Answered step by step

Verified Expert Solution

Question

1 Approved Answer

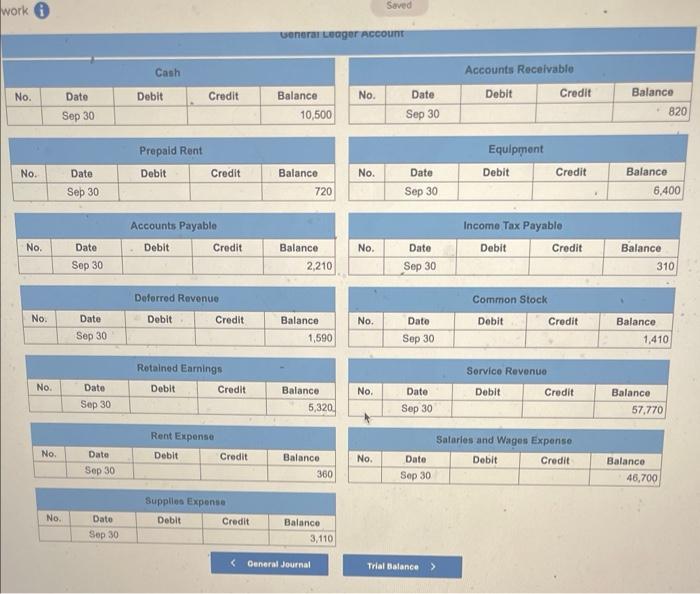

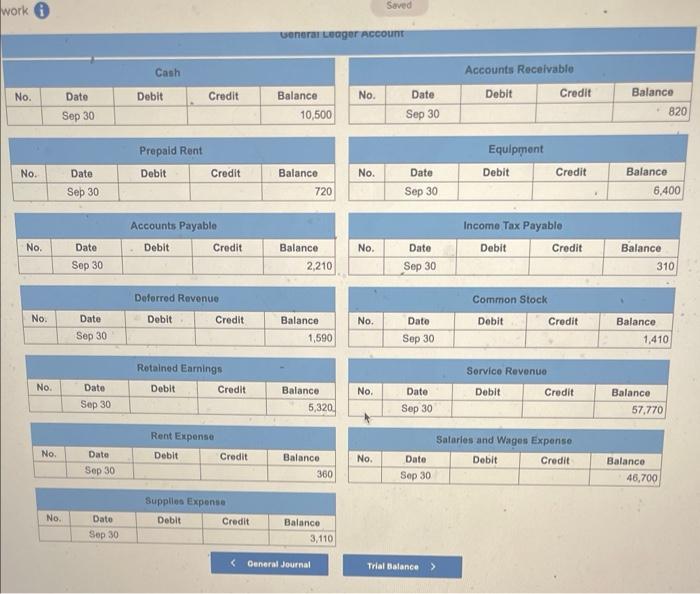

same question work i ueneral Legger Account begin{tabular}{|r|c|c|c|c|} hline multicolumn{4}{|c|}{ Cash } hline No. & Date & Debit & . Credit & Balance

same question

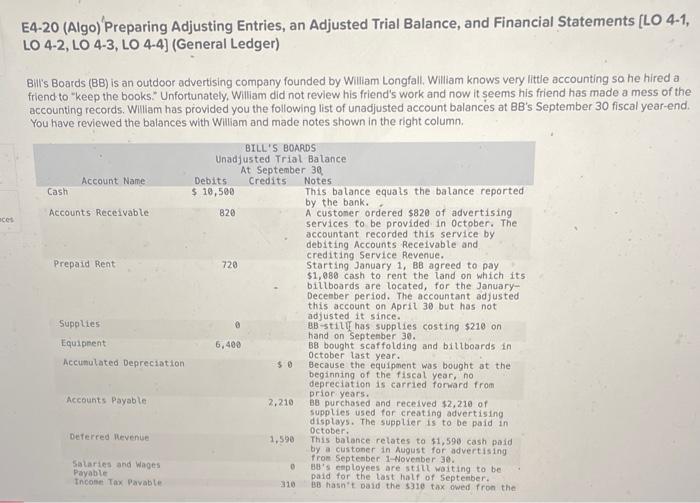

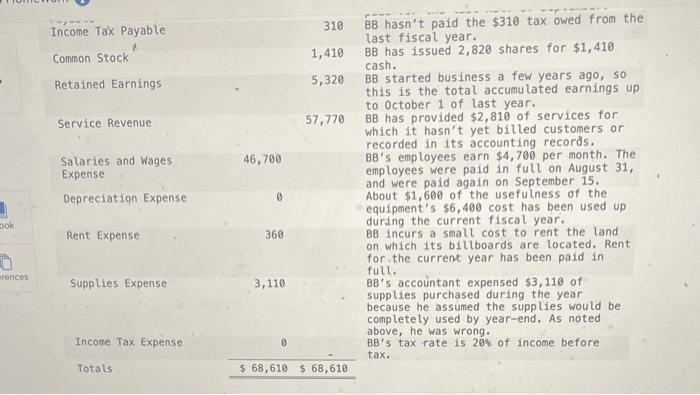

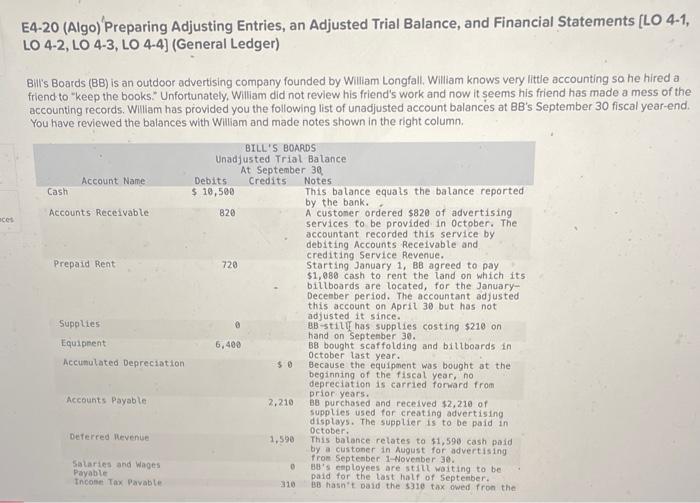

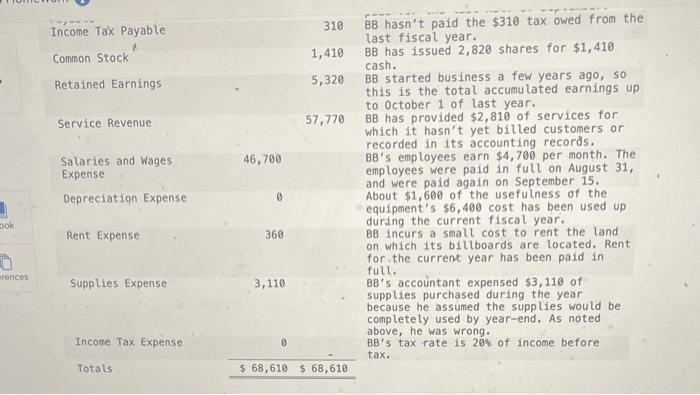

work i ueneral Legger Account \begin{tabular}{|r|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Cash } \\ \hline No. & Date & Debit & . Credit & Balance \\ \hline & Sep 30 & & & 10,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Recelvable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 820 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|l|}{ Prepaid Rent } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 720 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Equipmont } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 6.400 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,210 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 310 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Deforred Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,590 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,410 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Rotained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 5,320 \\ \hline \multicolumn{5}{|c|}{ Dent Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 360 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Sorvice Rovenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 57,770 \\ \hline \end{tabular} Supplins Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 3,110 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Sataries and Wages Expenso } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 46,700 \\ \hline \end{tabular} E4-20 (Algo)'Preparing Adjusting Entries, an Adjusted Trial Balance, and Financial Statements [LO 4-1, LO 4-2, LO 4-3, LO 4-4] (General Ledger) Bill's Boards (BB) is an outdoor advertising company founded by Willam Longfall. William knows very little accounting sa he hired a friend to "keep the books." Unfortunately. Willam did not review his friend's work and now it seems his friend has made a mess of the accounting records. William has provided you the following list of unadjusted account balances at 88 's September 30 fiscal year-end. You have reviewed the balances with Willam and made notes shown in the right column. last fiscal year. BB has issued 2,820 shares for $1,410 cash. BB started business a few years ago, so this is the total accumulated earnings up to 0ctober 1 of last year. BB has provided $2,810 of services for which it hasn't yet billed customers or recorded in its accounting records. BB's employees earn $4,700 per month. The employees were paid in full on August 31, and were paid again on September 15. About $1,600 of the usefulness of the equipment's $6,400 cost has been used up during the current fiscal year. B8 incurs a smalt cost to rent the land on which its billboards are located. Rent for the current year has been paid in fult. BB s accontant expensed $3,110 of supplies purchased during the year because he assumed the supplies would be completely used by year-end. As noted above, he was wrong. BB 's tax rate is 20% of income before tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started