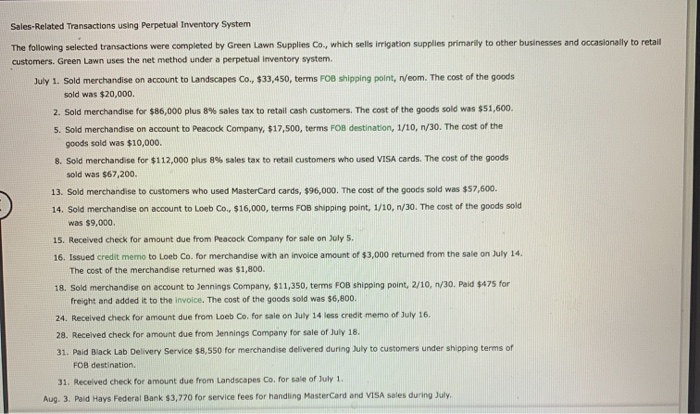

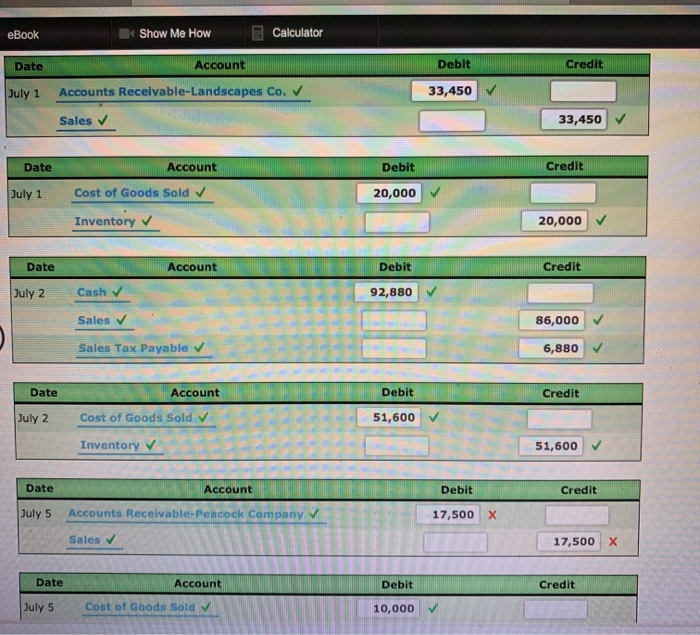

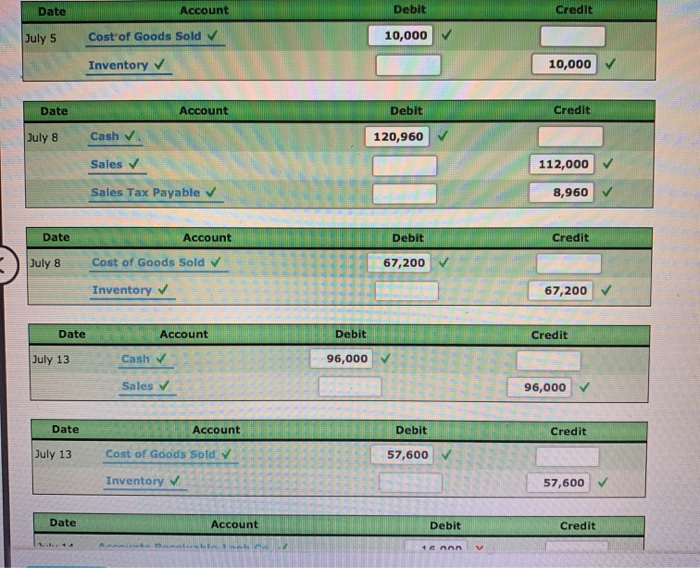

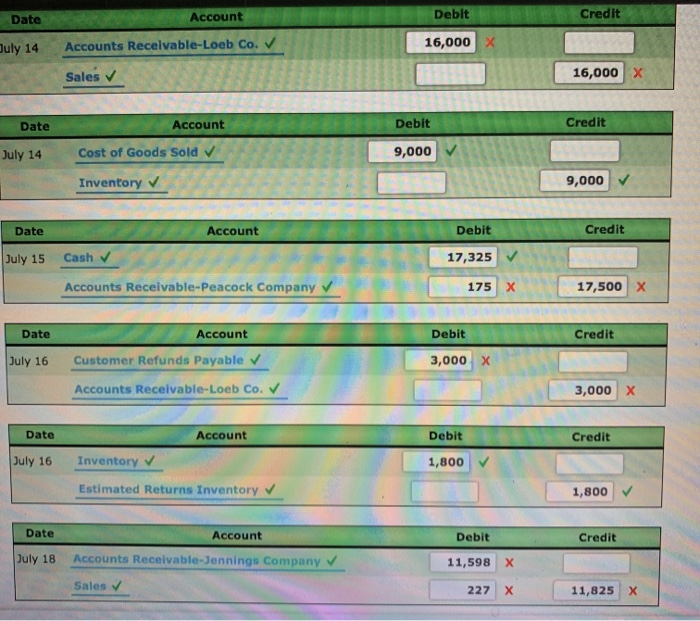

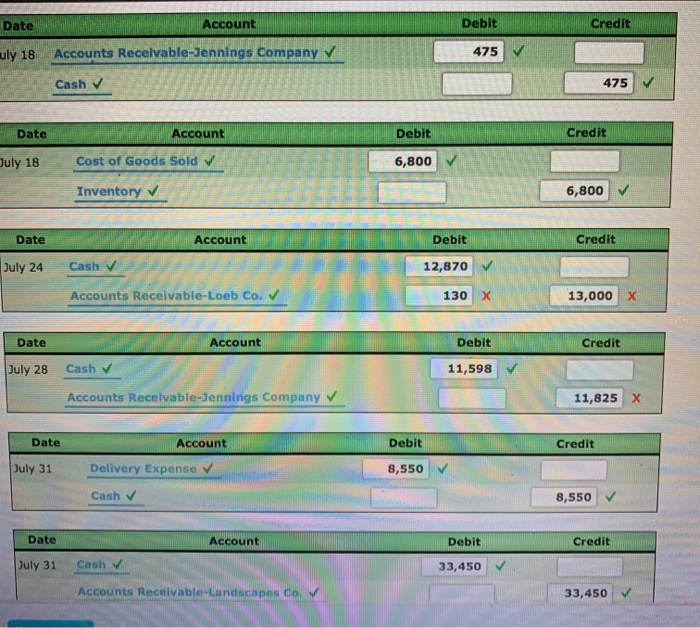

Sales-Related Transactions using Perpetual Inventory System The following selected transactions were completed by Green Lawn Supplies Co., which sells Irrigation supplies primarily to other businesses and occasionally to retail customers. Green Lawn uses the net method under a perpetual Inventory system. July 1. Sold merchandise on account to Landscapes Co., $33,450, terms FOB shipping point, n/eom. The cost of the goods sold was $20,000 2. Sold merchandise for $86,000 plus 8% sales tax to retail cash customers. The cost of the goods sold was $51,600. 5. Sold merchandise on account to Peacock Company, $17,500, terms FOB destination, 1/10, 1/30. The cost of the goods sold was $10,000. 8. Sold merchandise for $112,000 plus 8% sales tax to retail customers who used VISA cards. The cost of the goods sold was $67,200. 13. Sold merchandise to customers who used MasterCard cards, 596,000. The cost of the goods sold was $57,600. 14. Sold merchandise on account to Loeb Co., $16,000, terms FOB shipping point, 1/10, 1/30. The cost of the goods sold was $9.000 15. Received check for amount due from Peacock Company for sale on Joly 5. 16. Issued credit memo to Loeb Co. for merchandise with an invoice amount of $3,000 returned from the sale on July 14. The cost of the merchandise returned was $1,800. 18. Sold merchandise on account to Jennings Company, $11,350, terms FOB shipping point, 2/10, 1/30. Paid $475 for freight and added it to the invoice. The cost of the goods sold was $6,800. 24. Received check for amount due from Loeb Co. for sale on July 14 less credit memo of July 16. 28. Received check for amount due from Jennings Company for sale of July 18. 31. Paid Black Lab Delivery Service $8,550 for merchandise delivered during July to customers under shipping terms of FOB destination. 31. Received check for amount due from Landscapes Co. for sale of July 1. Aug. 3. Pald Hays Federal Bank $3,770 for service fees for handling MasterCard and VISA sales during July eBook Show Me How Calculator Date Account Debit Credit July 1 Accounts Receivable-Landscapes Co. 33,450 Sales 33,450 Date Account Debit Credit July 1 Cost of Goods Sold 20,000 Inventory 20,000 Date Account Debit Credit July 2 Cash 92,880 Sales 86,000 Sales Tax Payable 6,880 Date Account Debit Credit July 2 Cost of Goods Sold 51,600 Inventory 51,600 Date Account Debit Credit July 5 Accounts Receivable-Peacock Company 17,500 X Sales 17,500 X Date Account Debit Credit July 5 Cost of Goods Sold 10,000 Date Account Debit Credit July 5 Cost of Goods Sold 10,000 Inventory 10,000 Date Account Debit Credit Duly 8 Cash 120,960 Sales 112,000 Sales Tax Payable 8,960 Date Account Debit Credit July 8 Cost of Goods Sold 67,200 Inventory 67,200 Date Account Debit Credit July 13 Cash 96,000 Sales 96,000 Date Debit Credit Account Cost of Goods Sold July 13 57,600 Inventory 57,600 Date Account Debit Credit 14 ennn Date Account Debit Credit July 14 Accounts Receivable-Loeb Co. 16,000 X Sales 16,000 X Date Account Debit Credit July 14 Cost of Goods Sold 9,000 Inventory 9,000 Date Account Debit Credit July 15 Cash 17,325 Accounts Receivable-Peacock Company 175 17,500 X Date Account Debit Credit July 16 Customer Refunds Payable 3,000 X Accounts Receivable-Loeb Co. 3,000 X Date Account Debit Credit July 16 Inventory 1,800 Estimated Returns Inventory 1,800 Date Account Debit Credit July 18 Accounts Receivable-Jennings Company 11,598 x Sales 227 11,825 X Date Account Debit Credit uly 18 Accounts Receivable-Jennings Company 475 Cash 475 Date Account Debit Credit July 18 Cost of Goods Sold 6,800 Inventory 6,800 Date Account Debit Credit July 24 Cash 12,870 Accounts Receivable-Loeb Co. 130 13,000 X Date Account Debit Credit July 28 Cash 11,598 Accounts Receivable-Jennings Company 11,825 x Date Account Debit Credit July 31 Delivery Expense 8,550 Cash 8,550 Date Account Debit Credit July 31 Cash 33,450 Accounts Receivable-Landscapes Co. V 33,450