Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Samantha Jones works for Broken Arrow Mills (BAM) as a risk management specialist in their Oklahoma flour mill. It is March, and the production schedule

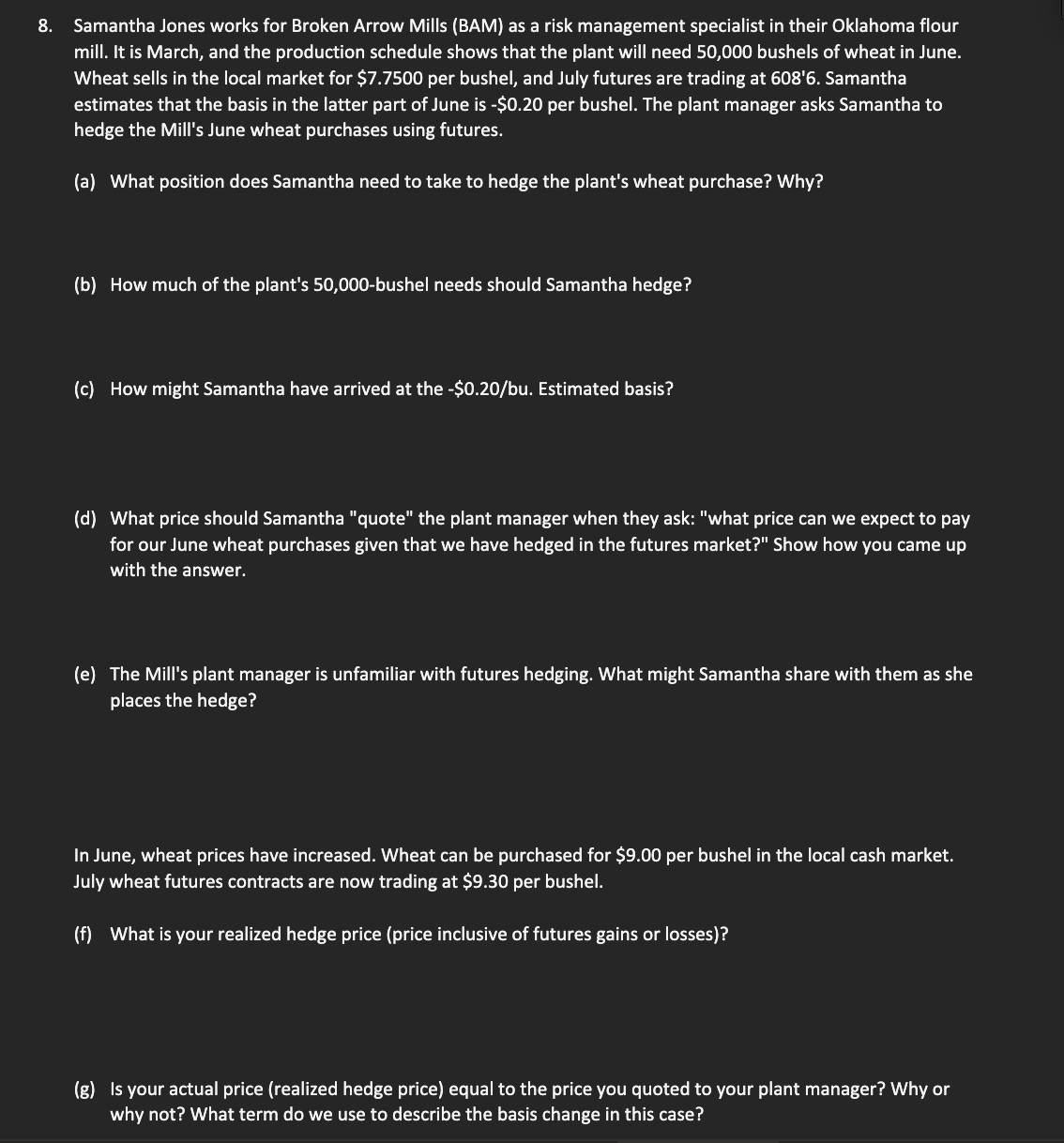

Samantha Jones works for Broken Arrow Mills (BAM) as a risk management specialist in their Oklahoma flour mill. It is March, and the production schedule shows that the plant will need 50,000 bushels of wheat in June. Wheat sells in the local market for $7.7500 per bushel, and July futures are trading at 608 '6. Samantha estimates that the basis in the latter part of June is $0.20 per bushel. The plant manager asks Samanto hedge the Mill's June wheat purchases using futures. (a) What position does Samantha need to take to hedge the plant's wheat purchase? Why? (b) How much of the plant's 50,000-bushel needs should Samantha hedge? (c) How might Samantha have arrived at the $0.20/ bu. Estimated basis? (d) What price should Samantha "quote" the plant manager when they ask: "what price can we expect to pay for our June wheat purchases given that we have hedged in the futures market?" Show how you came up with the answer. (e) The Mill's plant manager is unfamiliar with futures hedging. What might Samantha share with them as she places the hedge? In June, wheat prices have increased. Wheat can be purchased for $9.00 per bushel in the local cash market. July wheat futures contracts are now trading at $9.30 per bushel. (f) What is your realized hedge price (price inclusive of futures gains or losses)? (g) Is your actual price (realized hedge price) equal to the price you quoted to your plant manager? Why or why not? What term do we use to describe the basis change in this case

Samantha Jones works for Broken Arrow Mills (BAM) as a risk management specialist in their Oklahoma flour mill. It is March, and the production schedule shows that the plant will need 50,000 bushels of wheat in June. Wheat sells in the local market for $7.7500 per bushel, and July futures are trading at 608 '6. Samantha estimates that the basis in the latter part of June is $0.20 per bushel. The plant manager asks Samanto hedge the Mill's June wheat purchases using futures. (a) What position does Samantha need to take to hedge the plant's wheat purchase? Why? (b) How much of the plant's 50,000-bushel needs should Samantha hedge? (c) How might Samantha have arrived at the $0.20/ bu. Estimated basis? (d) What price should Samantha "quote" the plant manager when they ask: "what price can we expect to pay for our June wheat purchases given that we have hedged in the futures market?" Show how you came up with the answer. (e) The Mill's plant manager is unfamiliar with futures hedging. What might Samantha share with them as she places the hedge? In June, wheat prices have increased. Wheat can be purchased for $9.00 per bushel in the local cash market. July wheat futures contracts are now trading at $9.30 per bushel. (f) What is your realized hedge price (price inclusive of futures gains or losses)? (g) Is your actual price (realized hedge price) equal to the price you quoted to your plant manager? Why or why not? What term do we use to describe the basis change in this case Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started