Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sameer, Daoud and Narmen owned partnership has total assets of $480,000 (cash 100000, account receivables 100000, inventory 60000, and equipment 220000). Capital balances for

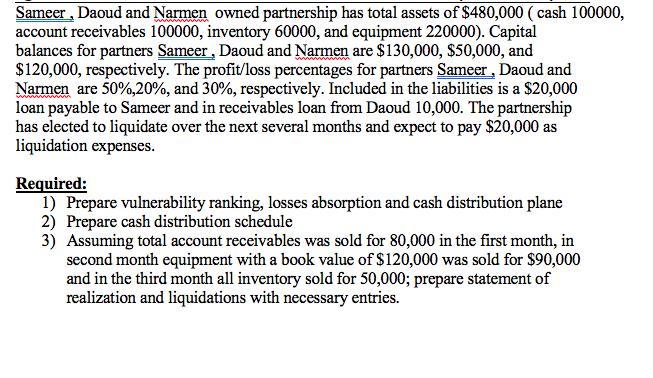

Sameer, Daoud and Narmen owned partnership has total assets of $480,000 (cash 100000, account receivables 100000, inventory 60000, and equipment 220000). Capital balances for partners Sameer, Daoud and Narmen are $130,000, $50,000, and $120,000, respectively. The profit/loss percentages for partners Sameer, Daoud and Narmen are 50%,20%, and 30%, respectively. Included in the liabilities is a $20,000 loan payable to Sameer and in receivables loan from Daoud 10,000. The partnership has elected to liquidate over the next several months and expect to pay $20,000 as liquidation expenses. Required: 1) Prepare vulnerability ranking, losses absorption and cash distribution plane 2) Prepare cash distribution schedule 3) Assuming total account receivables was sold for 80,000 in the first month, in second month equipment with a book value of $120,000 was sold for $90,000 and in the third month all inventory sold for 50,000; prepare statement of realization and liquidations with necessary entries.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer Statement of Realisation Particulars Balance Less Liquidation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started