Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Samantha, who is single and has MAGI of $28,000, was recently employed by an accounting firm. During the year, she spends $2,500 for a CPA

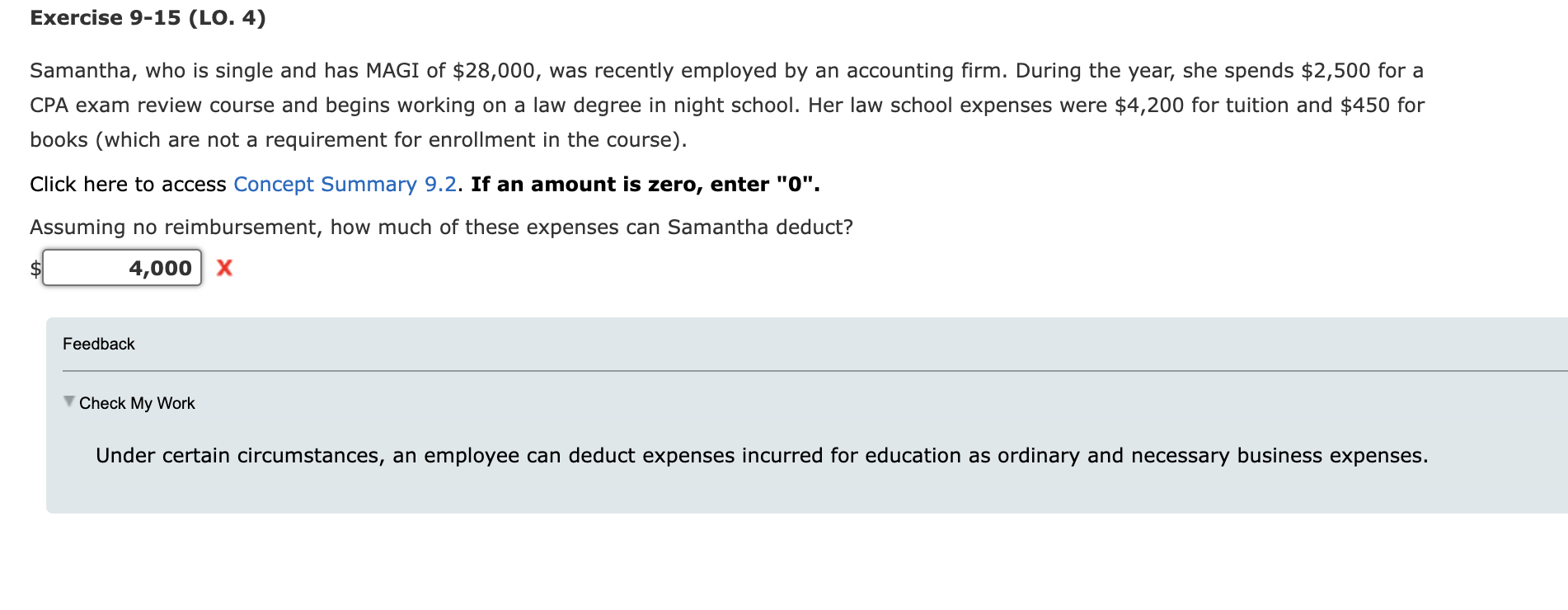

Samantha, who is single and has MAGI of $28,000, was recently employed by an accounting firm. During the year, she spends $2,500 for a CPA exam review course and begins working on a law degree in night school. Her law school expenses were $4,200 for tuition and $450 for books (which are not a requirement for enrollment in the course). Click here to access Concept Summary 9.2. If an amount is zero, enter "0". Assuming no reimbursement, how much of these expenses can Samantha deduct? $ x Feedback Check My Work Under certain circumstances, an employee can deduct expenses incurred for education as ordinary and necessary business expenses

Samantha, who is single and has MAGI of $28,000, was recently employed by an accounting firm. During the year, she spends $2,500 for a CPA exam review course and begins working on a law degree in night school. Her law school expenses were $4,200 for tuition and $450 for books (which are not a requirement for enrollment in the course). Click here to access Concept Summary 9.2. If an amount is zero, enter "0". Assuming no reimbursement, how much of these expenses can Samantha deduct? $ x Feedback Check My Work Under certain circumstances, an employee can deduct expenses incurred for education as ordinary and necessary business expenses Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started