Question

Salleh and Hawa have been married for 5 years. They own a condominium in Petaling Jaya, and have no children. Salleh is 28 and Hawa

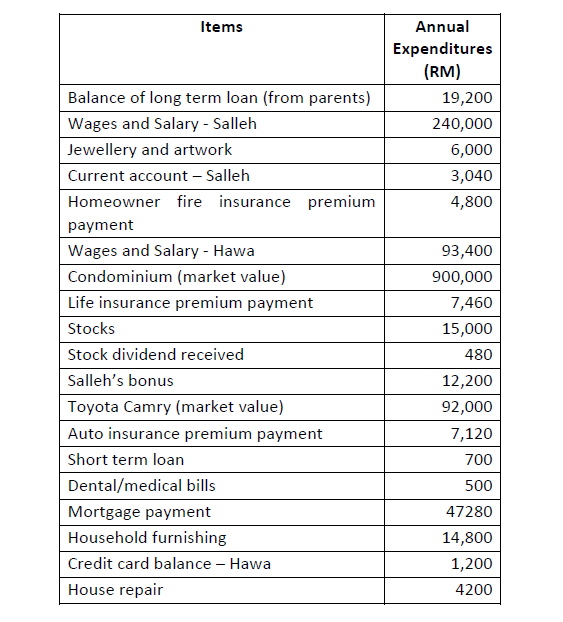

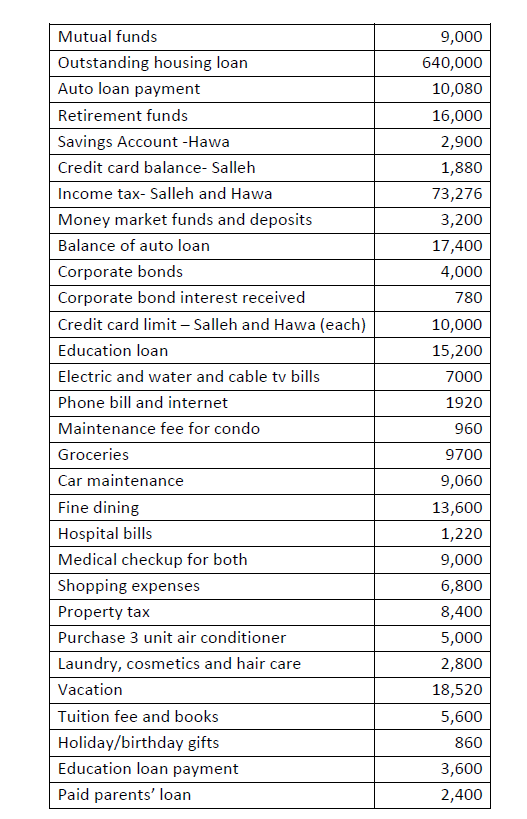

Salleh and Hawa have been married for 5 years. They own a condominium in Petaling Jaya, and have no children. Salleh is 28 and Hawa is 26 years old respectively. Both have set their longest term financial goal 34 years from now for their retirement. Salleh has just completed his final year as an engineer, working in an manufacturing company. Hawa an MBA graduate is working at a local advertising company. Both love to travel and enjoy water sports. Before they want to start a family, they want to to ensure that they are financially stable and have set up their children?s education fund and well as meet all their short and medium goals. They have decided to compile a list of their expenses so that they can see clearly. Below are information of their expenses so they can a regular savings program:-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started