Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Samco Ltd is currently having following capital structure - Equity Capital (1 lakh shares at par value 10/) - 12% Preference Capital (10,000 shares at

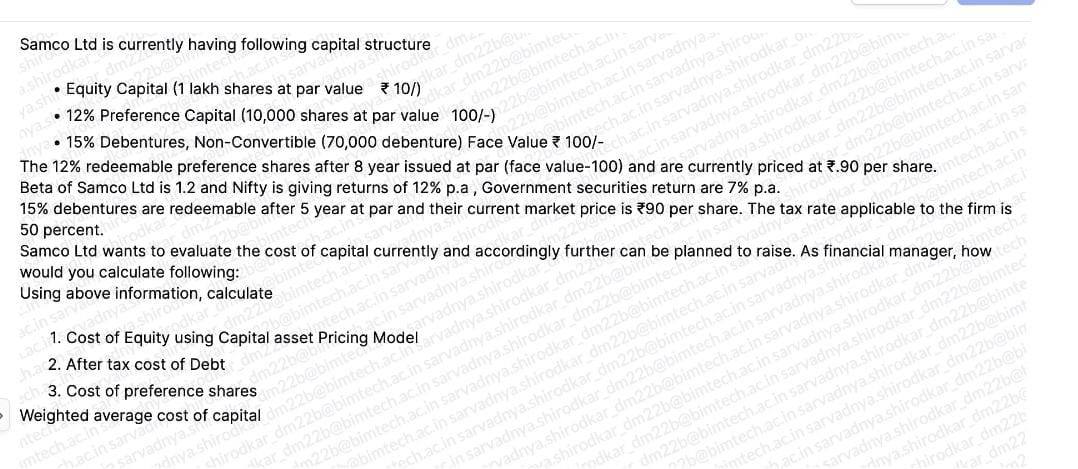

Samco Ltd is currently having following capital structure - Equity Capital (1 lakh shares at par value 10/) - 12% Preference Capital (10,000 shares at par value 100/) - 15\% Debentures, Non-Convertible (70,000 debenture) Face Value 100/ - The 12% redeemable preference shares after 8 year issued at par (face value-100) and are currently priced at .90 per share. Beta of Samco Ltd is 1.2 and Nifty is giving returns of 12% p.a , Government securities return are 7% p.a. 15% debentures are redeemable after 5 year at par and their current market price is 90 per share. The tax rate applicable to the firm is 50 percent. Samco Ltd wants to evaluate the cost of capital currently and accordingly further can be planned to raise. As financial manager, how would you calculate following: Using above information, calculate 1. Cost of Equity using Capital asset Pricing Model 2. After tax cost of Debt 3. Cost of preference shares Weighted average cost of capital

Samco Ltd is currently having following capital structure - Equity Capital (1 lakh shares at par value 10/) - 12% Preference Capital (10,000 shares at par value 100/) - 15\% Debentures, Non-Convertible (70,000 debenture) Face Value 100/ - The 12% redeemable preference shares after 8 year issued at par (face value-100) and are currently priced at .90 per share. Beta of Samco Ltd is 1.2 and Nifty is giving returns of 12% p.a , Government securities return are 7% p.a. 15% debentures are redeemable after 5 year at par and their current market price is 90 per share. The tax rate applicable to the firm is 50 percent. Samco Ltd wants to evaluate the cost of capital currently and accordingly further can be planned to raise. As financial manager, how would you calculate following: Using above information, calculate 1. Cost of Equity using Capital asset Pricing Model 2. After tax cost of Debt 3. Cost of preference shares Weighted average cost of capital Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started