Sales Territory and Salesperson Profitability Analysis - ACCOUNTING

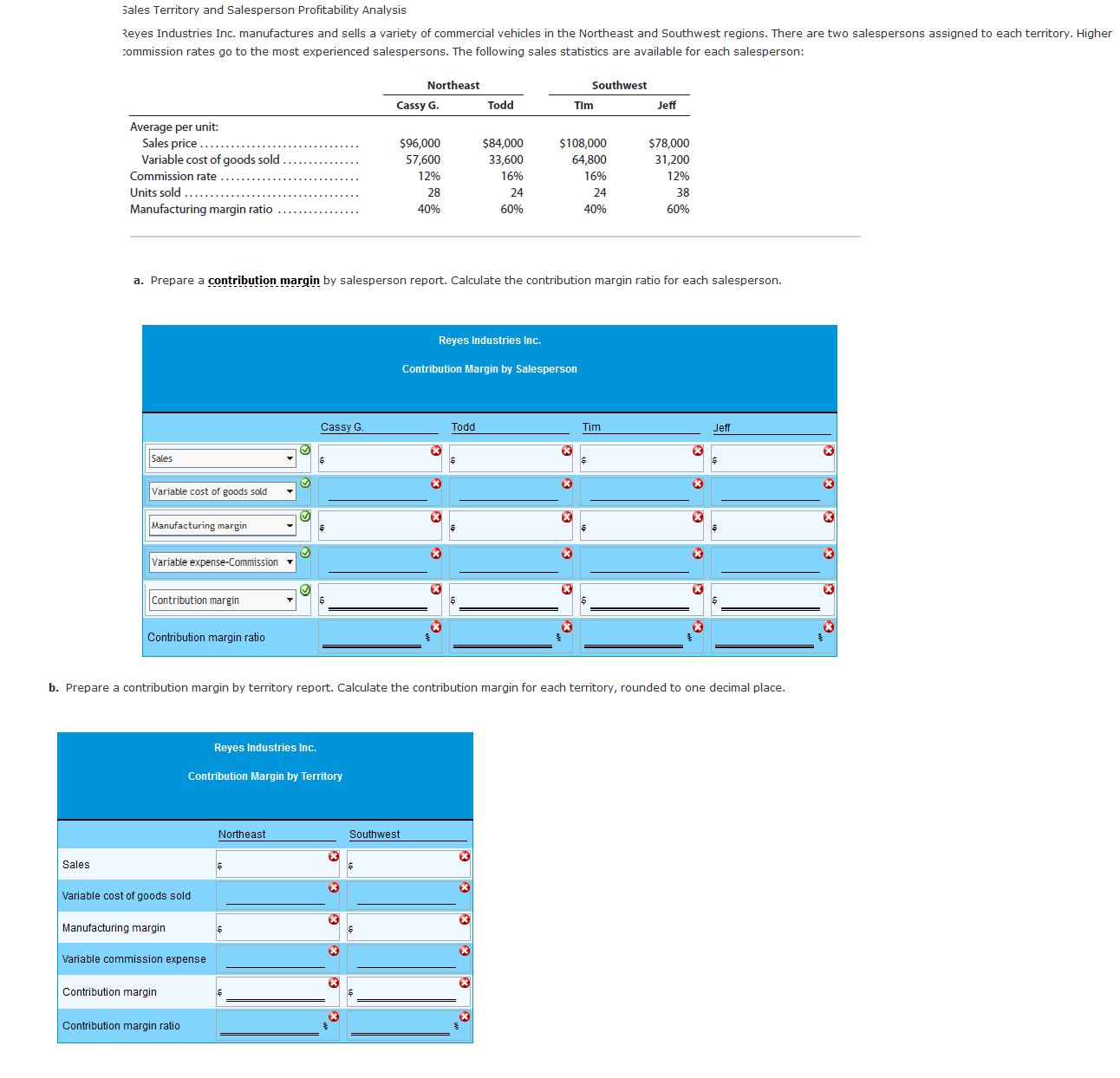

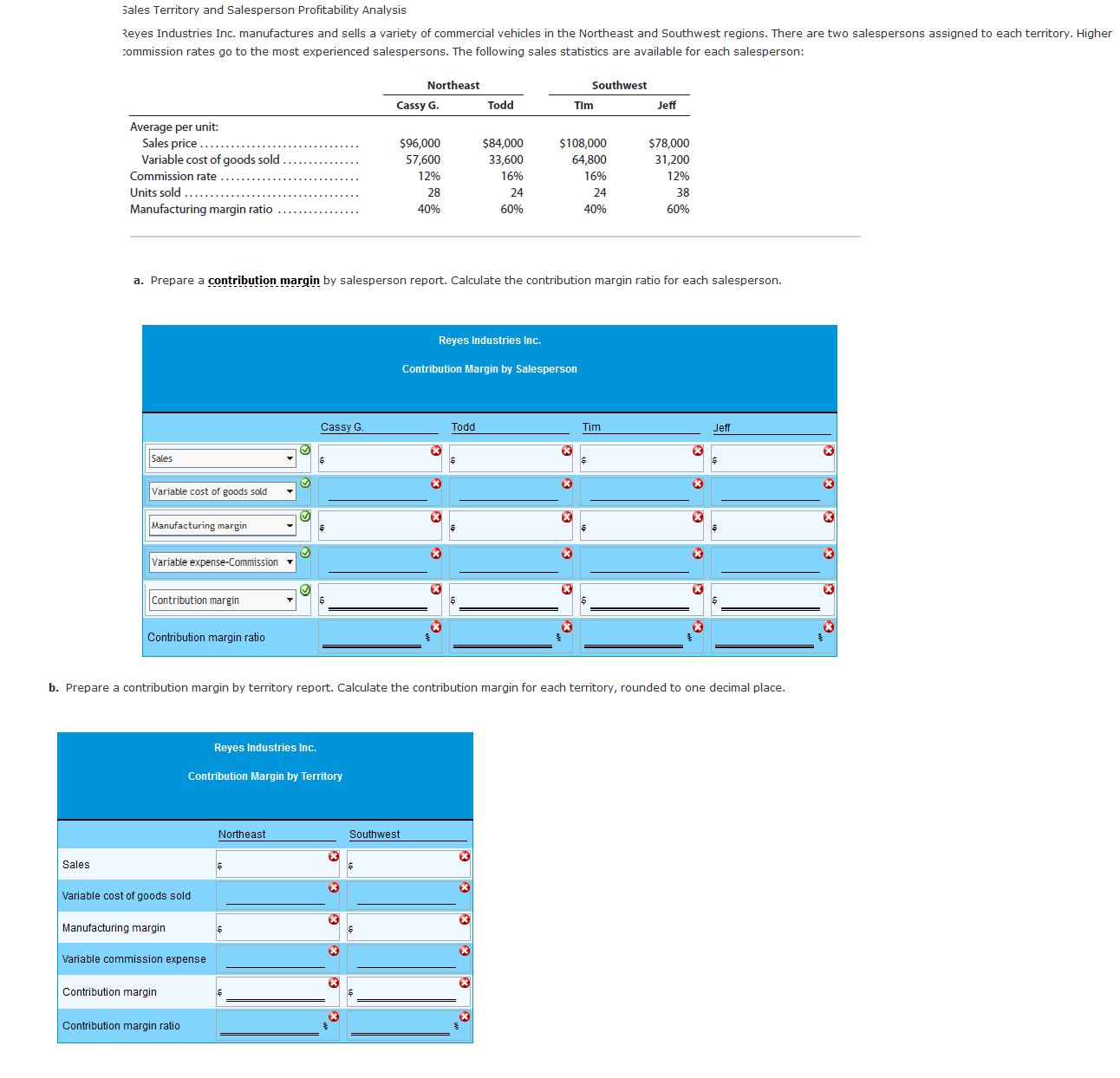

Sales Territory and Salesperson Profitability Analysis Reyes Industries Inc. manufactures and sells a variety of commercial vehicles in the Northeast and Southeast regions. There are two salespersons assigned to each territory. Higher commission rates go to the most experienced salespersons. The following sales statistics are available for each sales person : Northeast SouthwestCassy G. Todd Tim Jeff Average per unit : Sales price..............................$96000 $84000 $108000$78,000 variable cost of goods sold.......57600 336006480031200 Commission rate.....................12% 16% 16% 12% Units sold................................28 24 2438 Manufacturing margin ratio.....40% 60% 40% 60%a. Prepare a contribution margin by salesperson report. Calculate the contribution margin ratio for each salesperson. Sales Variable cost of goods sold Manufacturing margin Variable expense- Commission Contribution Margin Contribution margin ratio b. Prepare a contribution margin by territory report. Calculate the contribution margin for each territory, rounded to one decimal place. Sales Variable cost of goods sold Manufacturing margin Variable commission expense Contribution Margin Contribution margin ratio Sales Territory and Salesperson Profitability Analysis Reyes Industries Inc. manufactures and sells a variety of commercial vehicles in the Northeast and Southeast regions. There are two salespersons assigned to each territory. Higher commission rates go to the most experienced salespersons. The following sales statistics are available for each sales person : Northeast SouthwestCassy G. Todd Tim Jeff Average per unit : Sales price..............................$96000 $84000 $108000$78,000 variable cost of goods sold.......57600 336006480031200 Commission rate.....................12% 16% 16% 12% Units sold................................28 24 2438 Manufacturing margin ratio.....40% 60% 40% 60%a. Prepare a contribution margin by salesperson report. Calculate the contribution margin ratio for each salesperson. Sales Variable cost of goods sold Manufacturing margin Variable expense- Commission Contribution Margin Contribution margin ratio b. Prepare a contribution margin by territory report. Calculate the contribution margin for each territory, rounded to one decimal place. Sales Variable cost of goods sold Manufacturing margin Variable commission expense Contribution Margin Contribution margin ratio