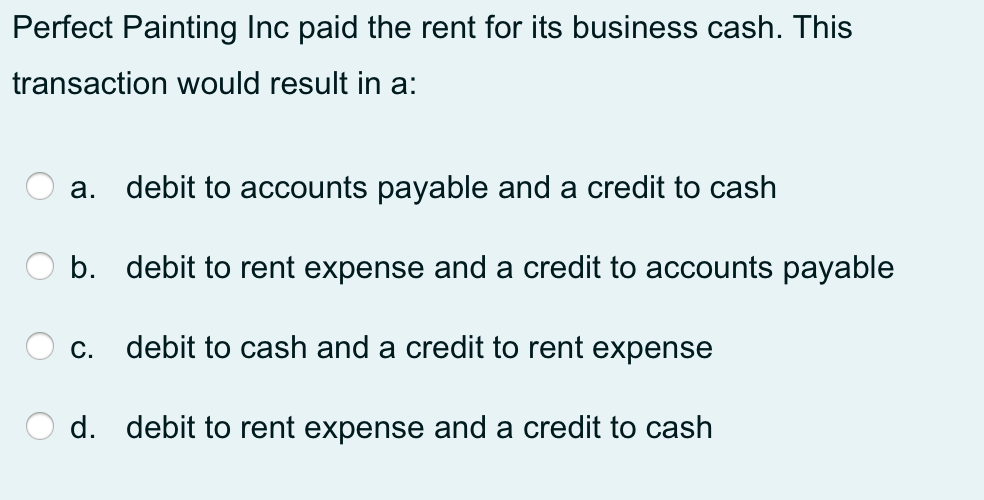

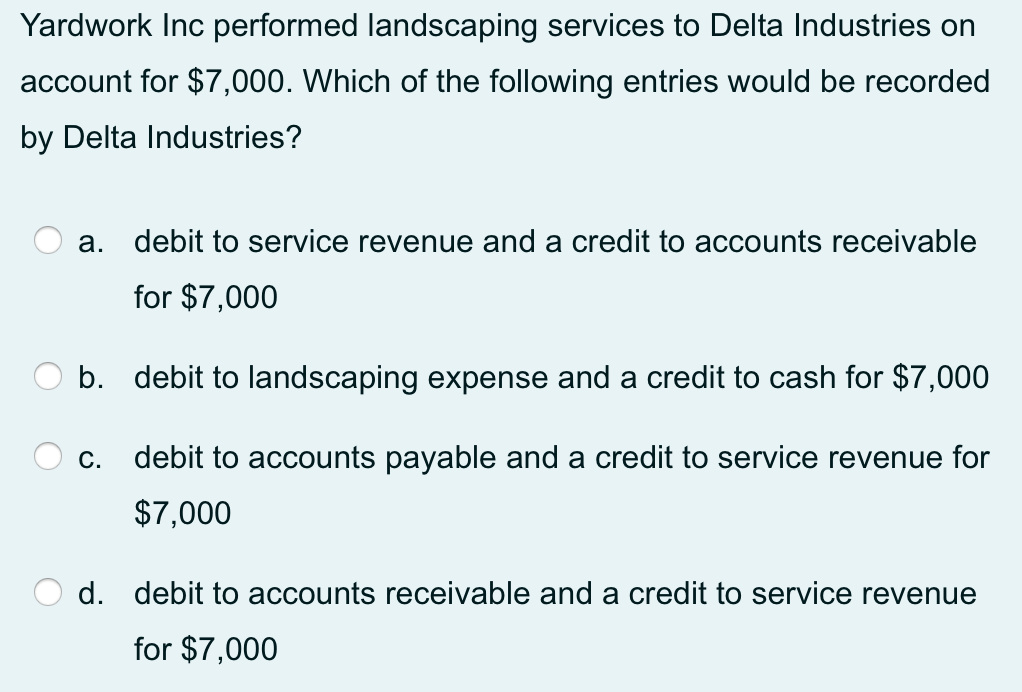

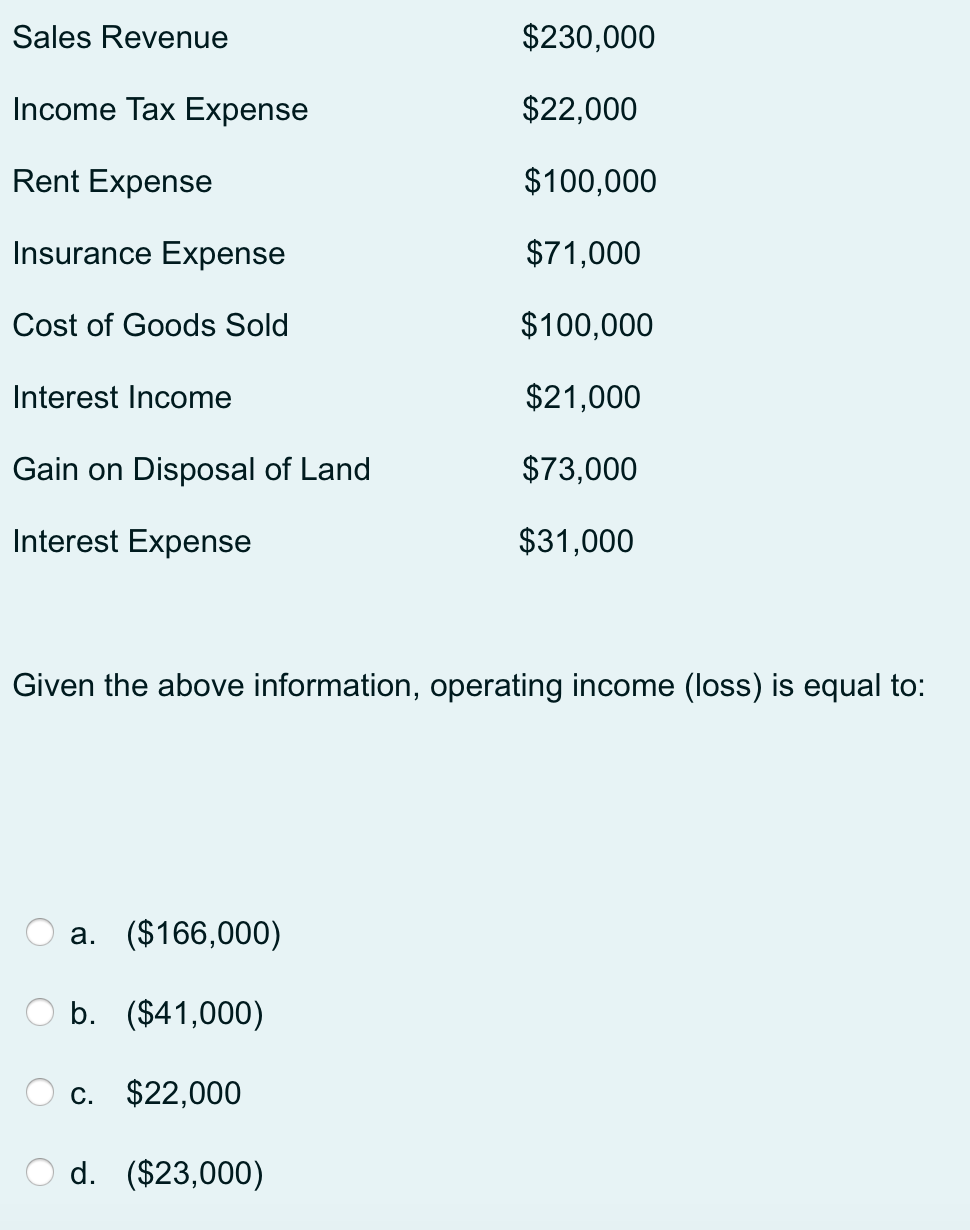

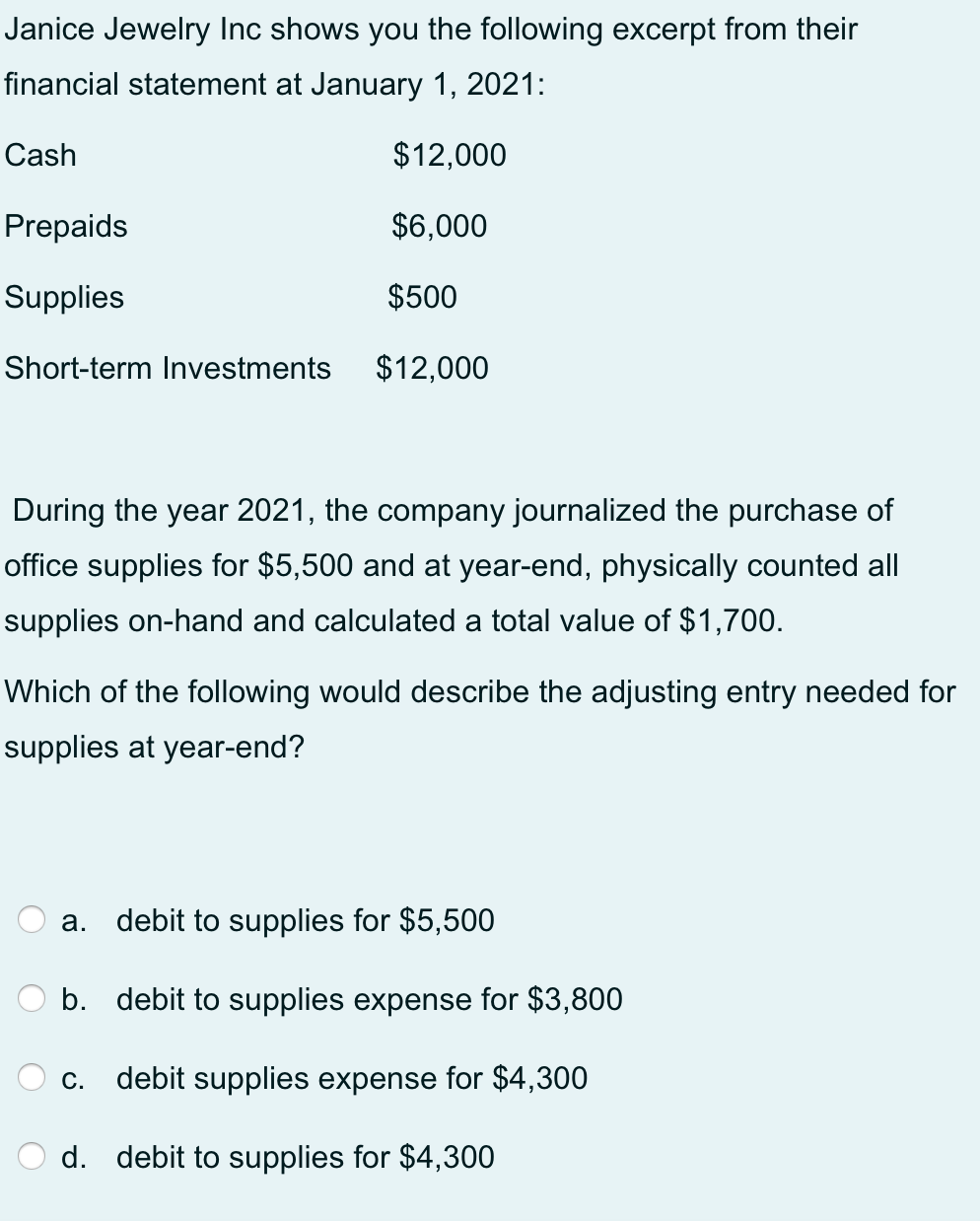

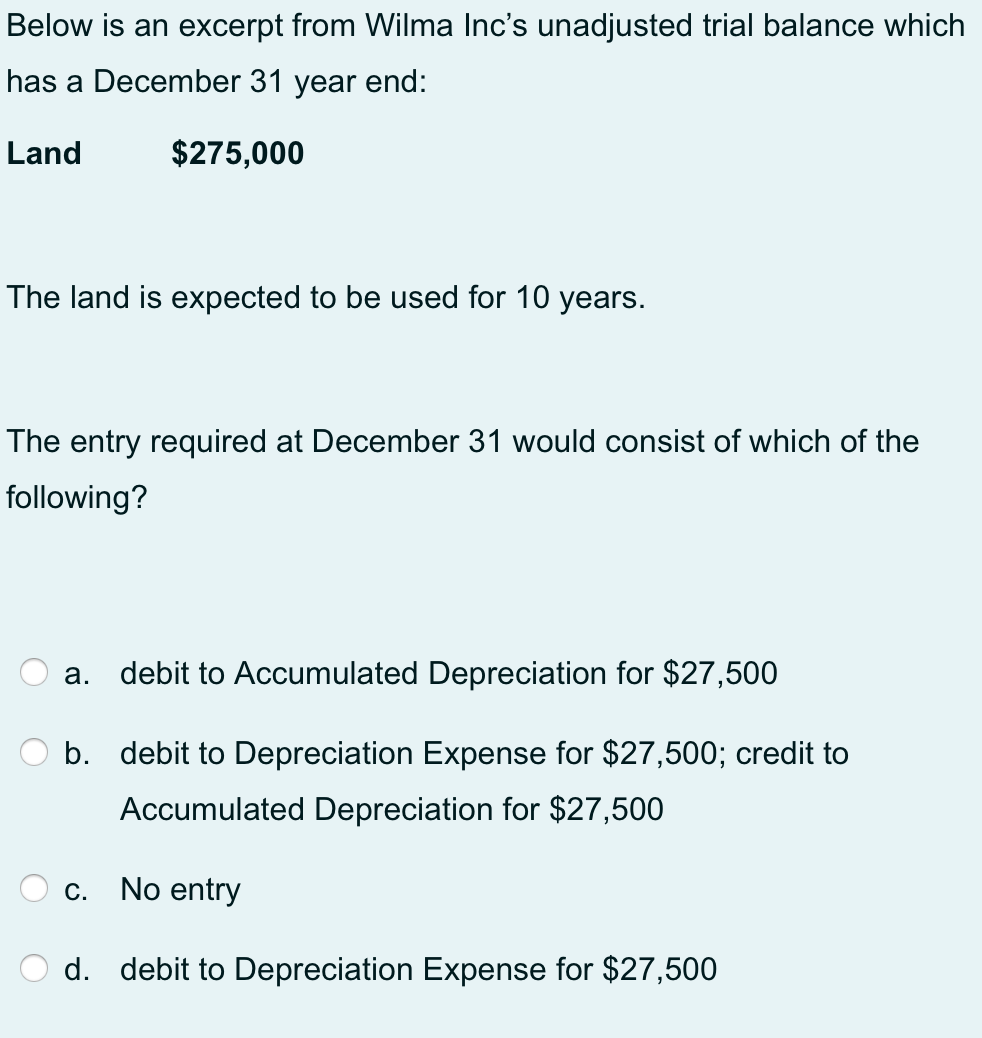

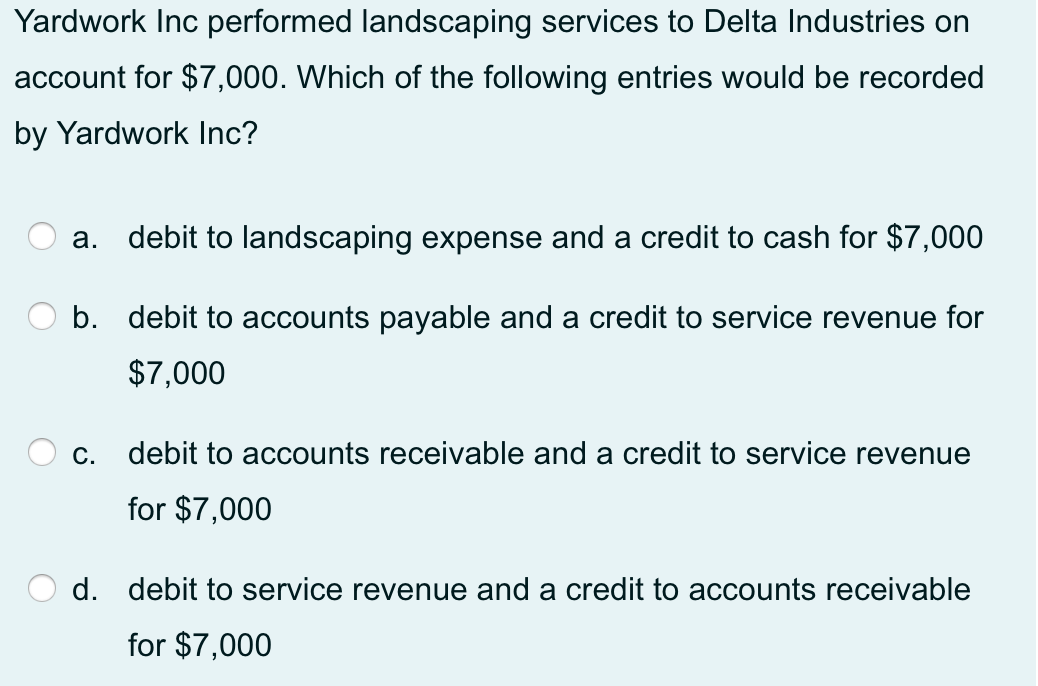

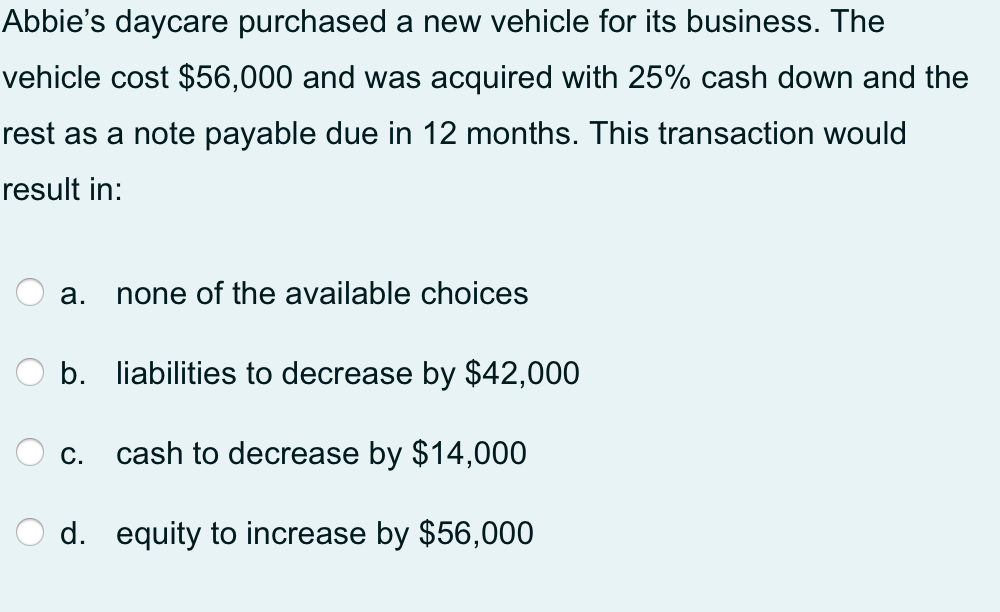

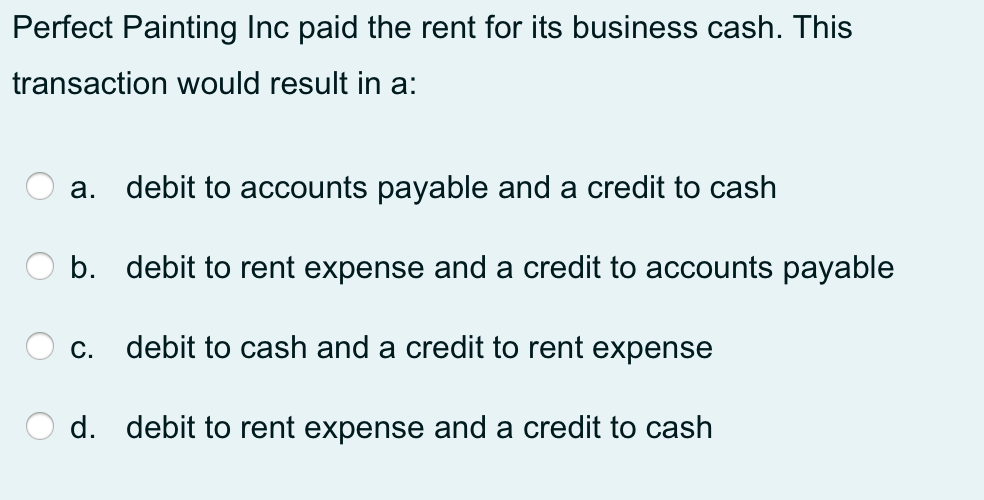

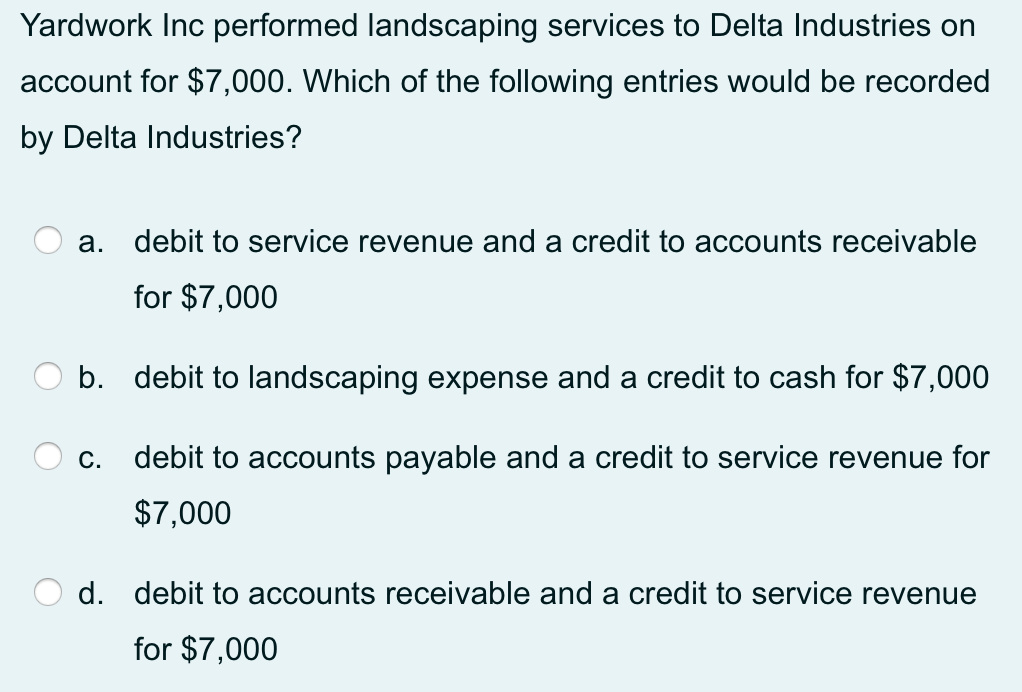

Sales Revenue $230,000 Income Tax Expense $22,000 Rent Expense $100,000 Insurance Expense $71,000 Cost of Goods Sold $100,000 Interest Income $21,000 Gain on Disposal of Land $73,000 Interest Expense $31,000 Given the above information, operating income (loss) is equal to: a. ($166,000) b. ($41,000) C. $22,000 d. ($23,000) Janice Jewelry Inc shows you the following excerpt from their financial statement at January 1, 2021: Cash $12,000 Prepaids $6,000 Supplies $500 Short-term Investments $12,000 During the year 2021, the company journalized the purchase of office supplies for $5,500 and at year-end, physically counted all supplies on-hand and calculated a total value of $1,700. Which of the following would describe the adjusting entry needed for supplies at year-end? a. debit to supplies for $5,500 b. debit to supplies expense for $3,800 C. debit supplies expense for $4,300 d. debit to supplies for $4,300 Below is an excerpt from Wilma Inc's unadjusted trial balance which has a December 31 year end: Land $275,000 The land is expected to be used for 10 years. The entry required at December 31 would consist of which of the following? a. debit to Accumulated Depreciation for $27,500 b. debit to Depreciation Expense for $27,500; credit to Accumulated Depreciation for $27,500 C. No entry d. debit to Depreciation Expense for $27,500 Yardwork Inc performed landscaping services to Delta Industries on account for $7,000. Which of the following entries would be recorded by Yardwork Inc? a. debit to landscaping expense and a credit to cash for $7,000 b. debit to accounts payable and a credit to service revenue for $7,000 C. debit to accounts receivable and a credit to service revenue for $7,000 d. debit to service revenue and a credit to accounts receivable for $7,000 Abbie's daycare purchased a new vehicle for its business. The vehicle cost $56,000 and was acquired with 25% cash down and the rest as a note payable due in 12 months. This transaction would result in: a. none of the available choices b. liabilities to decrease by $42,000 C. cash to decrease by $14,000 d. equity to increase by $56,000 Perfect Painting Inc paid the rent for its business cash. This transaction would result in a: a. debit to accounts payable and a credit to cash b. debit to rent expense and a credit to accounts payable C. debit to cash and a credit to rent expense d. debit to rent expense and a credit to cash Yardwork Inc performed landscaping services to Delta Industries on account for $7,000. Which of the following entries would be recorded by Delta Industries? a. debit to service revenue and a credit to accounts receivable for $7,000 O b. debit to landscaping expense and a credit to cash for $7,000 C. debit to accounts payable and a credit to service revenue for $7,000 d. debit to accounts receivable and a credit to service revenue for $7,000