Answered step by step

Verified Expert Solution

Question

1 Approved Answer

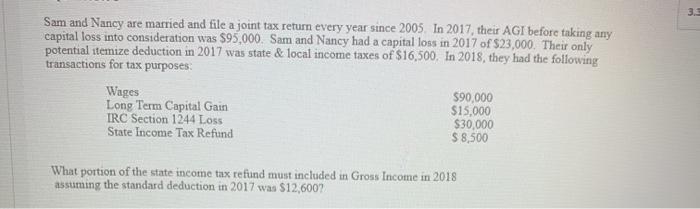

Sam and Nancy are married and file a joint tax return every year since 2005. In 2017, their AGI before taking any capital loss

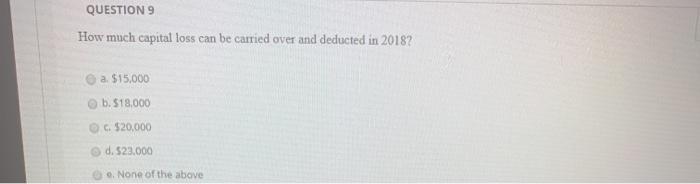

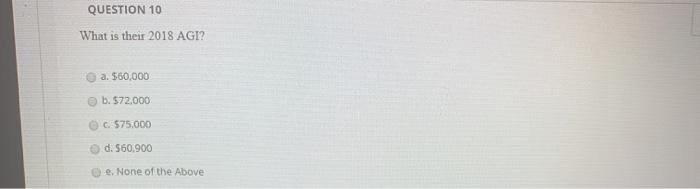

Sam and Nancy are married and file a joint tax return every year since 2005. In 2017, their AGI before taking any capital loss into consideration was $95,000. Sam and Nancy had a capital loss in 2017 of $23,000. Their only potential itemize deduction in 2017 was state & local income taxes of $16,500. In 2018, they had the following transactions for tax purposes: Wages Long Term Capital Gain IRC Section 1244 Loss State Income Tax Refund $90,000 $15,000 $30,000 $8,500 What portion of the state income tax refund must included in Gross Income in 2018 assuming the standard deduction in 2017 was $12,600? 3.3 QUESTION 9 How much capital loss can be carried over and deducted in 2018? a. $15,000 b. $18,000 c. $20,000 d. $23.000 e. None of the above QUESTION 10 What is their 2018 AGI? a. $60,000 b. $72,000 c. $75.000 d. $60,900 e. None of the Above

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The correct answer is a 3900 Supporting calculations ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started