Sam Gamgee, President of Middle Earth Toys, sat down with Legolas Rivendell, Executive Vice President, to discuss year-end performance evaluations of the management group.These discussions

Sam Gamgee, President of Middle Earth Toys, sat down with Legolas Rivendell, Executive Vice President, to discuss year-end performance evaluations of the management group.These discussions were important because the company had traditionally given its managers a sizable bonus based on their evaluation.To the extent that it was possible, Sam and Legolas preferred to base their evaluation on objective measures of performance with an emphasis on achievement of budgeted goals.

The budget process began in late August, and by mid-November the management team supplied the board of directors with a complete budget outlining monthly sales estimates, production cost estimates, and capital spending requirements.The directors then discussed the implications of the budget and, upon acceptance, authorized it.The firm's progress throughout the year was monitored against this budget every six months at the board meetings, which were held on the fifteenth of January and July.At the January meeting the board also voted on the management bonuses for the prior fiscal year.

Middle Earth Toys was a New England-based company that manufactured a very successful line of foam rubber toys called "Gollums."Each Gollum was a cuddly troll-like doll with a mischievous smile, and enormous feet, which sold for $20 wholesale.From the moment of introduction, they had been a runaway success.Plans to expand the line were on the drawing board, and a smaller baby version was to be introduced in the spring of 2021.

The business was highly seasonal with over half of the sales occurring from mid-August to early November.This was followed by a two-month trough before birthday and occasional gift sales picked up again.Sales were then fairly stable until the next Christmas rush began.Budgeted sales for fiscal 2020, ending November 30, 2020, had been $40 million with an expected gross margin, on full production cost, of 24 percent.

Management had decided that even though sales were highly seasonal, production would be level throughout the year.This enabled Middle Earth Toys to stabilize employment and to sell a greater number of toys during the Christmas period than would have been possible if a shift approach had been used.Normal production was at full capacity using one shift a day, five days a week.In 2019, sales had been considerably greater than expectation and had almost resulted in orders being rejected due to a lack of inventory.In fact, by year-end only 44,000 toys were left in stock to begin fiscal 2020.

Sam and Legolas decided to discuss the production manager's performance first.The production manager, Eowyn Gondor, had been with the firm for just over a year, and this was to be her first bonus.Sam and Legolas admired Eowyn and felt she had been very innovative and had substantially improved the production process.She had introduced a new production process at the beginning of the third quarter, in which she aimed to reduce the average material content of each toy from 5 lbs. to 4.5 lbs.

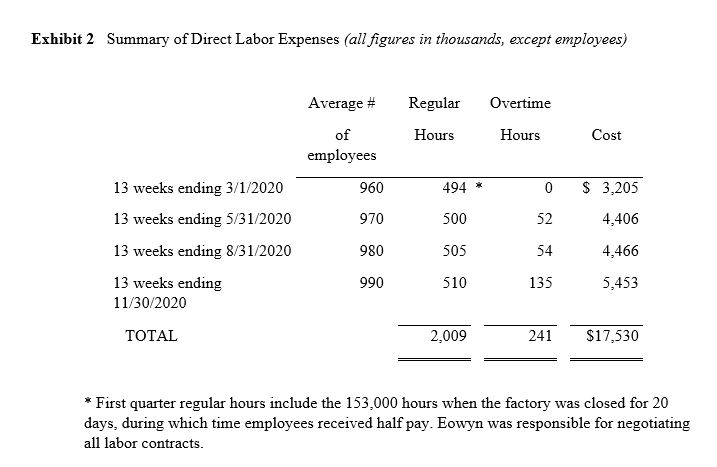

In measuring Eowyn's managerial performance, Sam and Legolas felt that some adjustment was necessary because 2020 had been a rather turbulent year.The factory had been closed from mid-March to mid-April (20 working days in total) due to an emergency stay-at-home order.During this period employees did not work but were given half of their normal pay.

To make up for lost production, an additional Saturday morning shift was introduced from mid-April until the end of the year.Employees were paid time-and-a-half for this work.Additional overtime was required in the fourth quarter when the sales department managed to gain a special order worth $750,000 in revenue from a catalog sales company for an extra 50,000 toys.The order was placed in the middle of October and, along with other orders, required that overtime be increased to 16 hours per weekend, at time-and-a-half, for seven weekends (this includes the Saturday morning time already planned).Sales for fiscal 2020 were 2,094,000 units, as the company had literally sold every toy available.

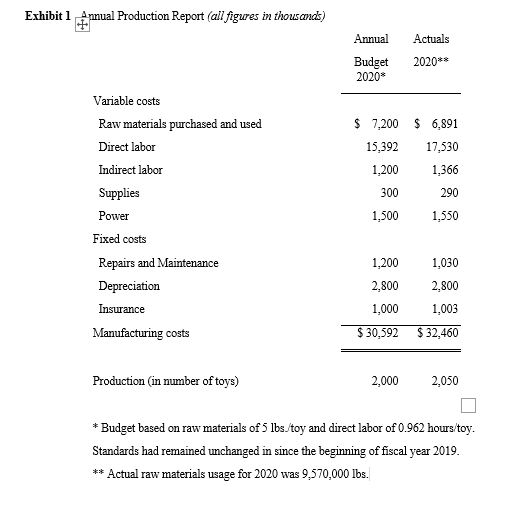

Sam and Legolas started with the budgeted and actual figures reported in Exhibit 1.The company had implemented a standard cost system since 2019.Because unit costs were relatively stable, direct materials were tracked in pounds, direct labor in hours, and actual usage was compared with budget.Before they could adequately judge Eowyn's performance, however, Sam and Legolas decided they needed additional information.Legolas contacted the payroll clerk and was given a summary of quarterly payroll listings (Exhibit 2).

Looking at the pile of information they had collected, Sam and Legolas settled down to the process of evaluating Eowyn's performance.

1- What was the firm's budgeted (standard) cost per toy?

2- create a (balanced) evaluation of Eowyn Gondor's performance as a production manager.Be as specific as possible.Evaluation criteria would include effectiveness and efficiency.

You might start with as many variances as you can compute, then make an interpretive judgment as to the importance of each variance and what/who is responsible for the variance.

3-Was the catalog order profitable?Support your answer.

Exhibit 1 Annual Production Report (all figures in thousands) Variable costs Annual Actuals Budget 2020** 2020* Supplies Power Raw materials purchased and used $ 7,200 $ 6,891 Direct labor 15,392 17,530 Indirect labor 1,200 1,366 300 290 1,500 1,550 Fixed costs Repairs and Maintenance 1,200 1,030 Depreciation 2,800 2,800 Insurance 1,000 1,003 Manufacturing costs $ 30,592 $32,460 Production (in number of toys) 2,000 2,050 Budget based on raw materials of 5 lbs./toy and direct labor of 0.962 hours/toy. Standards had remained unchanged in since the beginning of fiscal year 2019. ** Actual raw materials usage for 2020 was 9,570,000 lbs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started