Answered step by step

Verified Expert Solution

Question

1 Approved Answer

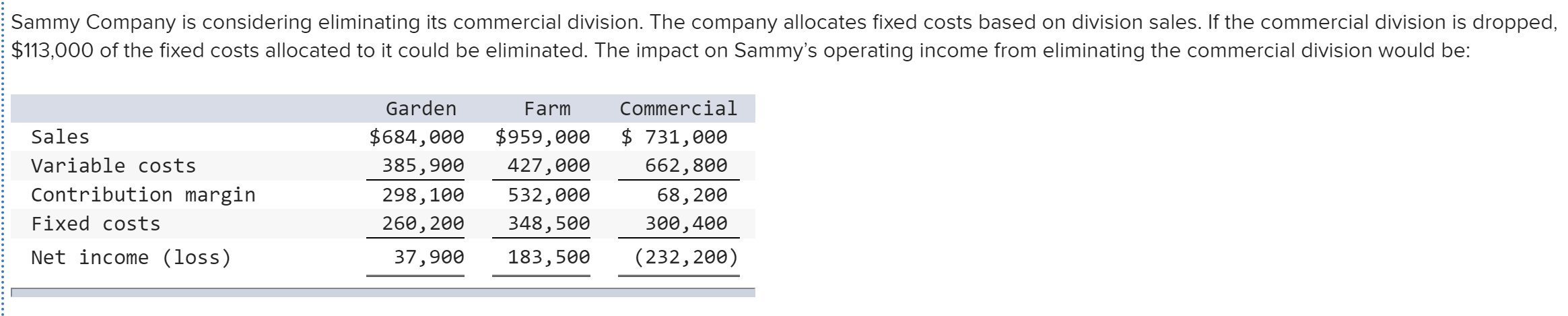

Sammy Company is considering eliminating its commercial division. The company allocates fixed costs based on division sales. If the commercial division is dropped, $113,000 of

Sammy Company is considering eliminating its commercial division. The company allocates fixed costs based on division sales. If the commercial division is dropped, $113,000 of the fixed costs allocated to it could be eliminated. The impact on Sammys operating income from eliminating the commercial division would be:

| Garden | Farm | Commercial | ||||||||||

| Sales | $ | 684,000 | $ | 959,000 | $ | 731,000 | ||||||

| Variable costs | 385,900 | 427,000 | 662,800 | |||||||||

| Contribution margin | 298,100 | 532,000 | 68,200 | |||||||||

| Fixed costs | 260,200 | 348,500 | 300,400 | |||||||||

| Net income (loss) | 37,900 | 183,500 | (232,200 | ) | ||||||||

|

| ||||||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started