Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Samsi has seen a growth in her business in recent months and, based on the advice of her Accountant, has created a small proprietary company

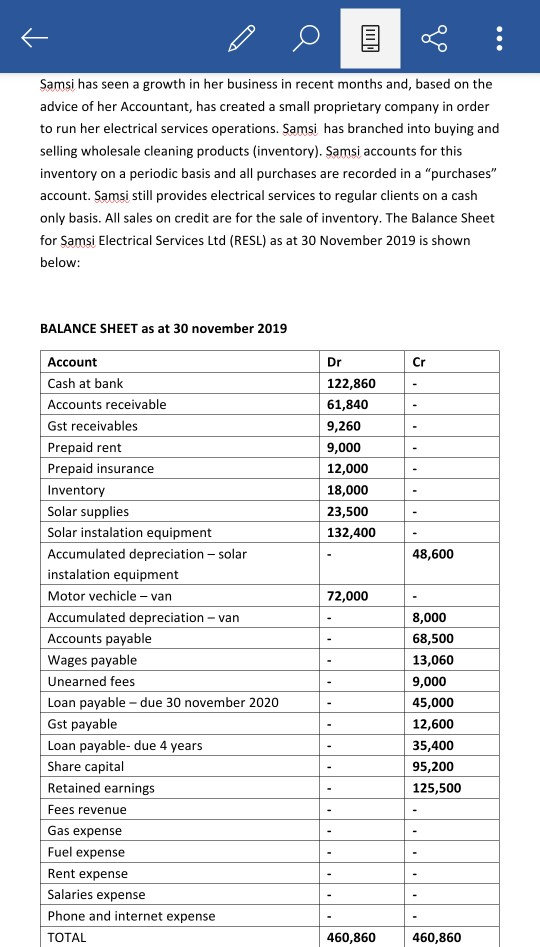

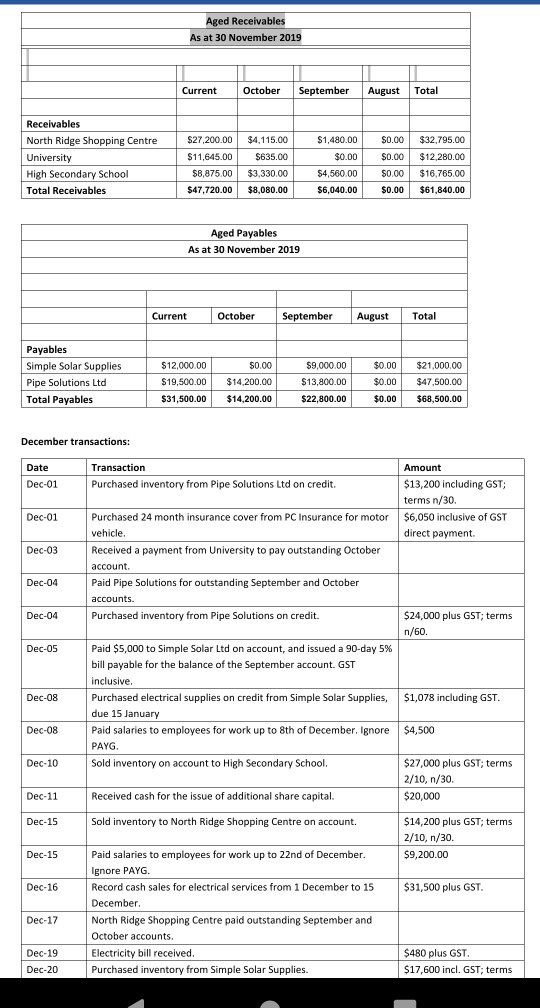

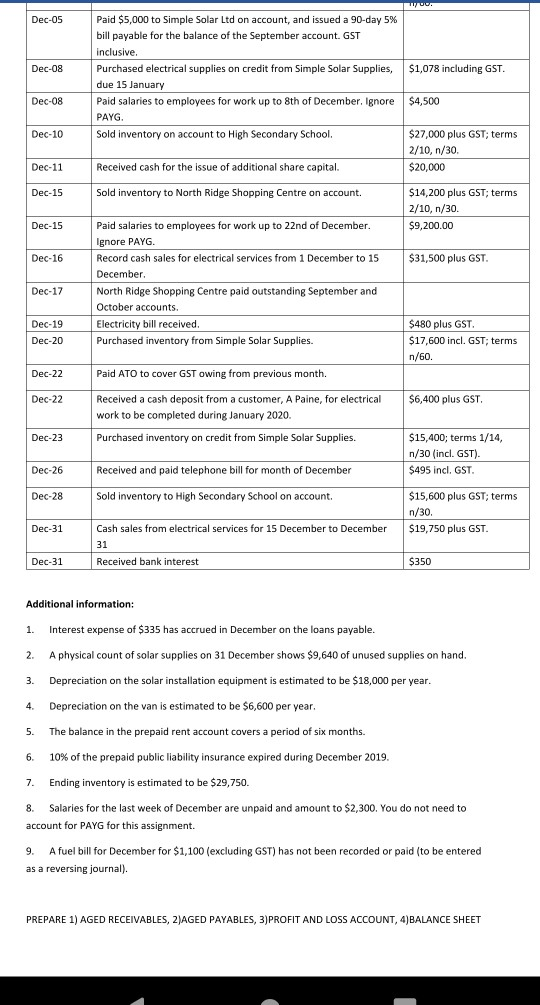

Samsi has seen a growth in her business in recent months and, based on the advice of her Accountant, has created a small proprietary company in order to run her electrical services operations. Samsi has branched into buying and selling wholesale cleaning products (inventory). Samsi accounts for this inventory on a periodic basis and all purchases are recorded in a "purchases" account. Samsi still provides electrical services to regular clients on a cash only basis. All sales on credit are for the sale of inventory. The Balance Sheet for Samsi Electrical Services Ltd (RESL) as at 30 November 2019 is shown below: BALANCE SHEET as at 30 november 2019 Dr 122,860 61,840 9,260 9,000 12,000 18,000 23,500 132,400 48,600 72,000 Account Cash at bank Accounts receivable Gst receivables Prepaid rent Prepaid insurance Inventory Solar supplies Solar instalation equipment Accumulated depreciation - solar instalation equipment Motor vechicle - van Accumulated depreciation - van Accounts payable Wages payable Unearned fees Loan payable - due 30 november 2020 Gst payable Loan payable- due 4 years Share capital Retained earnings Fees revenue Gas expense Fuel expense Rent expense Salaries expense Phone and internet expense TOTAL 8,000 68,500 13,060 9,000 45,000 12,600 35,400 95,200 125,500 460,860 460,860 Aged Receivables As at 30 November 2019 Current October September August Total Receivables North Ridge Shopping Centre University High Secondary School Total Receivables $27,200.00 $11,645.00 $8,875.00 $47.720.00 $4,115.00 $635.00 $3,330.00 $8,080.00 $1,480.00 $0.00 $4,560.00 $6,040.00 $0.00 $0.00 $0.00 $0.00 $32,795.00 $12,280.00 $16,765.00 $61,840.00 Aged Payables As at 30 November 2019 Current October September August | Total Payables Simple Solar Supplies Pipe Solutions Ltd Total Payables $12,000.00 $19,500.00 $31,500.00 $0.00 $14,200.00 $14,200.00 $9,000.00 $13,800.00 $22,800.00 $0.00 $0.00 $0.00 $21,000.00 $47,500.00 $68,500.00 December transactions: Date Dec-01 Transaction Purchased inventory from Pipe Solutions Ltd on credit. Amount $13,200 including GST; terms n/30. $6,050 inclusive of GST direct payment Dec-01 Purchased 24 month insurance cover from PC Insurance for motor vehicle. Dec-03 Dec-04 Received a payment from University to pay outstanding October account. Paid Pipe Solutions for outstanding September and October accounts. Purchased inventory from Pipe Solutions on credit. Dec-04 $24,000 plus GST terms n/60. Dec-05 Dec-08 $1,078 including GST. Paid $5,000 to Simple Solar Ltd on account, and issued a 90-day 5% bill payable for the balance of the September account. GST inclusive Purchased electrical supplies on credit from Simple Solar Supplies, due 15 January Paid salaries to employees for work up to 8th of December. Ignore PAYG. Sold inventory on account to High Secondary School Dec-08 $4,500 Dec-10 $27,000 plus GST; terms 2/10, n/30. $20,000 Dec-11 Received cash for the issue of additional share capital. Dec-15 Sold inventory to North Ridge Shopping Centre on account. $14,200 plus GST; terms 2/10, n/30. $9,200.00 Dec-15 Dec-16 $31,500 plus GST. Paid salaries to employees for work up to 22nd of December. Ignore PAYG. Record cash sales for electrical services from 1 December to 15 December North Ridge Shopping Centre paid outstanding September and October accounts. Electricity bill received. Electricity bill Purchased inventory from Simple Solar Supplies. Dec-17 $480 plus GST. Dec-19 Dec-20 $17,600 incl. GST; terms nuo. Dec-05 Dec-08 $1,078 including GST. Paid $5,000 to Simple Solar Ltd on account, and issued a 90-day 5% bill payable for the balance of the September account. GST inclusive. Purchased electrical supplies on credit from Simple Solar Supplies, due 15 January Paid salaries to employees for work up to 8th of December. Ignore PAYG Sold inventory on account to High Secondary School. Dec-08 $4,500 Dec-10 $27,000 plus GST; terms 2/10, n/30 $20,000 Dec-11 Received cash for the issue of additional share capital. Dec-15 Sold inventory to North Ridge Shopping Centre on account. $14,200 plus GST; terms 2/10, n/30. $9,200.00 Dec-15 Dec-16 $31,500 plus GST. Paid salaries to employees for work up to 22nd of December. Ignore PAYG. Record cash sales for electrical services from 1 December to 15 December. North Ridge Shopping Centre paid outstanding September and October accounts. Electricity bill received. Purchased inventory from Simple Solar Supplies. Dec-17 Dec-19 Dec-20 $480 plus GST $17,600 incl. GST; terms n/60. Dec-22 Paid ATO to cover GST owing from previous month. Dec-22 $6,400 plus GST Received a cash deposit from a customer, A Paine, for electrical work to be completed during January 2020. Dec-23 Purchased inventory on credit from Simple Solar Supplies. $15,400; terms 1/14, n/30 (incl. GST). $495 incl. GST. Dec-26 Received and paid telephone bill for month of December Dec-28 Sold inventory to High Secondary School on account. $15,600 plus GST; terms n/30. $19,750 plus GST. Dec-31 Cash sales from electrical services for 15 December to December 31 Received bank interest $350 1. Interest expense of $335 has accrued in December on the loans payable. 2. A physical count of solar supplies on 31 December shows $9,640 of unused supplies on hand. 4. Depreciation on the van is estimated to be $6,600 per year. 5. The balance in the prepaid rent account covers a period of six months. 6. 10% of the prepaid public liability insurance expired during December 2019. 7. Ending inventory is estimated to be $29,750. 8. Salaries for the last week of December are unpaid and amount to $2,300. You do not need to account for PAYG for this assignment. 9. A fuel bill for December for $1,100 (excluding GST) has not been recorded or paid to be entered as a reversing journal). PREPARE 1) AGED RECEIVABLES, 2)AGED PAYABLES, 3)PROFIT AND LOSS ACCOUNT, 4)BALANCE SHEET

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started