Answered step by step

Verified Expert Solution

Question

1 Approved Answer

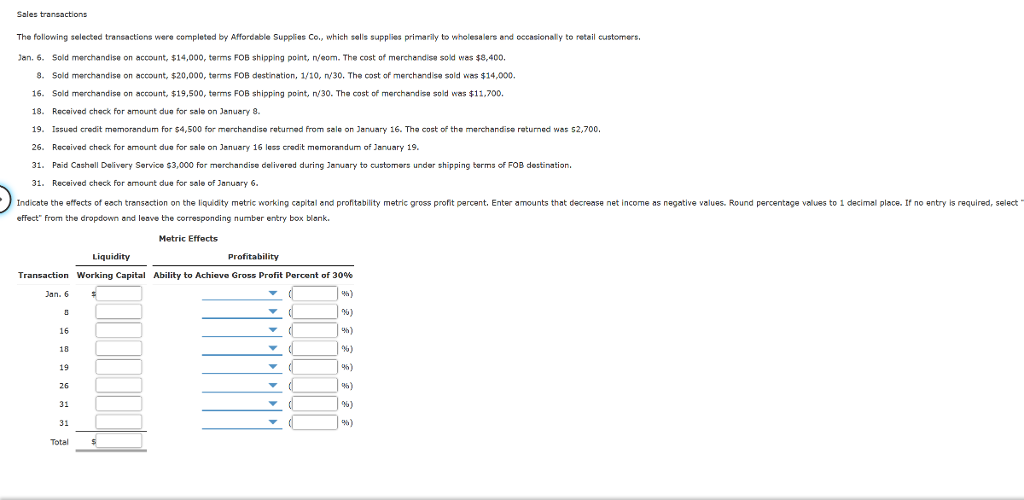

Sales transactions The following selected transactions were completed by Affordable Supplies Co., which sells supplies primarily to wholesalers and occasionally to retail customers. Jan. 6.

Sales transactions

The following selected transactions were completed by Affordable Supplies Co., which sells supplies primarily to wholesalers and occasionally to retail customers.

| Jan. 6. | Sold merchandise on account, $14,000, terms FOB shipping point, n/eom. The cost of merchandise sold was $8,400. | ||

| 8. | Sold merchandise on account, $20,000, terms FOB destination, 1/10, n/30. The cost of merchandise sold was $14,000. | ||

| 16. | Sold merchandise on account, $19,500, terms FOB shipping point, n/30. The cost of merchandise sold was $11,700. | ||

| 18. | Received check for amount due for sale on January 8. | ||

| 19. | Issued credit memorandum for $4,500 for merchandise returned from sale on January 16. The cost of the merchandise returned was $2,700. | ||

| 26. | Received check for amount due for sale on January 16 less credit memorandum of January 19. | ||

| 31. | Paid Cashell Delivery Service $3,000 for merchandise delivered during January to customers under shipping terms of FOB destination. | ||

| 31. | Received check for amount due for sale of January 6. |

Indicate the effects of each transaction on the liquidity metric working capital and profitability metric gross profit percent. Enter amounts that decrease net income as negative values. Round percentage values to 1 decimal place. If no entry is required, select "No effect" from the dropdown and leave the corresponding number entry box blank.

| Metric Effects | ||||||||||

| Liquidity | Profitability | |||||||||

| Transaction | Working Capital | Ability to Achieve Gross Profit Percent of 30% | ||||||||

| Jan. 6 | $ | (%) | ||||||||

| 8 | (%) | |||||||||

| 16 | (%) | |||||||||

| 18 | (%) | |||||||||

| 19 | (%) | |||||||||

| 26 | (%) | |||||||||

| 31 | (%) | |||||||||

| 31 | (%) | |||||||||

| Total | $ |  | ||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started