Answered step by step

Verified Expert Solution

Question

1 Approved Answer

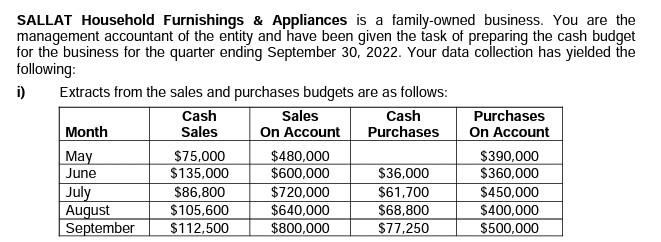

SALLAT Household Furnishings & Appliances is a family-owned business. You are the management accountant of the entity and have been given the task of preparing

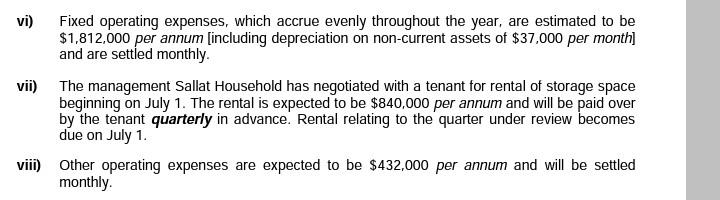

SALLAT Household Furnishings & Appliances is a family-owned business. You are the management accountant of the entity and have been given the task of preparing the cash budget for the business for the quarter ending September 30, 2022. Your data collection has yielded the following: i) Extracts from the sales and purchases budgets are as follows: Cash Sales Cash Purchases Month Sales On Account Purchases On Account May $75,000 $480,000 $390,000 June $135,000 $600,000 $36,000 $360,000 July $86,800 $720,000 $61,700 $450,000 August $105,600 $640,000 $68,800 $400,000 September $112,500 $800,000 $77,250 $500,000 vi) Fixed operating expenses, which accrue evenly throughout the year, are estimated to be $1,812,000 per annum [including depreciation on non-current assets of $37.000 per month] and are settled monthly vii) The management Sallat Household has negotiated with a tenant for rental of storage space beginning on July 1. The rental is expected to be $840,000 per annum and will be paid over by the tenant quarterly in advance. Rental relating to the quarter under review becomes due on July 1. viii) Other operating expenses are expected to be $432,000 per annum and will be settled monthly SALLAT Household Furnishings & Appliances is a family-owned business. You are the management accountant of the entity and have been given the task of preparing the cash budget for the business for the quarter ending September 30, 2022. Your data collection has yielded the following: i) Extracts from the sales and purchases budgets are as follows: Cash Sales Cash Purchases Month Sales On Account Purchases On Account May $75,000 $480,000 $390,000 June $135,000 $600,000 $36,000 $360,000 July $86,800 $720,000 $61,700 $450,000 August $105,600 $640,000 $68,800 $400,000 September $112,500 $800,000 $77,250 $500,000 vi) Fixed operating expenses, which accrue evenly throughout the year, are estimated to be $1,812,000 per annum [including depreciation on non-current assets of $37.000 per month] and are settled monthly vii) The management Sallat Household has negotiated with a tenant for rental of storage space beginning on July 1. The rental is expected to be $840,000 per annum and will be paid over by the tenant quarterly in advance. Rental relating to the quarter under review becomes due on July 1. viii) Other operating expenses are expected to be $432,000 per annum and will be settled monthly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started