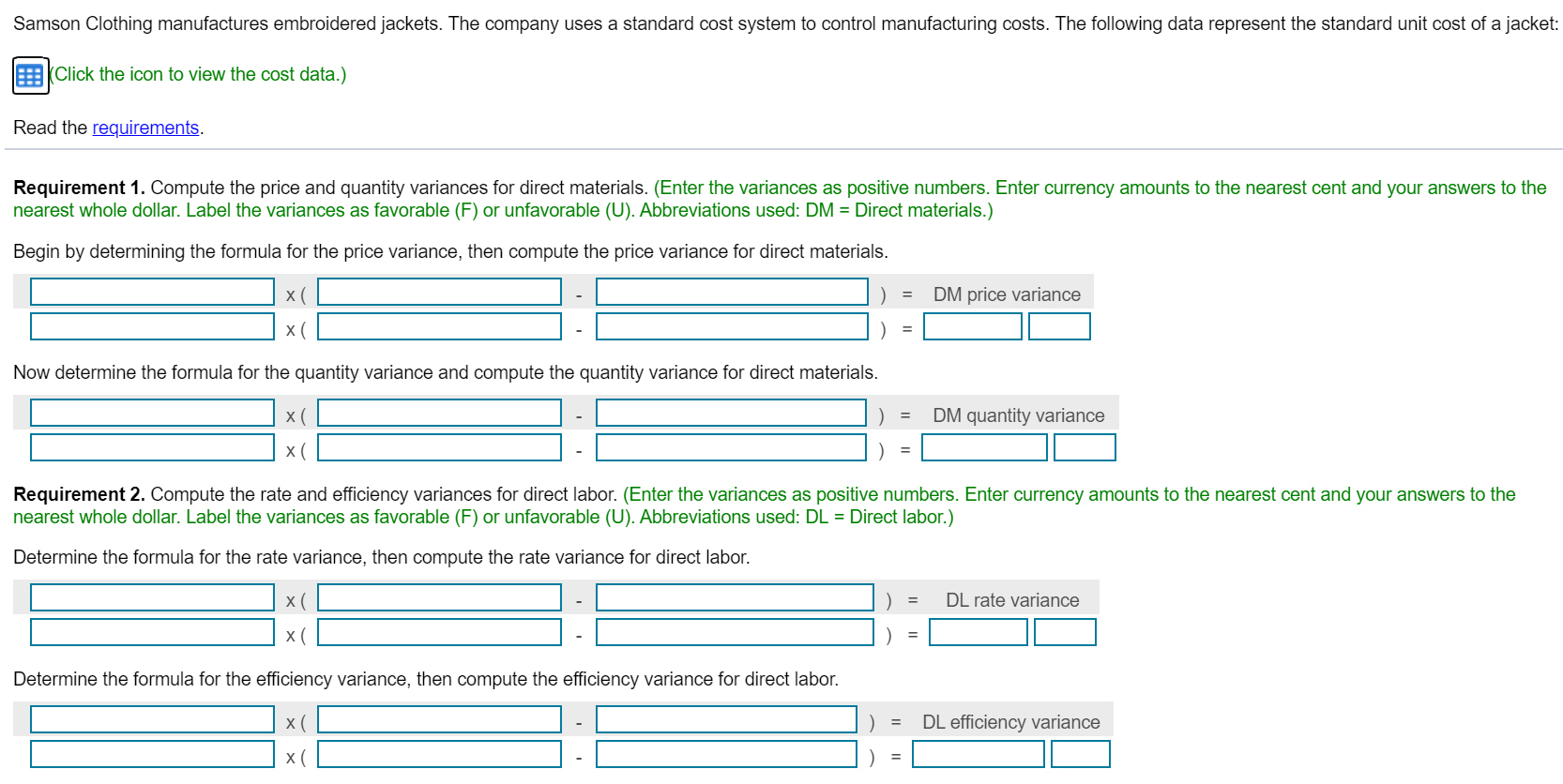

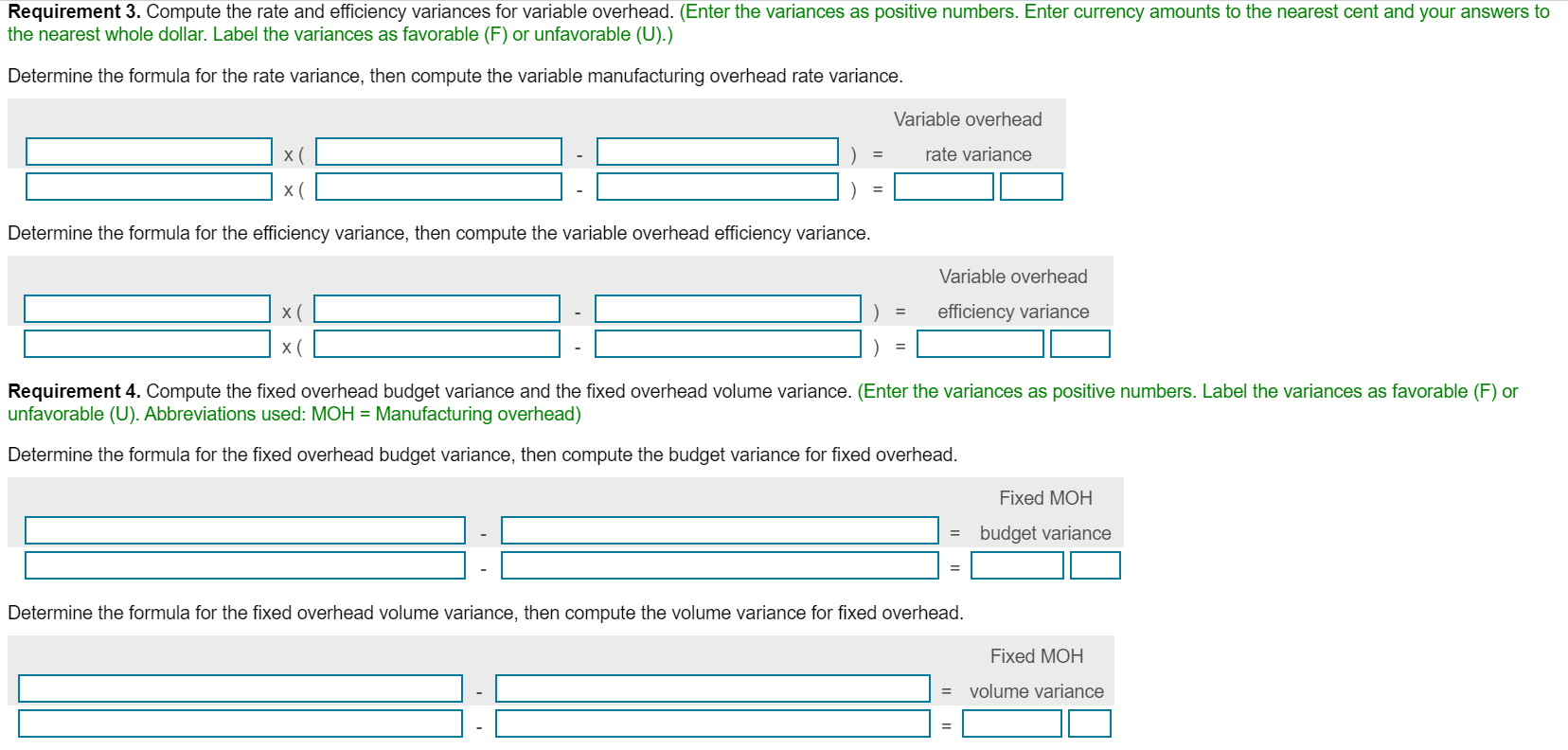

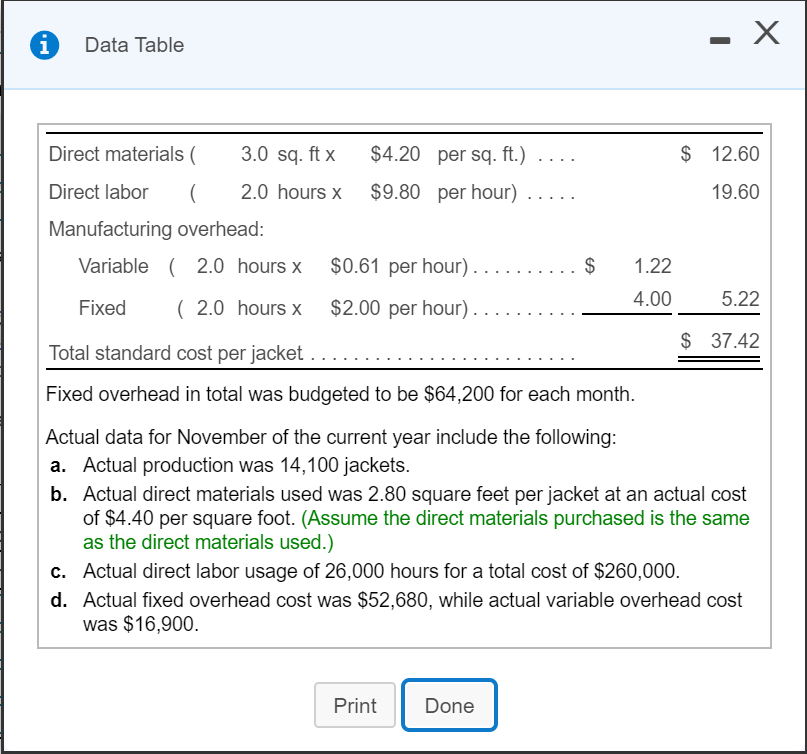

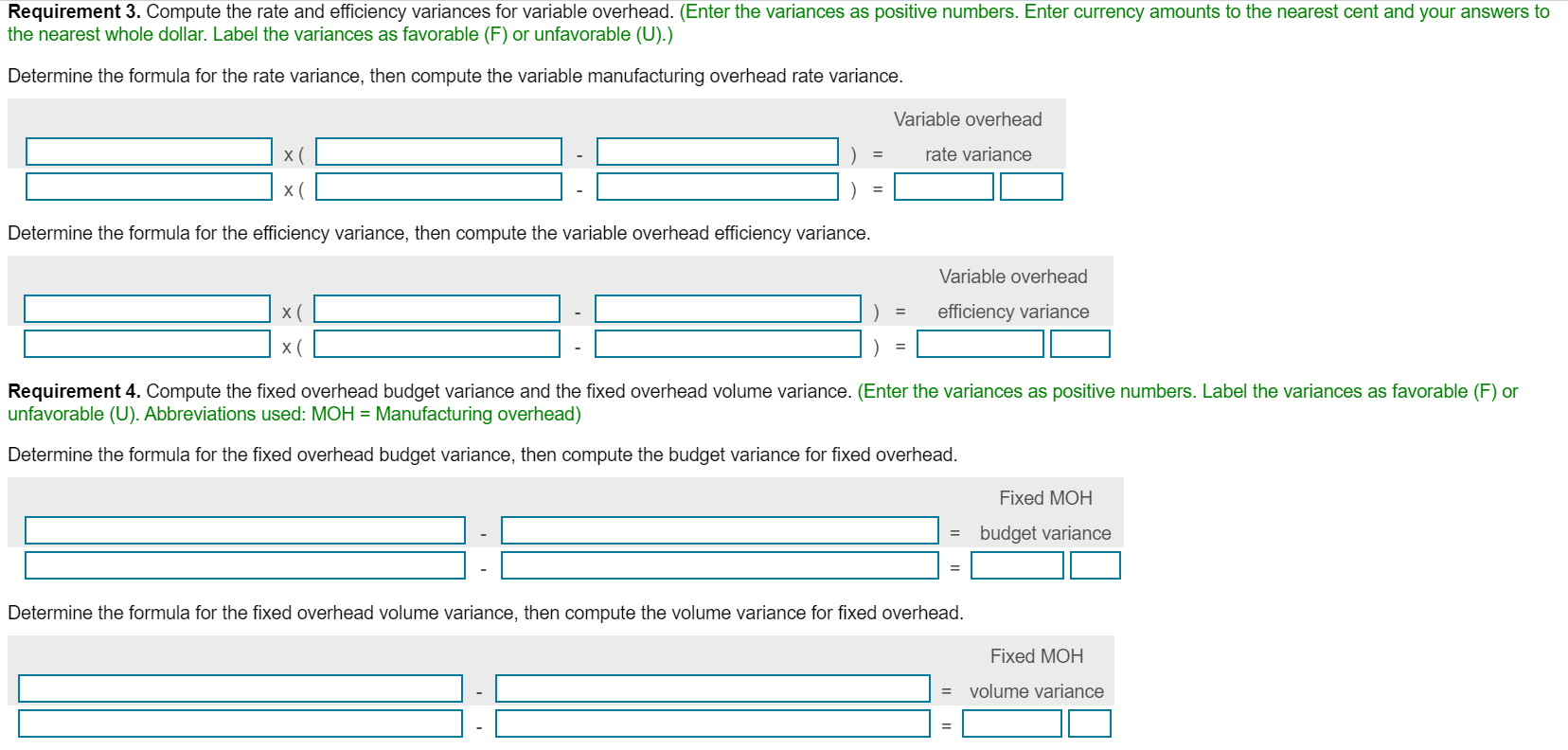

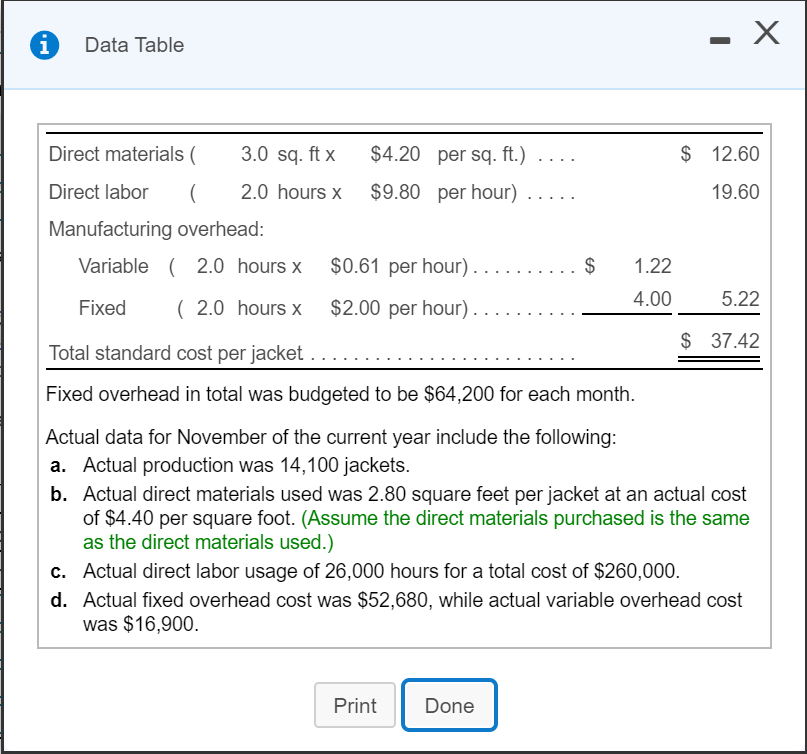

Samson Clothing manufactures embroidered jackets. The company uses a standard cost system to control manufacturing costs. The following data represent the standard unit cost of a jacket: Click the icon to view the cost data.) Read the requirements. Requirement 1. Compute the price and quantity variances for direct materials. (Enter the variances as positive numbers. Enter currency amounts to the nearest cent and your answers to the nearest whole dollar. Label the variances as favorable (F) or unfavorable (U). Abbreviations used: DM = Direct materials.) Begin by determining the formula for the price variance, then compute the price variance for direct materials. x DM price variance x Now determine the formula for the quantity variance and compute the quantity variance for direct materials. x DM quantity variance X Requirement 2. Compute the rate and efficiency variances for direct labor. (Enter the variances as positive numbers. Enter currency amounts to the nearest cent and your answers to the nearest whole dollar. Label the variances as favorable (F) or unfavorable (U). Abbreviations used: DL = Direct labor.) Determine the formula for the rate variance, then compute the rate variance for direct labor. x DL rate variance x Determine the formula for the efficiency variance, then compute the efficiency variance for direct labor. X DL efficiency variance x Requirement 3. Compute the rate and efficiency variances for variable overhead. (Enter the variances as positive numbers. Enter currency amounts to the nearest cent and your answers to the nearest whole dollar. Label the variances as favorable (F) or unfavorable (U).) Determine the formula for the rate variance, then compute the variable manufacturing overhead rate variance. Variable overhead X rate variance X Determine the formula for the efficiency variance, then compute the variable overhead efficiency variance. Variable overhead x efficiency variance x Requirement 4. Compute the fixed overhead budget variance and the fixed overhead volume variance. (Enter the variances as positive numbers. Label the variances as favorable (F) or unfavorable (U). Abbreviations used: MOH = Manufacturing overhead) Determine the formula for the fixed overhead budget variance, then compute the budget variance for fixed overhead. Fixed MOH budget variance = Determine the formula for the fixed overhead volume variance, then compute the volume variance for fixed overhead. Fixed MOH volume variance P. Data Table - X $ 12.60 ( 19.60 Direct materials 3.0 sq. ft x $4.20 per sq. ft.) Direct labor 2.0 hours x $9.80 per hour) Manufacturing overhead: Variable ( 2.0 hours x $0.61 per hour).. ..... $ 1.22 4.00 5.22 Fixed ( 2.0 hours x $2.00 per hour).. $ 37.42 Total standard cost per jacket.. Fixed overhead in total was budgeted to be $64,200 for each month. Actual data for November of the current year include the following: a. Actual production was 14,100 jackets. b. Actual direct materials used was 2.80 square feet per jacket at an actual cost of $4.40 per square foot. (Assume the direct materials purchased is the same as the direct materials used.) C. Actual direct labor usage of 26,000 hours for a total cost of $260,000. d. Actual fixed overhead cost was $52,680, while actual variable overhead cost was $16,900. Print Done