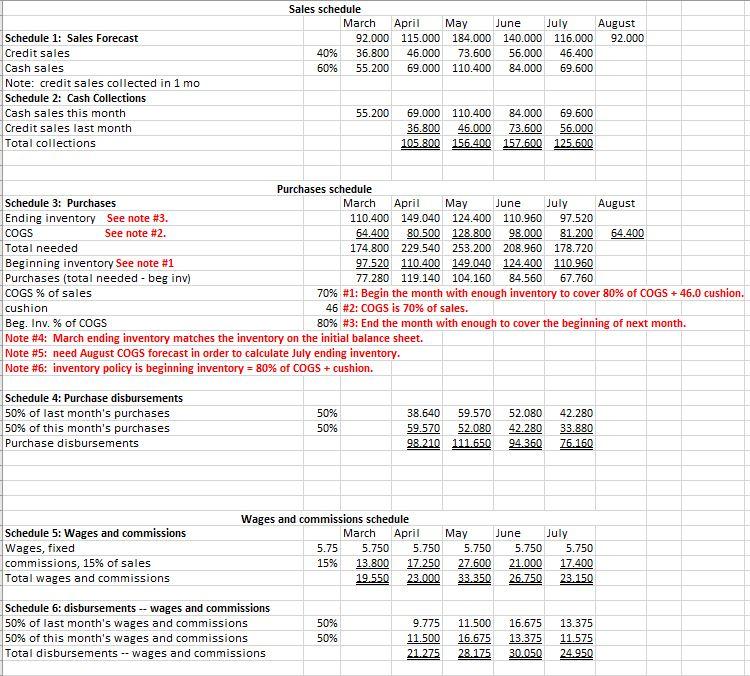

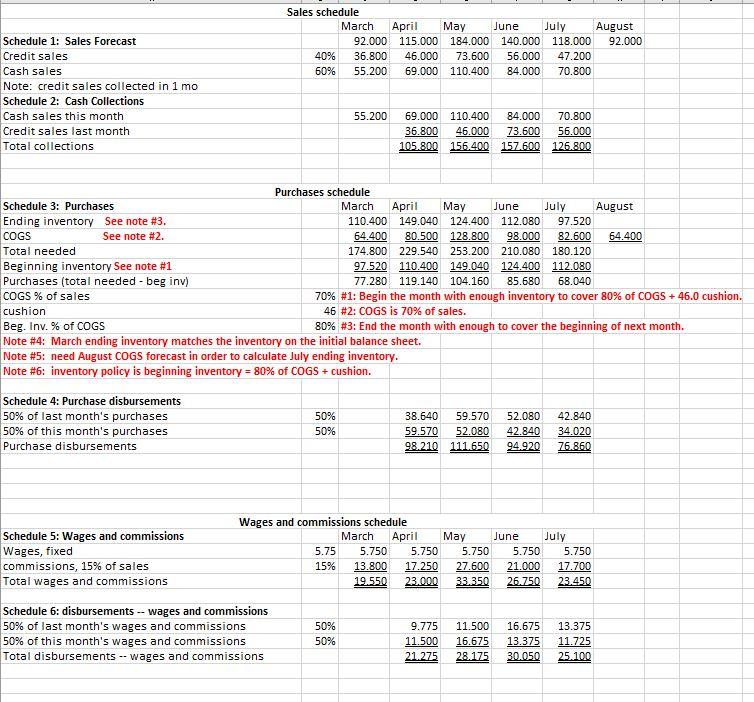

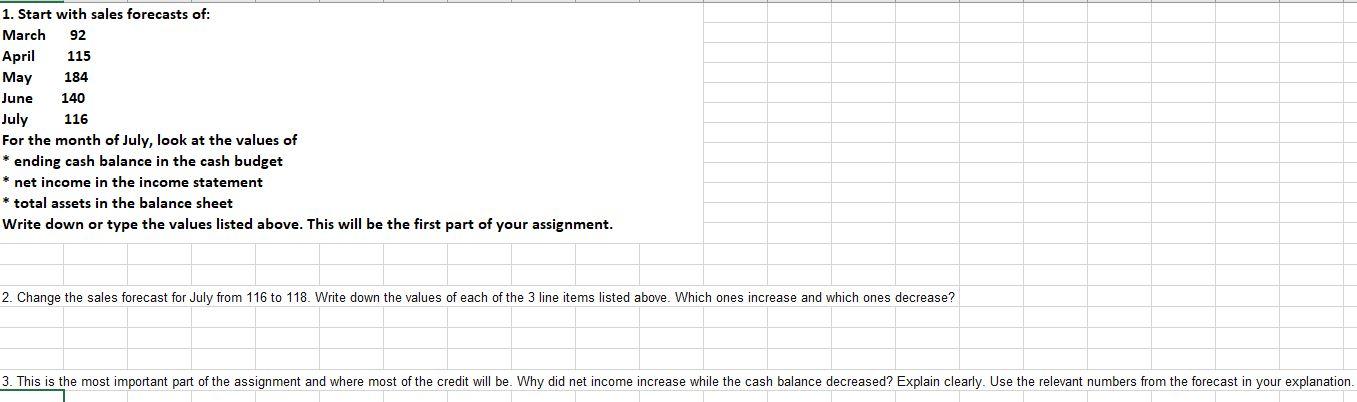

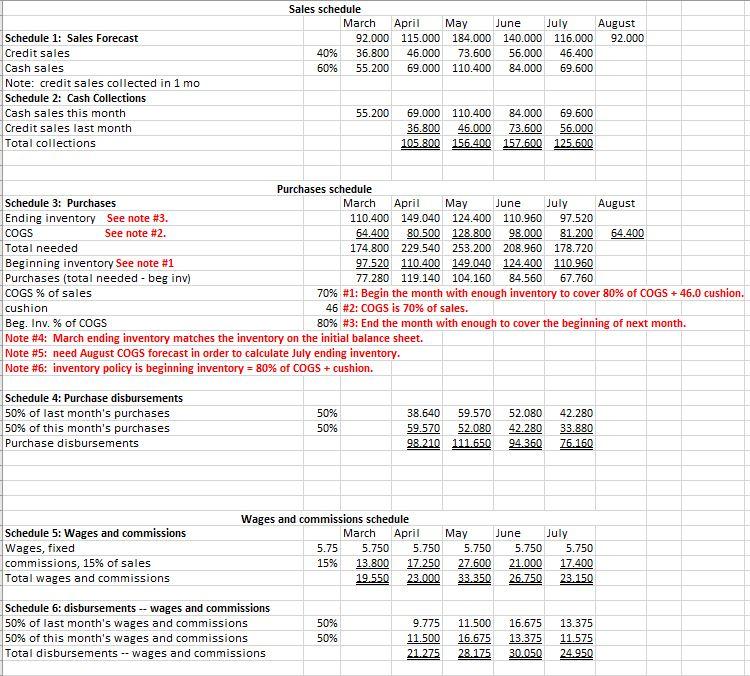

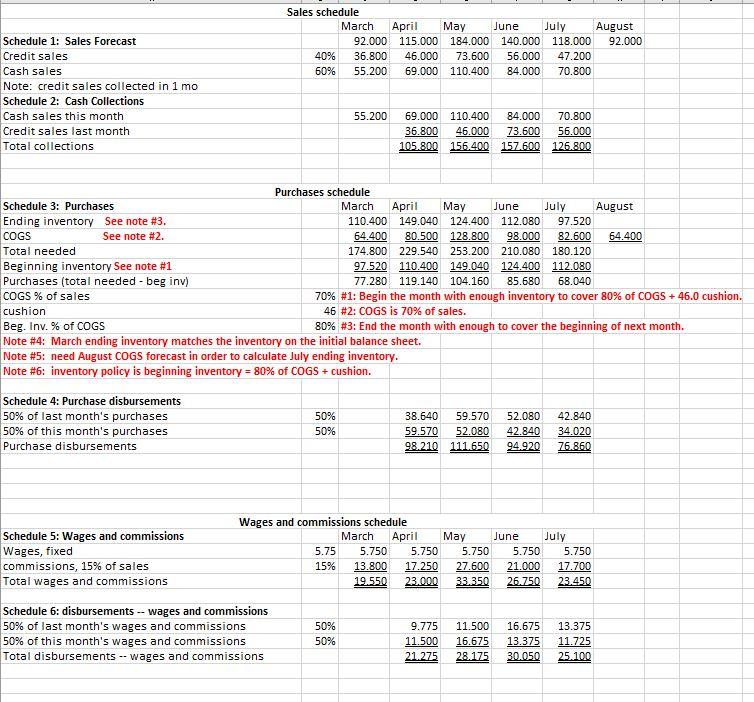

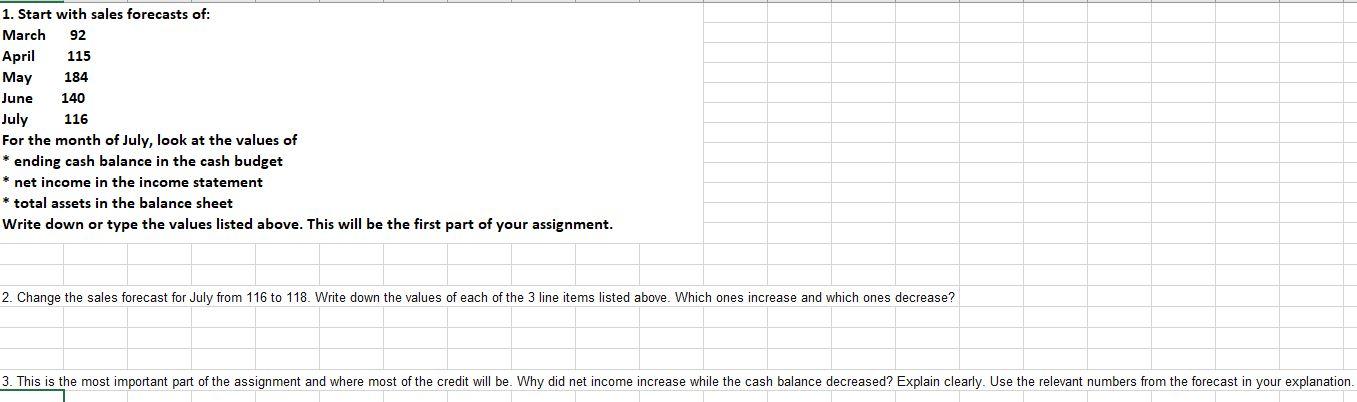

Sales schedule March April May June July August 92.000 115.000 184.000 140.000 116.000 92.000 40% 36.800 46.000 73.600 56.000 46.400 60% 55.200 69.000 110.400 84.000 69.600 Schedule 1: Sales Forecast Credit sales Cash sales Note: credit sales collected in 1 mo Schedule 2: Cash Collections Cash sales this month Credit sales last month Total collections 55.200 69.000 110.400 84.000 69.600 36.800 46.000 73.600 56.000 105.800 156.400 157.600 125.600 Purchases schedule Schedule 3: Purchases March April May June July August Ending inventory See note #3. 110.400 149.040 124.400 110.960 97.520 COGS See note #2. 64.400 80.500 128.800 98.000 81.200 64 400 Total needed 174.800 229.540 253.200 208.960 178.720 Beginning inventory See note #1 97.520 110.400 149.040 124.400 110.960 Purchases (total needed-beg inv) 77.280 119.140 104.160 84.560 67.760 COGS % of sales 70% #1: Begin the month with enough inventory to cover 80% of COGS + 46.0 cushion. cushion 46 #2: COGS is 70% of sales. Beg, Inv. % of COGS 80% #3: End the month with enough to cover the beginning of next month. Note #4: March ending inventory matches the inventory on the initial balance sheet. Note #5: need August COGS forecast in order to calculate July ending inventory. Note #6: inventory policy is beginning inventory = 80% of COGS + cushion. Schedule 4: Purchase disbursements 50% of last month's purchases 50% of this month's purchases Purchase disbursements 50% 50% 38.640 59.570 59.570 52.080 98.210 111.650 52.080 42.280 94.360 42.280 33.880 76.160 Schedule 5: Wages and commissions Wages, fixed commissions, 15% of sales Total wages and commissions Wages and commissions schedule March April May June July 5.75 5.750 5.750 5.750 5.750 5.750 15% 13.800 17.250 27.600 21.000 17.400 19.550 23.000 33.350 26.750 23.150 Schedule 6: disbursements -- wages and commissions 50% of last month's wages and commissions 50% of this month's wages and commissions Total disbursements -- wages and commissions 50% 50% 9.775 11.500 21.275 11.500 16.675 28.175 16.675 13.375 30.050 13.375 11.575 24.950 Sales schedule March April May June July August 92.000 115.000 184.000 140.000 118.000 92.000 40% 36.800 46.000 73.600 56.000 47.200 60% 55.200 69.000 110.400 84.000 70.800 Schedule 1: Sales Forecast Credit sales Cash sales Note: credit sales collected in 1 mo Schedule 2: Cash Collections Cash sales this month Credit sales last month Total collections 55.200 69.000 110.400 84.000 70.800 36.800 46.000 73.600 56.000 105.800 156.400 157.600 126.800 Purchases schedule Schedule 3: Purchases March April May June July August Ending inventory See note #3. 110.400 149.040 124.400 112.080 97.520 COGS See note #2. 64.400 80.500 128.800 98.000 82.600 64.400 Total needed 174.800 229.540 253.200 210.080 180.120 Beginning inventory See note #1 97.520 110.400 149.040 124.400 112.080 Purchases (total needed-beg inv) 77.280 119.140 104.160 85.680 68.040 COGS % of sales 70% #1: Begin the month with enough inventory to cover 80% of COGS + 46.0 cushion. cushion 46 #2: COGS is 70% of sales. Beg. Inv.% of COGS 80% #3: End the month with enough to cover the beginning of next month. Note #4: March ending inventory matches the inventory on the initial balance sheet. Note #5: need August COGS forecast in order to calculate July ending inventory. Note #6: inventory policy is beginning inventory = 80% of COGS + cushion. Schedule 4: Purchase disbursements 50% of last month's purchases 50% of this month's purchases Purchase disbursements 50% 50% 38.640 59.570 59.570 52.080 98.210 111.650 52.080 42.840 94.920 42.840 34.020 76.860 Schedule 5: Wages and commissions Wages, fixed commissions, 15% of sales Total wages and commissions Wages and commissions schedule March April May June July 5.75 5.750 5.750 5.750 5.750 5.750 15% 13.800 17.250 27.600 21.000 17.700 19.550 23.000 33.350 26.750 23.450 Schedule 6: disbursements -- wages and commissions 50% of last month's wages and commissions 50% of this month's wages and commissions Total disbursements -- wages and commissions 50% 50% 9.775 11.500 21.275 11.500 16.675 28.175 16.675 13.375 30.050 13.375 11.725 25.100 1. Start with sales forecasts of: March 92 April 115 May 184 June 140 July 116 For the month of July, look at the values of * ending cash balance in the cash budget * net income in the income statement * total assets in the balance sheet Write down or type the values listed above. This will be the first part of your assignment. 2. Change the sales forecast for July from 116 to 118. Write down the values of each of the 3 line items listed above. Which ones increase and which ones decrease? 3. This is the most important part of the assignment and where most of the credit will be. Why did net income increase while the cash balance decreased? Explain clearly. Use the relevant numbers from the forecast in your explanation. Sales schedule March April May June July August 92.000 115.000 184.000 140.000 116.000 92.000 40% 36.800 46.000 73.600 56.000 46.400 60% 55.200 69.000 110.400 84.000 69.600 Schedule 1: Sales Forecast Credit sales Cash sales Note: credit sales collected in 1 mo Schedule 2: Cash Collections Cash sales this month Credit sales last month Total collections 55.200 69.000 110.400 84.000 69.600 36.800 46.000 73.600 56.000 105.800 156.400 157.600 125.600 Purchases schedule Schedule 3: Purchases March April May June July August Ending inventory See note #3. 110.400 149.040 124.400 110.960 97.520 COGS See note #2. 64.400 80.500 128.800 98.000 81.200 64 400 Total needed 174.800 229.540 253.200 208.960 178.720 Beginning inventory See note #1 97.520 110.400 149.040 124.400 110.960 Purchases (total needed-beg inv) 77.280 119.140 104.160 84.560 67.760 COGS % of sales 70% #1: Begin the month with enough inventory to cover 80% of COGS + 46.0 cushion. cushion 46 #2: COGS is 70% of sales. Beg, Inv. % of COGS 80% #3: End the month with enough to cover the beginning of next month. Note #4: March ending inventory matches the inventory on the initial balance sheet. Note #5: need August COGS forecast in order to calculate July ending inventory. Note #6: inventory policy is beginning inventory = 80% of COGS + cushion. Schedule 4: Purchase disbursements 50% of last month's purchases 50% of this month's purchases Purchase disbursements 50% 50% 38.640 59.570 59.570 52.080 98.210 111.650 52.080 42.280 94.360 42.280 33.880 76.160 Schedule 5: Wages and commissions Wages, fixed commissions, 15% of sales Total wages and commissions Wages and commissions schedule March April May June July 5.75 5.750 5.750 5.750 5.750 5.750 15% 13.800 17.250 27.600 21.000 17.400 19.550 23.000 33.350 26.750 23.150 Schedule 6: disbursements -- wages and commissions 50% of last month's wages and commissions 50% of this month's wages and commissions Total disbursements -- wages and commissions 50% 50% 9.775 11.500 21.275 11.500 16.675 28.175 16.675 13.375 30.050 13.375 11.575 24.950 Sales schedule March April May June July August 92.000 115.000 184.000 140.000 118.000 92.000 40% 36.800 46.000 73.600 56.000 47.200 60% 55.200 69.000 110.400 84.000 70.800 Schedule 1: Sales Forecast Credit sales Cash sales Note: credit sales collected in 1 mo Schedule 2: Cash Collections Cash sales this month Credit sales last month Total collections 55.200 69.000 110.400 84.000 70.800 36.800 46.000 73.600 56.000 105.800 156.400 157.600 126.800 Purchases schedule Schedule 3: Purchases March April May June July August Ending inventory See note #3. 110.400 149.040 124.400 112.080 97.520 COGS See note #2. 64.400 80.500 128.800 98.000 82.600 64.400 Total needed 174.800 229.540 253.200 210.080 180.120 Beginning inventory See note #1 97.520 110.400 149.040 124.400 112.080 Purchases (total needed-beg inv) 77.280 119.140 104.160 85.680 68.040 COGS % of sales 70% #1: Begin the month with enough inventory to cover 80% of COGS + 46.0 cushion. cushion 46 #2: COGS is 70% of sales. Beg. Inv.% of COGS 80% #3: End the month with enough to cover the beginning of next month. Note #4: March ending inventory matches the inventory on the initial balance sheet. Note #5: need August COGS forecast in order to calculate July ending inventory. Note #6: inventory policy is beginning inventory = 80% of COGS + cushion. Schedule 4: Purchase disbursements 50% of last month's purchases 50% of this month's purchases Purchase disbursements 50% 50% 38.640 59.570 59.570 52.080 98.210 111.650 52.080 42.840 94.920 42.840 34.020 76.860 Schedule 5: Wages and commissions Wages, fixed commissions, 15% of sales Total wages and commissions Wages and commissions schedule March April May June July 5.75 5.750 5.750 5.750 5.750 5.750 15% 13.800 17.250 27.600 21.000 17.700 19.550 23.000 33.350 26.750 23.450 Schedule 6: disbursements -- wages and commissions 50% of last month's wages and commissions 50% of this month's wages and commissions Total disbursements -- wages and commissions 50% 50% 9.775 11.500 21.275 11.500 16.675 28.175 16.675 13.375 30.050 13.375 11.725 25.100 1. Start with sales forecasts of: March 92 April 115 May 184 June 140 July 116 For the month of July, look at the values of * ending cash balance in the cash budget * net income in the income statement * total assets in the balance sheet Write down or type the values listed above. This will be the first part of your assignment. 2. Change the sales forecast for July from 116 to 118. Write down the values of each of the 3 line items listed above. Which ones increase and which ones decrease? 3. This is the most important part of the assignment and where most of the credit will be. Why did net income increase while the cash balance decreased? Explain clearly. Use the relevant numbers from the forecast in your explanation