Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SAMAR COMPANY produces a single product: product X. In February 2011, The company's management is concerning preparation of the company's master budget for next (march

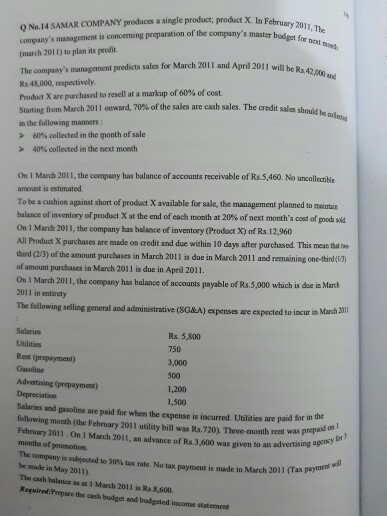

SAMAR COMPANY produces a single product: product X. In February 2011, The company's management is concerning preparation of the company's master budget for next (march 2011) to plan its profit. The companys management predicts sales for March 2011 and April 2011 will be Rs.42,000 and Rs.48,000, respectively. Product X are purchased to resell at a markup of 60% of cost. Starting from March 2011 onward, 70% of the sales are cash sales. The credit sales should be in the following manners: 60% collected in the month of sale 40% collected in the next month On 1 March 2011, the company has balance of accounts receivable of Rs.5, 460. No uncollectible amount is estimated. To be a cushion against short of product X available for sale, the management planned to balance of inventory of product X at the end of each month at 20% of next month's cost of goods sold. On 1 March 2011, the company has balance of inventory (Product X) of Rs.12, 960 All Product X purchases are made on credit and due within 10 days after purchased. This mean third(2/3) of the amount purchases in March 2011 is due in March 2011 and remaining of amount purchases in March 2011 is due in April 2011. On 1 March 2011, the company has balance of accounts payable of Rs.5,000 which is due in March 2011 in entirety The following selling general and administrative (SG & A) expenses are expected to incur in March 2011 Salaries and gasoline are paid for when expense is incurred. Utilities are paid for in the following the month (the February 2011 utility bill was Rs.720). Three-month rent was an advance agency for 3 month of promotion. The company is subjected to 30% tax rate. No tax payment is made in March 2011 (Tax payment will be made 2011). The cash balance as at 1 March 2011 is Rs. 8, 600. prepare the cash budget and budgeted income statement1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started