Answered step by step

Verified Expert Solution

Question

1 Approved Answer

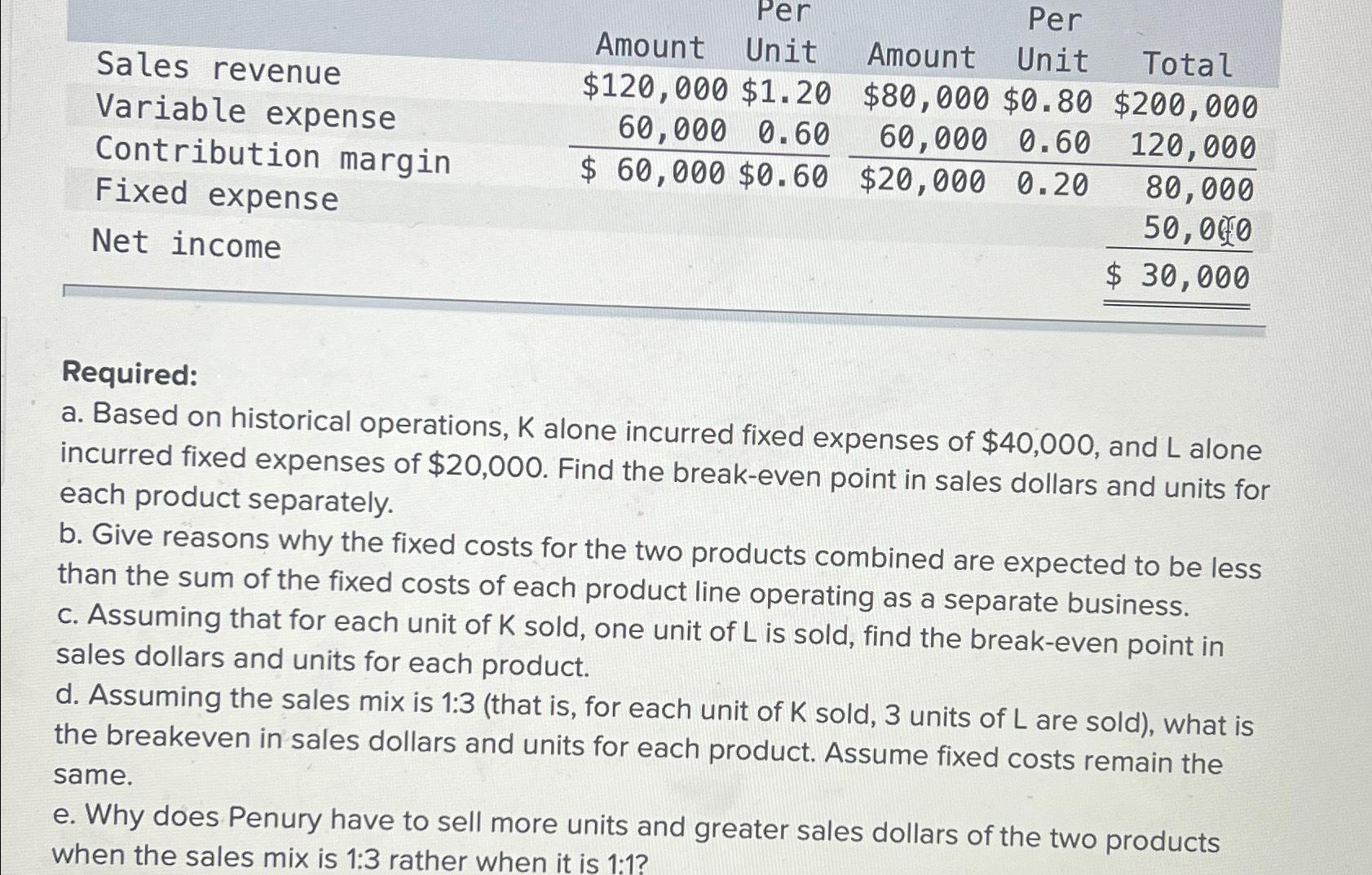

Sales revenue Variable expense Contribution margin Fixed expense Net income Per Amount Unit $120,000 $1.20 60,000 0.60 60,000 0.60 120,000 $ 60,000 $0.60 $20,000

Sales revenue Variable expense Contribution margin Fixed expense Net income Per Amount Unit $120,000 $1.20 60,000 0.60 60,000 0.60 120,000 $ 60,000 $0.60 $20,000 0.20 Per Amount Unit Total $80,000 $0.80 $200,000 80,000 50,000 $ 30,000 Required: a. Based on historical operations, K alone incurred fixed expenses of $40,000, and L alone incurred fixed expenses of $20,000. Find the break-even point in sales dollars and units for each product separately. b. Give reasons why the fixed costs for the two products combined are expected to be less than the sum of the fixed costs of each product line operating as a separate business. c. Assuming that for each unit of K sold, one unit of L is sold, find the break-even point in sales dollars and units for each product. d. Assuming the sales mix is 1:3 (that is, for each unit of K sold, 3 units of L are sold), what is the breakeven in sales dollars and units for each product. Assume fixed costs remain the same. e. Why does Penury have to sell more units and greater sales dollars of the two products when the sales mix is 1:3 rather when it is 1:1?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find the breakeven point in sales dollars and units for each product separately we can use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started