Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sam's Bakery's cash balance in June is expected to be $2,000. Though a small business, the owner, Sam, wants to maintain a minimum monthly

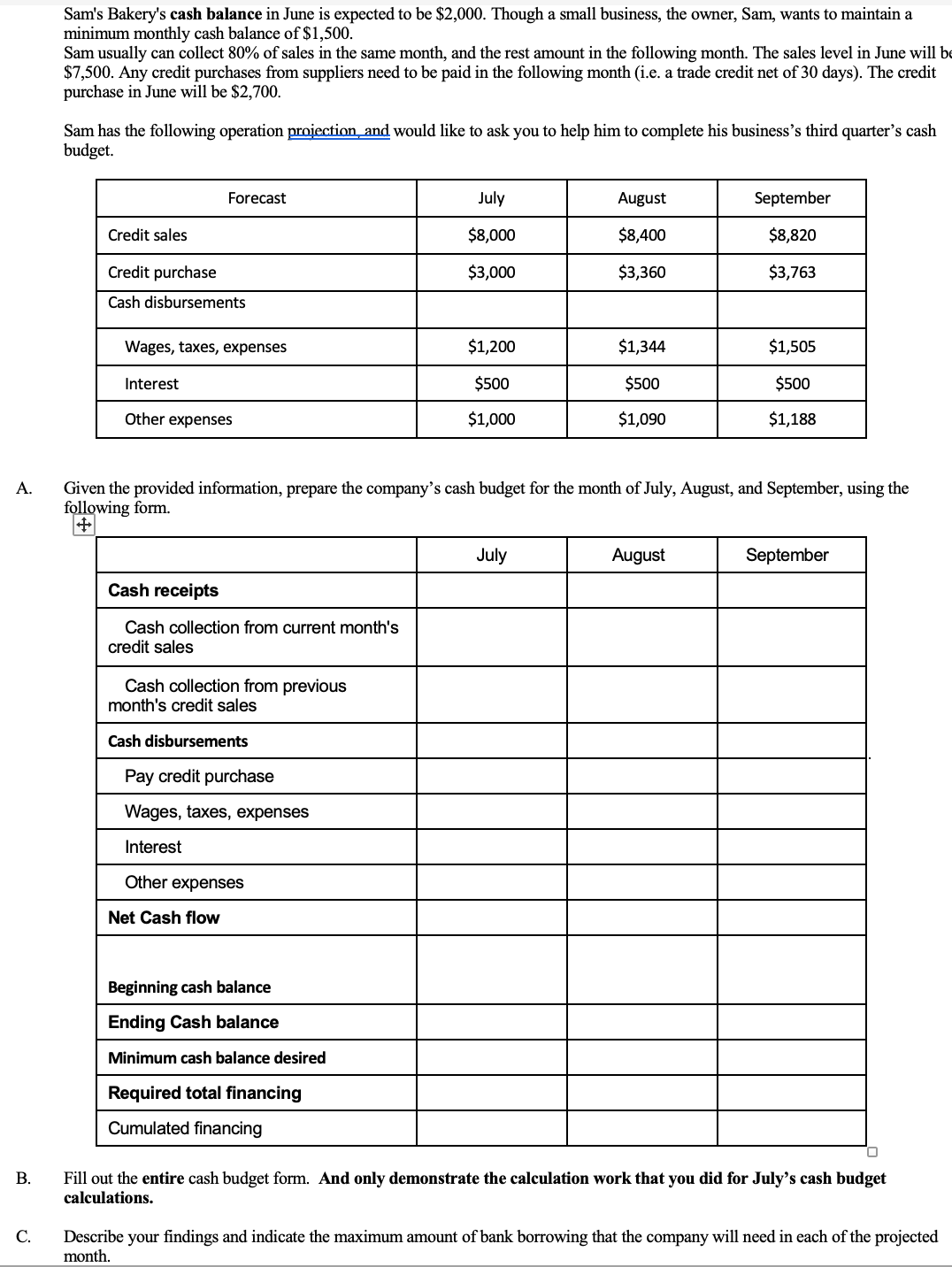

Sam's Bakery's cash balance in June is expected to be $2,000. Though a small business, the owner, Sam, wants to maintain a minimum monthly cash balance of $1,500. Sam usually can collect 80% of sales in the same month, and the rest amount in the following month. The sales level in June will be $7,500. Any credit purchases from suppliers need to be paid in the following month (i.e. a trade credit net of 30 days). The credit purchase in June will be $2,700. Sam has the following operation projection and would like to ask you to help him to complete his business's third quarter's cash budget. Forecast Credit sales Credit purchase July August September $8,000 $8,400 $8,820 $3,000 $3,360 $3,763 Cash disbursements Wages, taxes, expenses $1,200 $1,344 $1,505 Interest $500 $500 $500 Other expenses $1,000 $1,090 $1,188 A. Given the provided information, prepare the company's cash budget for the month of July, August, and September, using the following form. B. C. Cash receipts Cash collection from current month's credit sales Cash collection from previous month's credit sales Cash disbursements Pay credit purchase Wages, taxes, expenses Interest Other expenses Net Cash flow July August September Beginning cash balance Ending Cash balance Minimum cash balance desired Required total financing Cumulated financing Fill out the entire cash budget form. And only demonstrate the calculation work that you did for July's cash budget calculations. Describe your findings and indicate the maximum amount of bank borrowing that the company will need in each of the projected month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started