Answered step by step

Verified Expert Solution

Question

1 Approved Answer

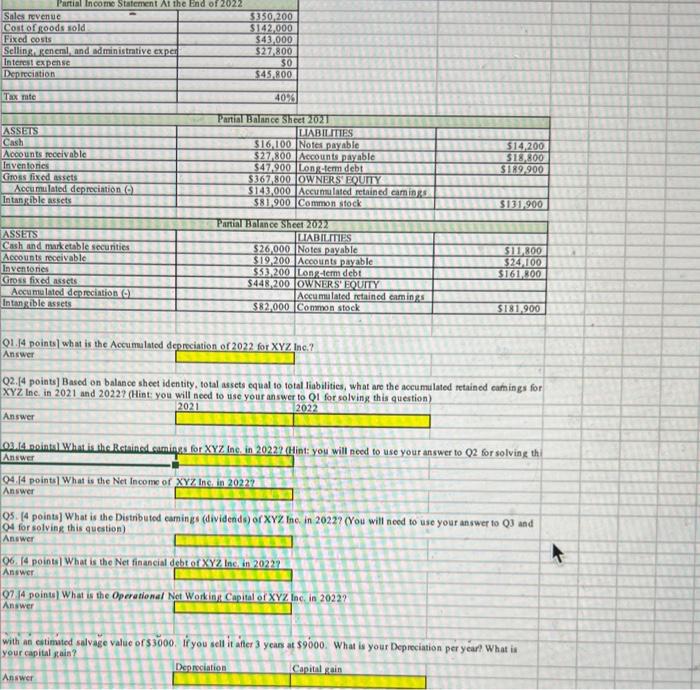

Sales revenue Cost of goods sold Fixed costs Selling, geneml, and administrative exper Interest expense Depreciation Tax rate ASSETS Cash Partial Income Statement At

Sales revenue Cost of goods sold Fixed costs Selling, geneml, and administrative exper Interest expense Depreciation Tax rate ASSETS Cash Partial Income Statement At the End of 2022 Accounts receivable Inventories Gross fixed assets Accumulated depreciation () Intangible assets ASSETS Cash and marketable securities Accounts receivable Inventories Gross fixed assets Accumulated depreciation () Intangible assets Answer $350,200 $142,000 $43,000 $27,800 $0 $45,800 40% Partial Balance Sheet 2021 $16,100 Notes payable $27,800 Accounts payable $47,900 Long-term debt $367,800 OWNERS' EQUITY $143,000 Accumulated retained carmings $81,900 Common stock LIABILITIES Partial Balance Sheet 2022 Answer $26,000 Notes payable $19,200 Accounts payable $53,200 Long-term debt $448.200 OWNERS' EQUITY $82,000 Q1.14 points] what is the Accumulated depreciation of 2022 for XYZ. Inc.? Answer 04.14 points] What is the Net Income of XYZ Inc. in 20227 Answer LIABILITIES Accumulated retained eamings Common stock 06. 14 points) What is the Net financial debt of XYZ Inc. in 20227 Answer 02.(4 points] Based on balance sheet identity, total assets equal to total liabilities, what are the accumulated retained camings for XYZ Inc. in 2021 and 2022? (Hint: you will need to use your answer to Q1 for solving this question) 2021 2022 $14,200 $18.800 $189.900 $131.900 03.14 points What is the Retained camings for XYZ Inc. in 2022? (Hint: you will need to use your answer to Q2 for solving thi Answer 07.14 points) What is the Operational Net Working Capital of XYZ Inc. in 2022? Answer $11,800 $24,100 $161,800 $181,900 Q5. (4 points] What is the Distributed camings (dividends) of XYZ Inc. in 2022? (You will need to use your answer to Q3 and 04 for solving this question) Answer with an estimated salvage value of $3000. If you sell it after 3 years at $9000. What is your Depreciation per year? What is your capital gain? Depreciation Capital gain 1132

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Q1 What is the Accumulated depreciation of 2022 for XYZ Inc Answer The accumulated depreciation for 2022 cannot be determined from the given informati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started