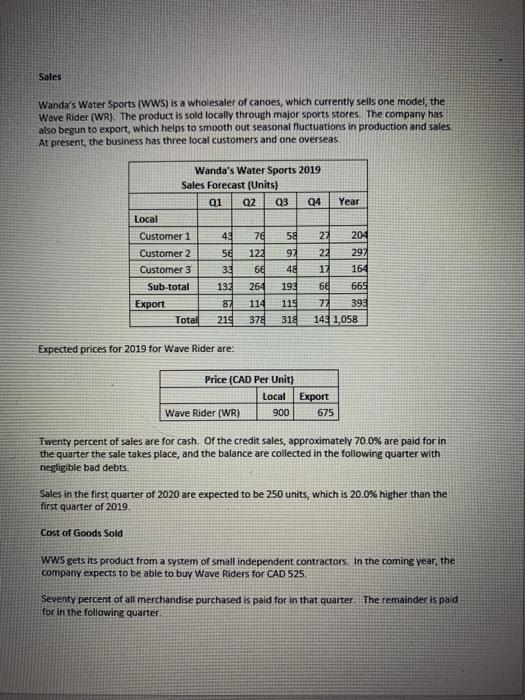

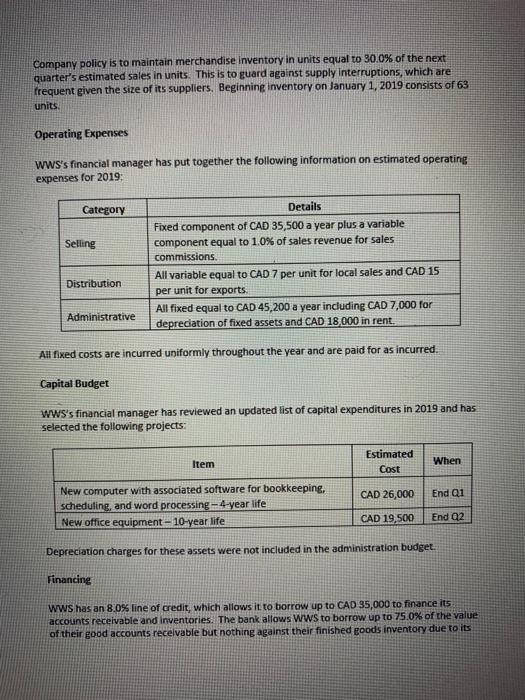

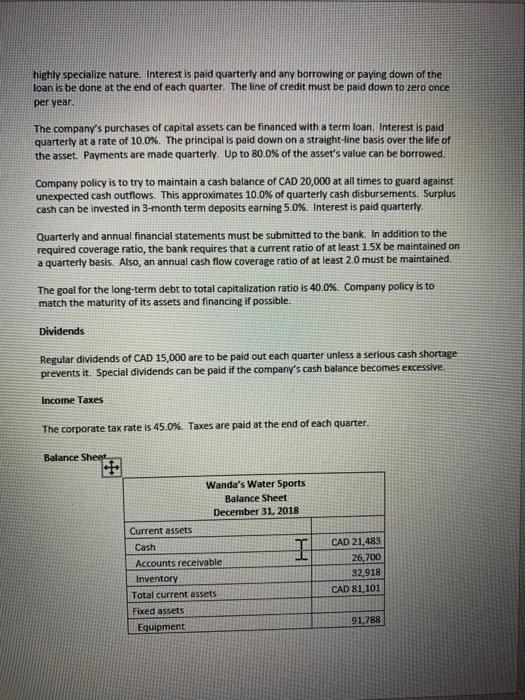

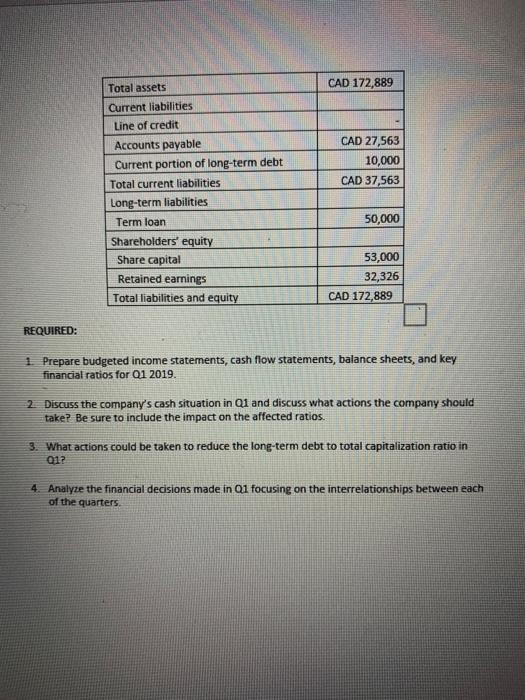

Sales Wanda's Water Sports (WWS) is a wholesaler of canoes, which currently sells one model, the Wave Rider (WR). The product is sold locally through major sports stores. The company has also begun to export, which helps to smooth out seasonal fluctuations in production and sales At present, the business has three local customers and one overseas 27 Wanda's Water Sports 2019 Sales Forecast (Units) Q1 Q2 Q3 Q4 Year Local Customer 1 43 76 58 204 Customer 2 56 122 97 22 297 Customer 3 30 66 48 17 164 Sub-total 132 264 193 60 665 Export 87 114 119 77 393 Total 219 378 318 14 1,058 Expected prices for 2019 for Wave Rider are: Price (CAD Per Unit) Local Export Wave Rider (WR) 900 675 Twenty percent of sales are for cash. Of the credit sales, approximately 70 0% are paid for in the quarter the sale takes place, and the balance are collected in the following quarter with negligible bad debts. Sales in the first quarter of 2020 are expected to be 250 units, which is 20.0% higher than the first quarter of 2019 Cost of Goods Sold WWS gets its product from a system of small independent contractors. In the coming year, the company expects to be able to buy Wave Riders for CAD 525. Seventy percent of all merchandise purchased is paid for in that quarter. The remainder is paid for in the following quarter Company policy is to maintain merchandise inventory in units equal to 30.0% of the next quarter's estimated sales in units. This is to guard against supply interruptions, which are frequent given the size of its suppliers. Beginning inventory on January 1, 2019 consists of 63 units Operating Expenses WWS's financial manager has put together the following information on estimated operating expenses for 2019 Category Selling Details Fixed component of CAD 35,500 a year plus a variable component equal to 1.0% of sales revenue for sales commissions All variable equal to CAD 7 per unit for local sales and CAD 15 per unit for exports All fixed equal to CAD 45,200 a year including CAD 7,000 for depreciation of fixed assets and CAD 18,000 in rent, Distribution Administrative Al fixed costs are incurred uniformly throughout the year and are paid for as incurred. Capital Budget WWS's financial manager has reviewed an updated list of capital expenditures in 2019 and has selected the following projects: Item Estimated Cost When CAD 26,000 End 01 New computer with associated software for bookkeeping, scheduling, and word processing - 4-year life New office equipment -10 year life CAD 19,500 End 02 Depreciation charges for these assets were not included in the administration budget. Financing WWS has an 8.0% line of credit, which allows it to borrow up to CAD 95,000 to finance its accounts receivable and inventories. The bank allows WWS to borrow up to 75.0% of the value of their good accounts receivable but nothing against their finished goods inventory due to its highly specialize nature. Interest is paid quarterly and any borrowing or paying down of the loan is be done at the end of each quarter. The line of credit must be paid down to zero once per year The company's purchases of capital assets can be financed with a term loan. Interest is paid quarterly at a rate of 10.0%. The principal is paid down on a straight-line basis over the life of the asset. Payments are made quarterly. Up to 80.0% of the asset's value can be borrowed. Company policy is to try to maintain a cash balance of CAD 20,000 at all times to guard against unexpected cash outflows. This approximates 10.0% of quarterly cash disbursements. Surplus cash can be invested in 3- month term deposits earning 5.0%. Interest is paid quarterly Quarterly and annual financial statements must be submitted to the bank. In addition to the required coverage ratio, the bank requires that a current ratio of at least 1.5X be maintained on a quarterly basis. Also, an annual cash flow coverage ratio of at least 20 must be maintained. The goal for the long-term debt to total capitalization ratio is 40.0%. Company policy is to match the maturity of its assets and financing if possible. Dividends Regular dividends of CAD 15,000 are to be paid out each quarter unless a serious cash shortage prevents it. Special dividends can be paid if the company's cash balance becomes excessive Income Taxes The corporate tax rate is 45.0%. Taxes are paid at the end of each quarter. Balance Sheet Wanda's Water Sports Balance Sheet December 31, 2018 Current assets Cash Accounts receivable Inventory Total current assets Fixed assets Equipment I CAD 21.483 26,700 32,918 CAD 81,101 91,788 CAD 172,889 CAD 27,563 10,000 CAD 37,563 Total assets Current liabilities Line of credit Accounts payable Current portion of long-term debt Total current liabilities Long-term liabilities Term loan Shareholders' equity Share capital Retained earnings Total liabilities and equity 50,000 53,000 32,326 CAD 172,889 REQUIRED: 1. Prepare budgeted income statements, cash flow statements, balance sheets, and key financial ratios for Q1 2019. 2 Discuss the company's cash situation in Q1 and discuss what actions the company should take? Be sure to include the impact on the affected ratios. 3. What actions could be taken to reduce the long-term debt to total capitalization ratio in 012 4. Analyze the financial decisions made in Q1 focusing on the interrelationships between each of the quarters Sales Wanda's Water Sports (WWS) is a wholesaler of canoes, which currently sells one model, the Wave Rider (WR). The product is sold locally through major sports stores. The company has also begun to export, which helps to smooth out seasonal fluctuations in production and sales At present, the business has three local customers and one overseas 27 Wanda's Water Sports 2019 Sales Forecast (Units) Q1 Q2 Q3 Q4 Year Local Customer 1 43 76 58 204 Customer 2 56 122 97 22 297 Customer 3 30 66 48 17 164 Sub-total 132 264 193 60 665 Export 87 114 119 77 393 Total 219 378 318 14 1,058 Expected prices for 2019 for Wave Rider are: Price (CAD Per Unit) Local Export Wave Rider (WR) 900 675 Twenty percent of sales are for cash. Of the credit sales, approximately 70 0% are paid for in the quarter the sale takes place, and the balance are collected in the following quarter with negligible bad debts. Sales in the first quarter of 2020 are expected to be 250 units, which is 20.0% higher than the first quarter of 2019 Cost of Goods Sold WWS gets its product from a system of small independent contractors. In the coming year, the company expects to be able to buy Wave Riders for CAD 525. Seventy percent of all merchandise purchased is paid for in that quarter. The remainder is paid for in the following quarter Company policy is to maintain merchandise inventory in units equal to 30.0% of the next quarter's estimated sales in units. This is to guard against supply interruptions, which are frequent given the size of its suppliers. Beginning inventory on January 1, 2019 consists of 63 units Operating Expenses WWS's financial manager has put together the following information on estimated operating expenses for 2019 Category Selling Details Fixed component of CAD 35,500 a year plus a variable component equal to 1.0% of sales revenue for sales commissions All variable equal to CAD 7 per unit for local sales and CAD 15 per unit for exports All fixed equal to CAD 45,200 a year including CAD 7,000 for depreciation of fixed assets and CAD 18,000 in rent, Distribution Administrative Al fixed costs are incurred uniformly throughout the year and are paid for as incurred. Capital Budget WWS's financial manager has reviewed an updated list of capital expenditures in 2019 and has selected the following projects: Item Estimated Cost When CAD 26,000 End 01 New computer with associated software for bookkeeping, scheduling, and word processing - 4-year life New office equipment -10 year life CAD 19,500 End 02 Depreciation charges for these assets were not included in the administration budget. Financing WWS has an 8.0% line of credit, which allows it to borrow up to CAD 95,000 to finance its accounts receivable and inventories. The bank allows WWS to borrow up to 75.0% of the value of their good accounts receivable but nothing against their finished goods inventory due to its highly specialize nature. Interest is paid quarterly and any borrowing or paying down of the loan is be done at the end of each quarter. The line of credit must be paid down to zero once per year The company's purchases of capital assets can be financed with a term loan. Interest is paid quarterly at a rate of 10.0%. The principal is paid down on a straight-line basis over the life of the asset. Payments are made quarterly. Up to 80.0% of the asset's value can be borrowed. Company policy is to try to maintain a cash balance of CAD 20,000 at all times to guard against unexpected cash outflows. This approximates 10.0% of quarterly cash disbursements. Surplus cash can be invested in 3- month term deposits earning 5.0%. Interest is paid quarterly Quarterly and annual financial statements must be submitted to the bank. In addition to the required coverage ratio, the bank requires that a current ratio of at least 1.5X be maintained on a quarterly basis. Also, an annual cash flow coverage ratio of at least 20 must be maintained. The goal for the long-term debt to total capitalization ratio is 40.0%. Company policy is to match the maturity of its assets and financing if possible. Dividends Regular dividends of CAD 15,000 are to be paid out each quarter unless a serious cash shortage prevents it. Special dividends can be paid if the company's cash balance becomes excessive Income Taxes The corporate tax rate is 45.0%. Taxes are paid at the end of each quarter. Balance Sheet Wanda's Water Sports Balance Sheet December 31, 2018 Current assets Cash Accounts receivable Inventory Total current assets Fixed assets Equipment I CAD 21.483 26,700 32,918 CAD 81,101 91,788 CAD 172,889 CAD 27,563 10,000 CAD 37,563 Total assets Current liabilities Line of credit Accounts payable Current portion of long-term debt Total current liabilities Long-term liabilities Term loan Shareholders' equity Share capital Retained earnings Total liabilities and equity 50,000 53,000 32,326 CAD 172,889 REQUIRED: 1. Prepare budgeted income statements, cash flow statements, balance sheets, and key financial ratios for Q1 2019. 2 Discuss the company's cash situation in Q1 and discuss what actions the company should take? Be sure to include the impact on the affected ratios. 3. What actions could be taken to reduce the long-term debt to total capitalization ratio in 012 4. Analyze the financial decisions made in Q1 focusing on the interrelationships between each of the quarters