Answered step by step

Verified Expert Solution

Question

1 Approved Answer

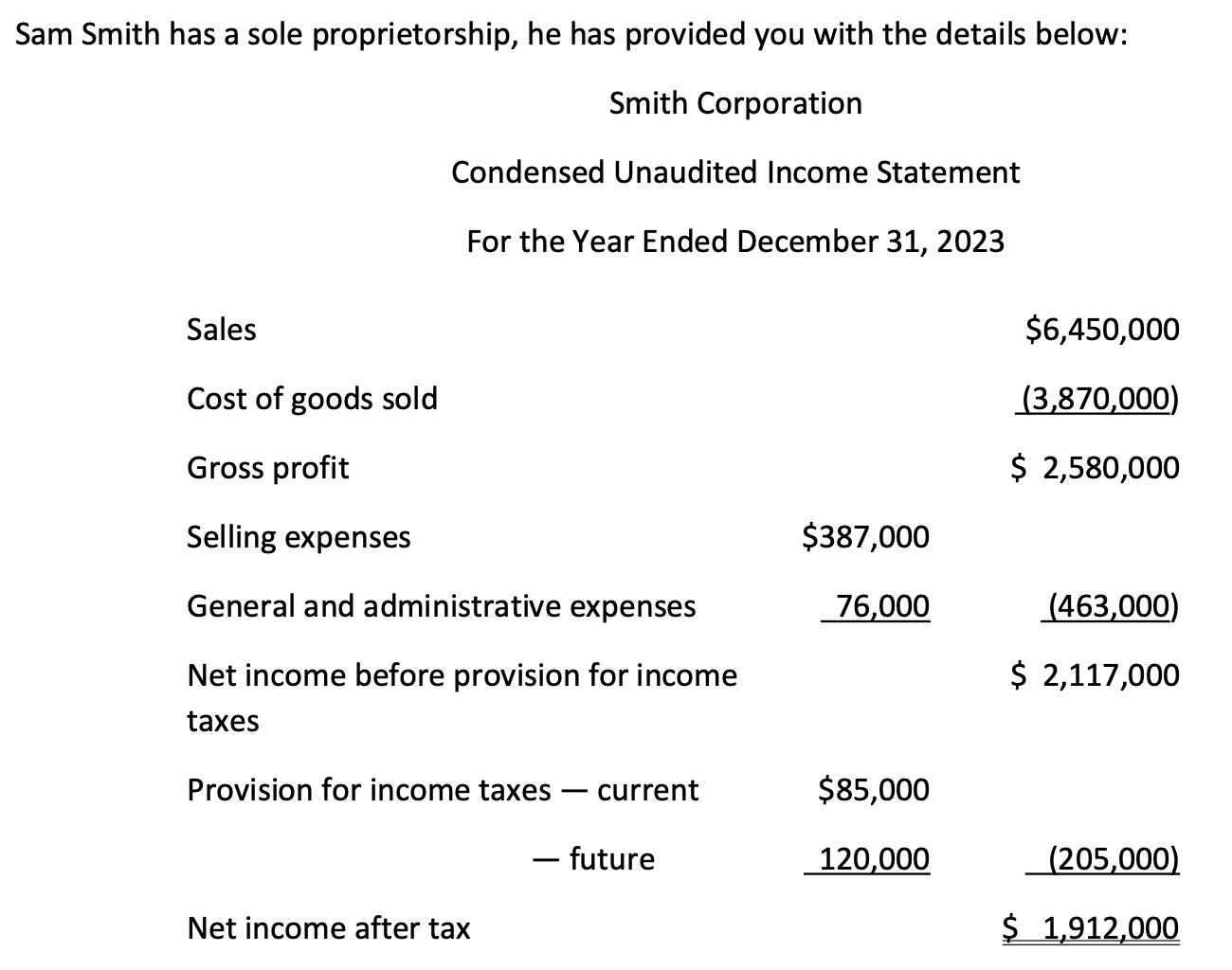

Sam Smith has a sole proprietorship, he has provided you with the details below: Smith Corporation Condensed Unaudited Income Statement For the Year Ended

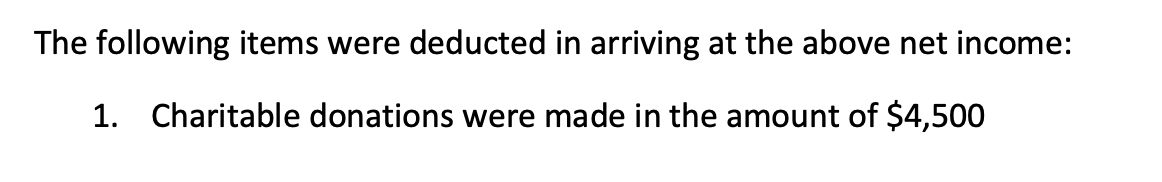

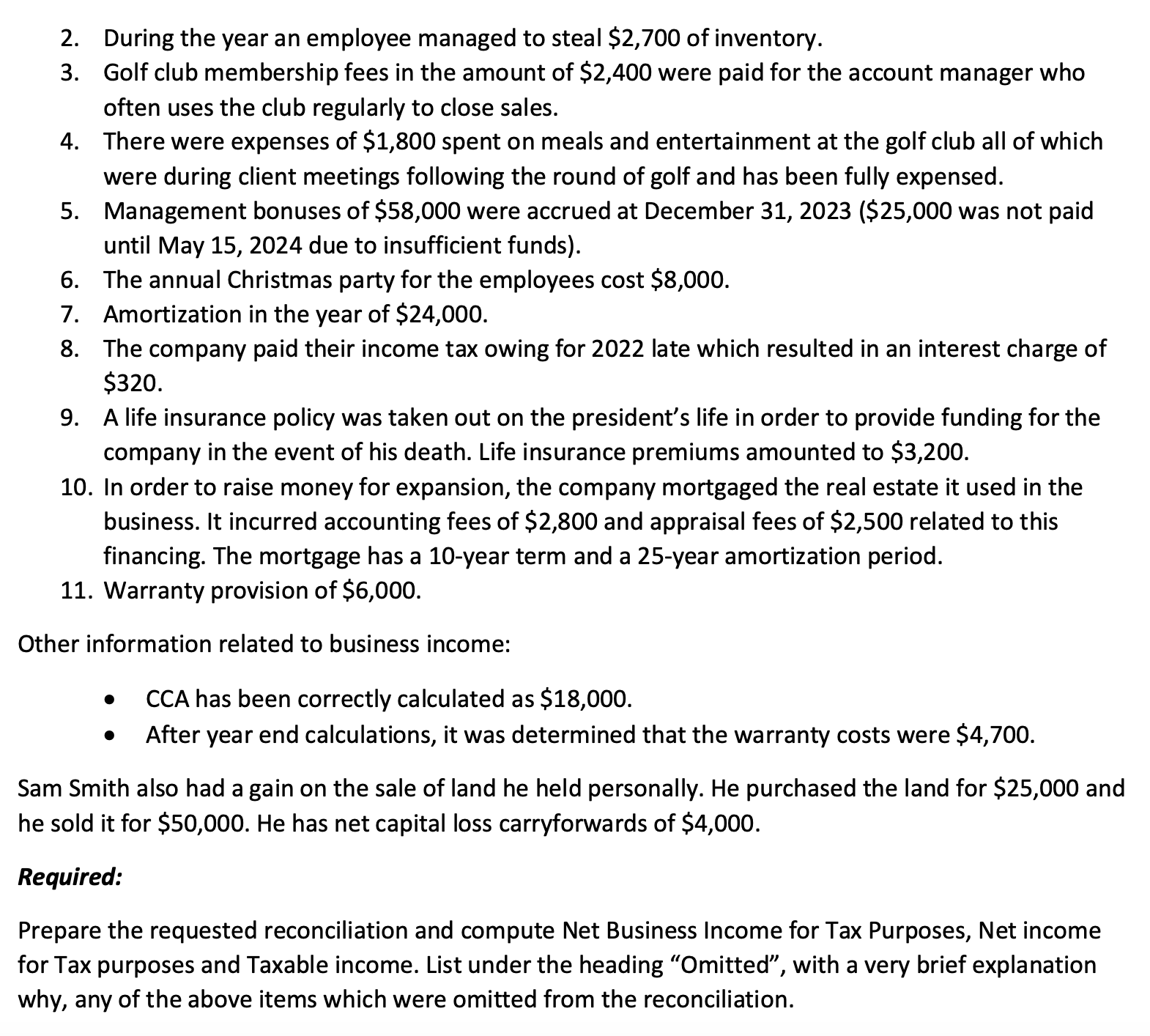

Sam Smith has a sole proprietorship, he has provided you with the details below: Smith Corporation Condensed Unaudited Income Statement For the Year Ended December 31, 2023 Sales Cost of goods sold Gross profit Selling expenses General and administrative expenses Net income before provision for income taxes $6,450,000 (3,870,000) $ 2,580,000 $387,000 76,000 (463,000) $ 2,117,000 Provision for income taxes - - current $85,000 - - future 120,000 Net income after tax (205,000) $ 1,912,000 The following items were deducted in arriving at the above net income: 1. Charitable donations were made in the amount of $4,500 2. During the year an employee managed to steal $2,700 of inventory. 3. Golf club membership fees in the amount of $2,400 were paid for the account manager who often uses the club regularly to close sales. 4. There were expenses of $1,800 spent on meals and entertainment at the golf club all of which were during client meetings following the round of golf and has been fully expensed. 5. Management bonuses of $58,000 were accrued at December 31, 2023 ($25,000 was not paid until May 15, 2024 due to insufficient funds). 6. The annual Christmas party for the employees cost $8,000. 7. Amortization in the year of $24,000. 8. The company paid their income tax owing for 2022 late which resulted in an interest charge of $320. 9. A life insurance policy was taken out on the president's life in order to provide funding for the company in the event of his death. Life insurance premiums amounted to $3,200. 10. In order to raise money for expansion, the company mortgaged the real estate it used in the business. It incurred accounting fees of $2,800 and appraisal fees of $2,500 related to this financing. The mortgage has a 10-year term and a 25-year amortization period. 11. Warranty provision of $6,000. Other information related to business income: CCA has been correctly calculated as $18,000. After year end calculations, it was determined that the warranty costs were $4,700. Sam Smith also had a gain on the sale of land he held personally. He purchased the land for $25,000 and he sold it for $50,000. He has net capital loss carryforwards of $4,000. Required: Prepare the requested reconciliation and compute Net Business Income for Tax Purposes, Net income for Tax purposes and Taxable income. List under the heading "Omitted", with a very brief explanation why, any of the above items which were omitted from the reconciliation.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To compute the Net Business Income for Tax Purposes Net Income for Tax Purposes and Taxable Income we need to reconcile the net income reported on the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started