Answered step by step

Verified Expert Solution

Question

1 Approved Answer

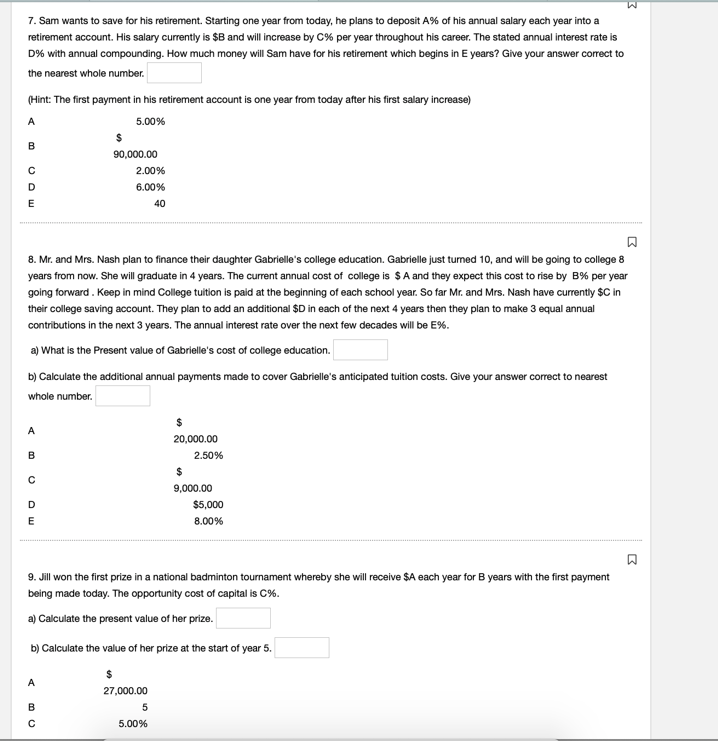

Sam wants to save for his retirement. Starting one year from today, he plans to deposit A % of his annual salary each year into

Sam wants to save for his retirement. Starting one year from today, he plans to deposit A of his annual salary each year into a

retirement account. His salary currently is $ and will increase by per year throughout his career. The stated annual interest rate is

with annual compounding. How much money will Sam have for his retirement which begins in E years? Give your answer correct to

the nearest whole number.

Hint: The first payment in his retirement account is one year from today after his first salary increase

A

B

$

C

D

E

Mr and Mrs Nash plan to finance their daughter Gabrielle's college education. Gabrielle just tumed and will be going to college

years from now. She will graduate in years. The current annual cost of college is $A and they expect this cost to rise by B per year

going forward. Keep in mind College tuition is paid at the beginning of each school year. So far Mr and Mrs Nash have currently $ in

their college saving account. They plan to add an additional $D in each of the next years then they plan to make equal annual

contributions in the next years. The annual interest rate over the next few decades will be E

a What is the Present value of Gabrielle's cost of college education.

b Calculate the additional annual payments made to cover Gabrielle's anticipated tuition costs. Give your answer correct to nearest

whole number.

A

$

B

C

$

D

$

E

Jill won the first prize in a national badminton tournament whereby she will receive $A each year for B years with the first payment

being made today. The opportunity cost of capital is

a Calculate the present value of her prize.

b Calculate the value of her prize at the start of year

A

B

C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started