Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Same parts just different numbers Return to question 13 Part 1 of 3 Required information The following information apolies to the questions displayed below! On

Same parts just different numbers

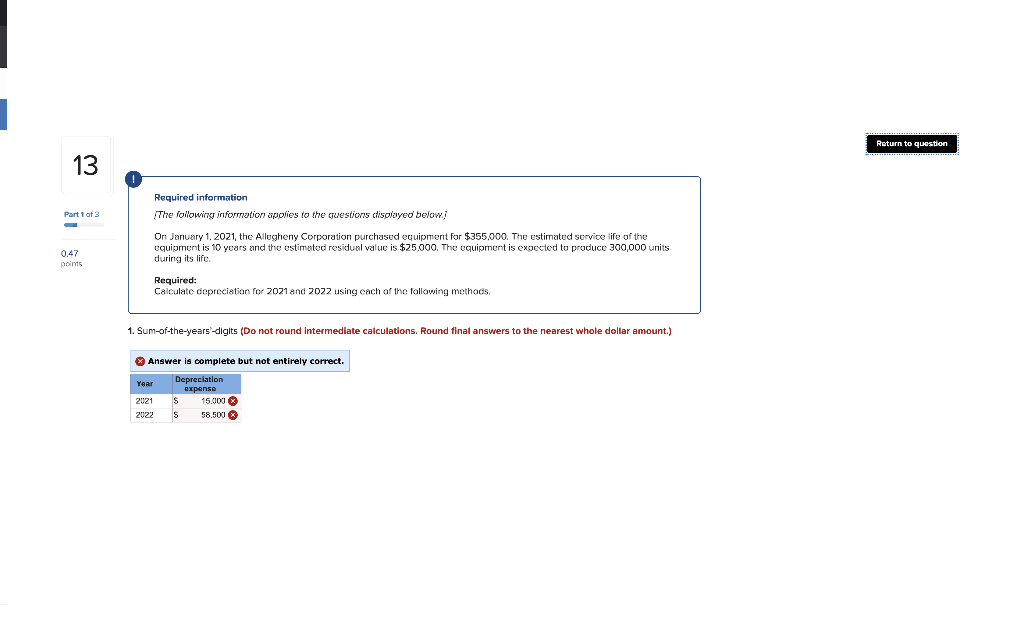

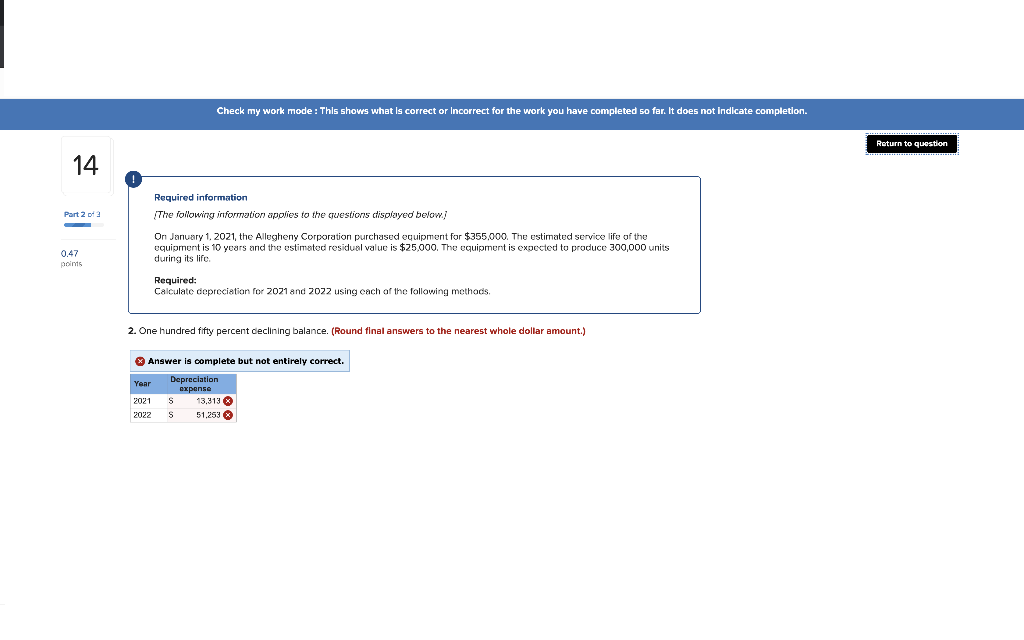

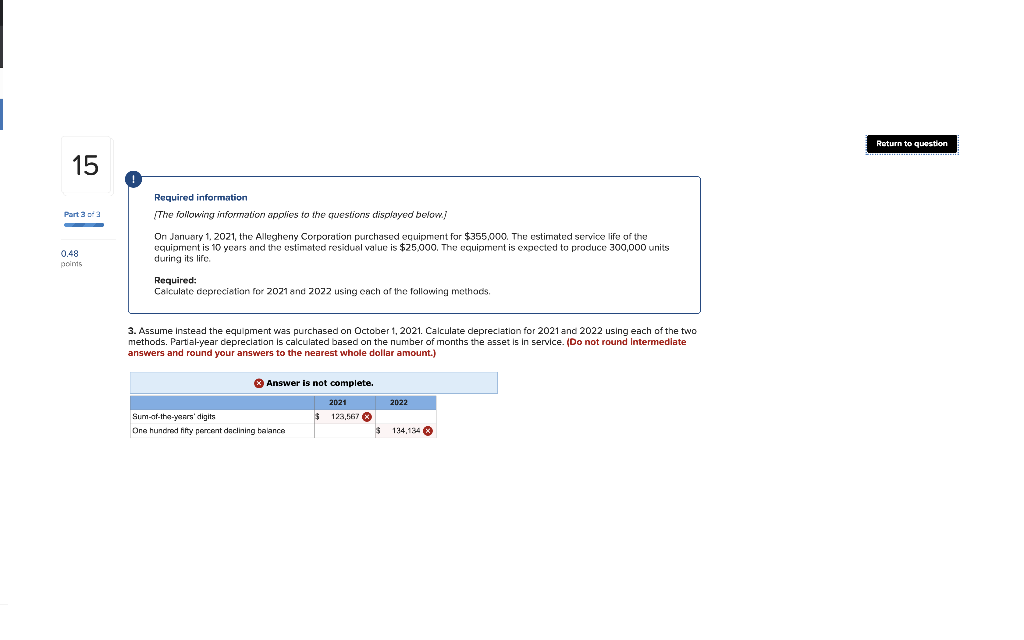

Return to question 13 Part 1 of 3 Required information The following information apolies to the questions displayed below! On January 1, 2021, the Allegheny Corporation purchased equipment for $355,000. The estimated service life of the equipment is 10 years and the estimated residual value is $25,000. The equipment is expected to produce 300,000 units during its life 0.47 points Required: Calculate depreciation for 2021 and 2022 using cach of the following methods. 1. Sum-of-the-years-digits (Do not round Intermediate calculations. Round final answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. Year Depreciation expense 2021 S 15.000 2022 S 58.500 Check my work mode: This shows what is correct or Incorrect for the work you have completed so far. It does not indicate completion. Return to question 14 Part 2 Required information The following information apolies to the questions displayed below! On January 1, 2021, the Allegheny Corporation purchased equipment for $355,000. The estimated service life of the equipment is 10 years and the estimated residual value is $25,000. The equipment is expected to produce 300,000 units during its life 0.47 points Required: Calculate depreciation for 2021 and 2022 using cach of the following methods. 2. One hundred fifty percent declining balance. (Round final answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. Year Depreciation expense 2021 S 13,913 2022 S 51,253 Return to question 15 Part 2 Required information The following information apolies to the questions displayed below! On January 1, 2021, the Allegheny Corporation purchased equipment for $355,000. The estimated service life of the equipment is 10 years and the estimated residual value is $25,000. The equipment is expected to produce 300,000 units during its life 0.48 points Required: Calculate depreciation for 2021 and 2022 using cach of the following methods. 3. Assume Instead the equipment was purchased on October 1, 2021. Calculate depreciation for 2021 and 2022 using each of the two methods. Partial-year depreciation is calculated based on the number of months the asset is in service. (Do not round Intermediate answers and round your answers to the nearest whole dollar amount.) Answer is not complete. 2021 2022 Sum-at-the-years' digits 123,567 One hundred Hity percent declining balance $ 124,134Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started