Samantha and John agree both to the participating preferred and that the company will probably need another round of financing in addition to the

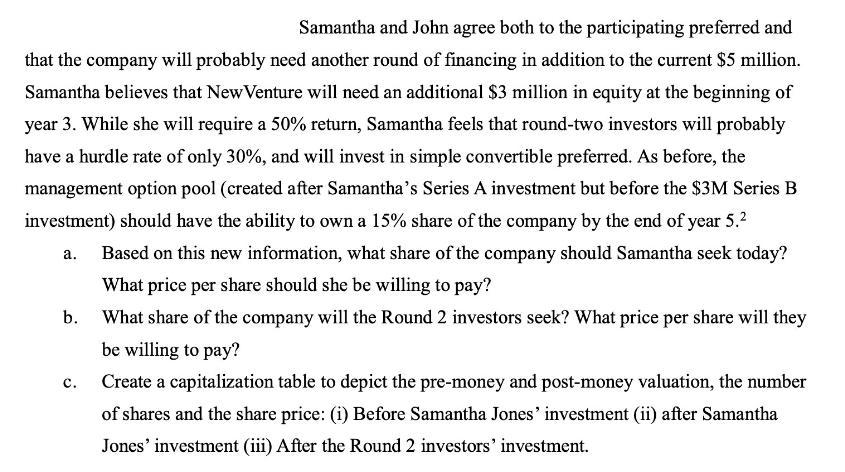

Samantha and John agree both to the participating preferred and that the company will probably need another round of financing in addition to the current $5 million. Samantha believes that New Venture will need an additional $3 million in equity at the beginning of year 3. While she will require a 50% return, Samantha feels that round-two investors will probably have a hurdle rate of only 30%, and will invest in simple convertible preferred. As before, the management option pool (created after Samantha's Series A investment but before the $3M Series B investment) should have the ability to own a 15% share of the company by the end of year 5. Based on this new information, what share of the company should Samantha seek today? What price per share should she be willing to pay? b. What share of the company will the Round 2 investors seek? What price per share will they be willing to pay? Create a capitalization table to depict the pre-money and post-money valuation, the number of shares and the share price: (i) Before Samantha Jones' investment (ii) after Samantha Jones' investment (iii) After the Round 2 investors' investment. a. C.

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Certainly lets solve this step by step with a clear explanation Well start with Samantha Jones investment Step 1 Samantha Jones Investment Samantha is investing 5 million initially and requires a 50 r...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started