Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Salwa is considering three competing Food and Beverage projects for investment. The projected cash flows of the three considered projects over a 6-year period are

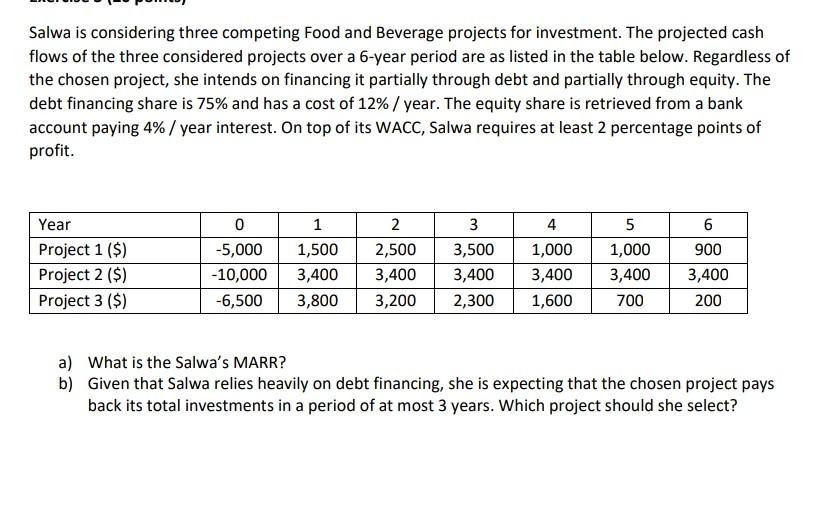

Salwa is considering three competing Food and Beverage projects for investment. The projected cash flows of the three considered projects over a 6-year period are as listed in the table below. Regardless of the chosen project, she intends on financing it partially through debt and partially through equity. The debt financing share is 75% and has a cost of 12% / year. The equity share is retrieved from a bank account paying 4% / year interest. On top of its WACC, Salwa requires at least 2 percentage points of profit. Year Project 1 ($) Project 2 ($) Project 3 ($) 0 -5,000 - 10,000 -6,500 1 1,500 3,400 3,800 2 2,500 3,400 3,200 3 3,500 3,400 2,300 4 1,000 3,400 1,600 5 1,000 3,400 700 6 900 3,400 200 a) What is the Salwa's MARR? b) Given that Salwa relies heavily on debt financing, she is expecting that the chosen project pays back its total investments in a period of at most 3 years. Which project should she select

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started