Question

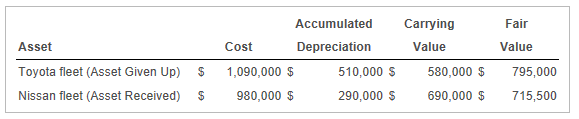

Sam's Taxi Company exchanged a fleet of Toyota vehicles for an equal-sized fleet of Nissan vehicles from the Dave Transportaion Group. The carrying value and

Sam's Taxi Company exchanged a fleet of Toyota vehicles for an equal-sized fleet of Nissan vehicles from the Dave Transportaion Group. The carrying value and fair value of each fleet of vehicles on the date of the exchange are as follows:

Sam's Taxi received cash of $79,500 and the Nissan fleet in exchange for the Toyota fleet. Sam's Taxi does not expect the future cash flows to change significantly as a result of this exchange and, therefore, the transaction lacks commercial substance.

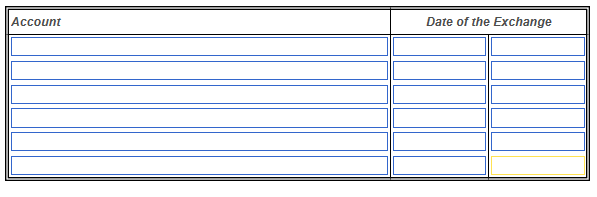

Prepare the journal entry to record the exchange transaction for Sam's Taxi Company. (Record debits first, then credits. Exclude explanations from any journal entries.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started