Question

Sam and Ella are buying their first home. The cost of the house is $360,000. They put 20% down and finance the balance through a

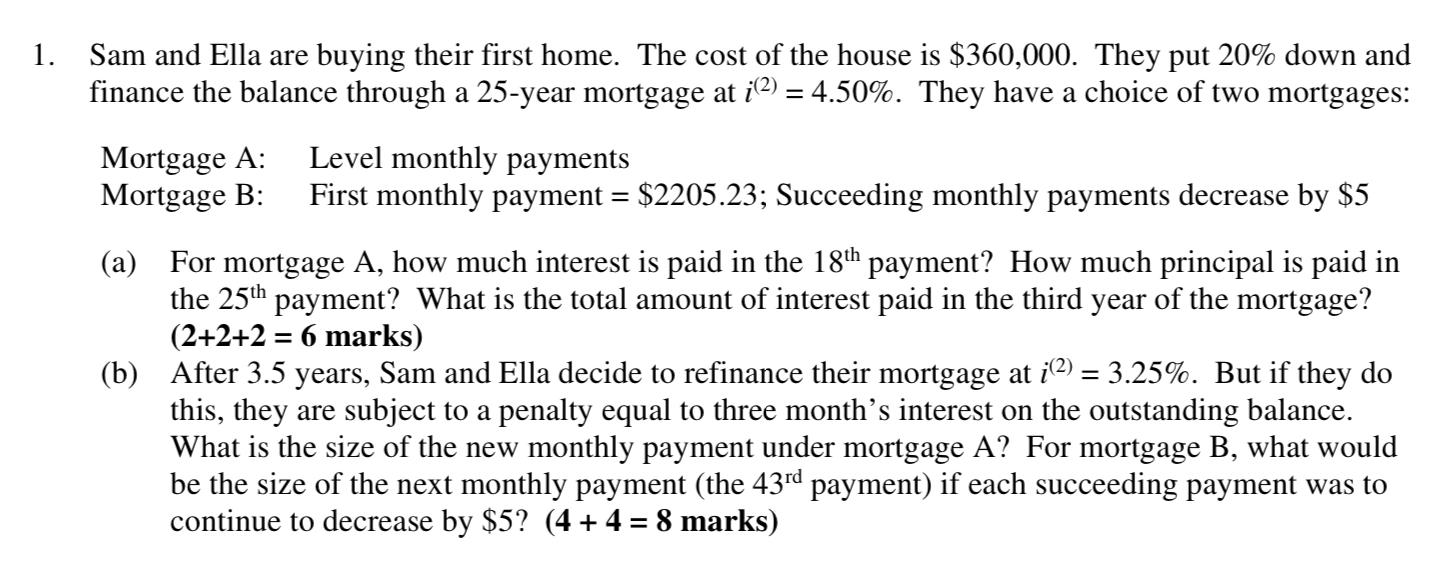

Sam and Ella are buying their first home. The cost of the house is $360,000. They put 20% down and finance the balance through a 25-year mortgage at i(2) = 4.50%. They have a choice of two mortgages: Mortgage A: Level monthly payments Mortgage B: First monthly payment = $2205.23; Succeeding monthly payments decrease by $5 (a) For mortgage A, how much interest is paid in the 18th payment? How much principal is paid in the 25th payment? What is the total amount of interest paid in the third year of the mortgage? (2+2+2 = 6 marks) (b) After 3.5 years, Sam and Ella decide to refinance their mortgage at i(2) = 3.25%. But if they do this, they are subject to a penalty equal to three months interest on the outstanding balance. What is the size of the new monthly payment under mortgage A? For mortgage B, what would be the size of the next monthly payment (the 43rd payment) if each succeeding payment was to continue to decrease by $5? (4 + 4 = 8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started