Answered step by step

Verified Expert Solution

Question

1 Approved Answer

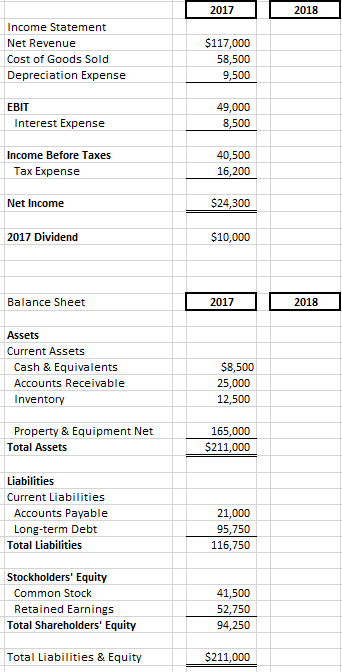

Sales will grow by 10%. All costs, assets, and current liabilities vary with sales. Tax rate and dividend payout ratio remain the same. 2017 Income

Sales will grow by 10%. All costs, assets, and current liabilities vary with sales. Tax rate and dividend payout ratio remain the same.

| 2017 | ||

| Income Statement | ||

| Net Revenue | $117,000 | |

| Cost of Goods Sold | 58,500 | |

| Depreciation Expense | 9,500 | |

| EBIT | 49,000 | |

| Interest Expense | 8,500 | |

| Income Before Taxes | 40,500 | |

| Tax Expense | 16,200 | |

| Net Income | $24,300 | |

| 2017 Dividend | $10,000 |

| Balance Sheet | 2017 | |

| Assets | ||

| Current Assets | ||

| Cash & Equivalents | $8,500 | |

| Accounts Receivable | 25,000 | |

| Inventory | 12,500 | |

| Property & Equipment Net | 165,000 | |

| Total Assets | $211,000 | |

| Liabilities | ||

| Current Liabilities | ||

| Accounts Payable | 21,000 | |

| Long-term Debt | 95,750 | |

| Total Liabilities | 116,750 | |

| Stockholders' Equity | ||

| Common Stock | 41,500 | |

| Retained Earnings | 52,750 | |

| Total Shareholders' Equity | 94,250 | |

| Total Liabilities & Equity | $211,000 |

a.) Prepare 2018 forecast, and what is 2018 dividend and addition to retained earnings

Can you show excel formulas so I can learn better? Thank you!

2017 2018 Income Statement Net Revenue Cost of Goods Sold Depreciation Expense $117,000 58,500 9,500 EBIT Interest Expense 49,000 8,500 Income Before Taxes Tax Expense 40,500 16,200 Net Income $24,300 2017 Dividend $10,000 Balance Sheet 2017 2018 Assets Current Assets Cash & Equivalents Accounts Receivable Inventory $8,500 25,000 12,500 Property & Equipment Net Total Assets 165,000 $211,000 Liabilities Current Liabilities Accounts Payable Long-term Debt Total Liabilities 21,000 95,750 116,750 Stockholders' Equity Common Stock Retained Earnings Total Shareholders' Equity 41,500 52,750 94,250 Total Liabilities & Equity $211,000 2017 2018 Income Statement Net Revenue Cost of Goods Sold Depreciation Expense $117,000 58,500 9,500 EBIT Interest Expense 49,000 8,500 Income Before Taxes Tax Expense 40,500 16,200 Net Income $24,300 2017 Dividend $10,000 Balance Sheet 2017 2018 Assets Current Assets Cash & Equivalents Accounts Receivable Inventory $8,500 25,000 12,500 Property & Equipment Net Total Assets 165,000 $211,000 Liabilities Current Liabilities Accounts Payable Long-term Debt Total Liabilities 21,000 95,750 116,750 Stockholders' Equity Common Stock Retained Earnings Total Shareholders' Equity 41,500 52,750 94,250 Total Liabilities & Equity $211,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started