Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Samsam, single status and without dependent, is the Manager of Walter Mart. He is earning P45,000.00 per month.Contri The following are his contributions being

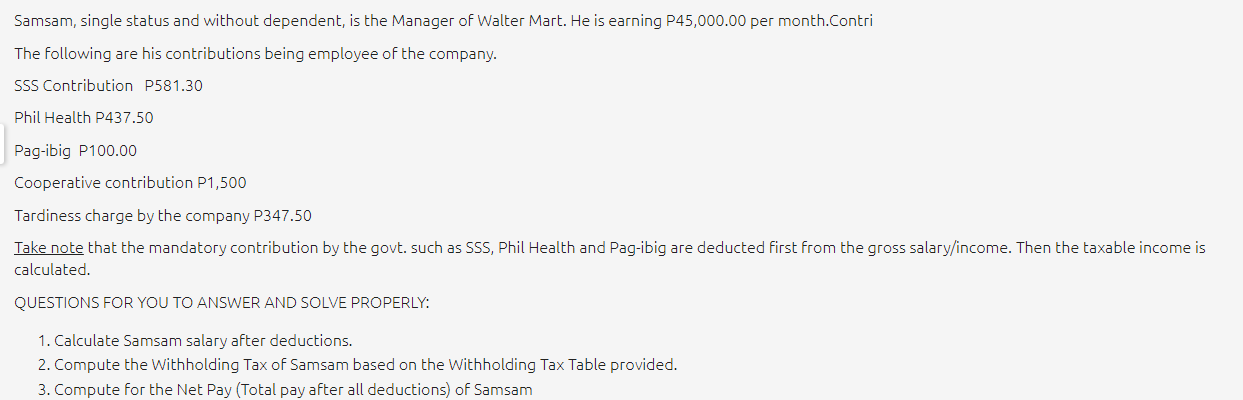

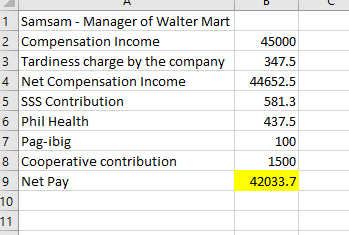

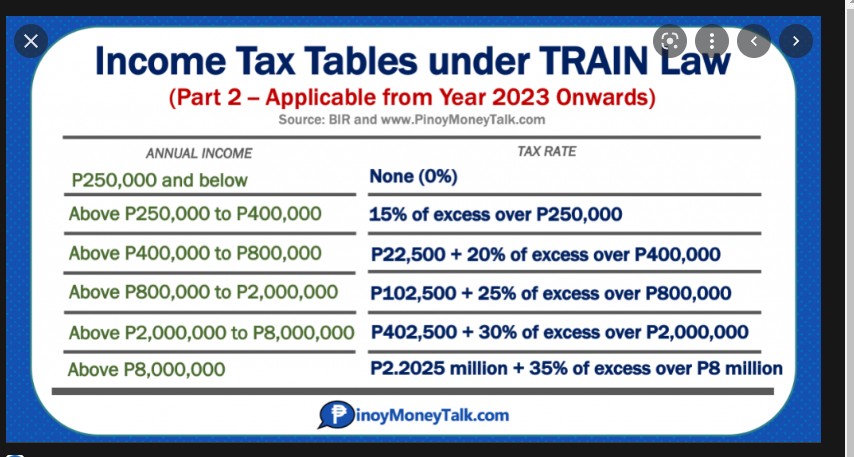

Samsam, single status and without dependent, is the Manager of Walter Mart. He is earning P45,000.00 per month.Contri The following are his contributions being employee of the company. SSS Contribution P581.30 Phil Health P437.50 Pag-ibig P100.00 Cooperative contribution P1,500 Tardiness charge by the company P347.50 Take note that the mandatory contribution by the govt. such as SSS, Phil Health and Pag-ibig are deducted first from the gross salary/income. Then the taxable income is calculated. QUESTIONS FOR YOU TO ANSWER AND SOLVE PROPERLY: 1. Calculate Samsam salary after deductions. 2. Compute the Withholding Tax of Samsam based on the Withholding Tax Table provided. 3. Compute for the Net Pay (Total pay after all deductions) of Samsam 1 Samsam - Manager of Walter Mart 2 Compensation Income 3 Tardiness charge by the company 4 Net Compensation Income 5 SSS Contribution 6 Phil Health 7 Pag-ibig 8 Cooperative contribution 9 Net Pay 10 11 45000 347.5 44652.5 581.3 437.5 100 1500 42033.7 X Income Tax Tables under TRAIN Law (Part 2 - Applicable from Year 2023 Onwards) Source: BIR and www.PinoyMoneyTalk.com ANNUAL INCOME P250,000 and below Above P250,000 to P400,000 Above P400,000 to P800,000 Above P800,000 to P2,000,000 Above P2,000,000 to P8,000,000 Above P8,000,000 TAX RATE None (0%) 15% of excess over P250,000 P22,500 + 20% of excess over P400,000 P102,500 + 25% of excess over P800,000 P402,500 + 30% of excess over P2,000,000 P2.2025 million + 35% of excess over P8 million PinoyMoneyTalk.com

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculate Samsam salary after deductions Gross salary PHP 45000 Deductions SSS co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started