Question

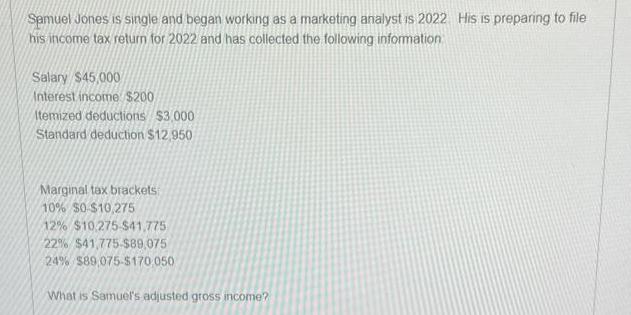

Samuel Jones is single and began working as a marketing analyst is 2022 His is preparing to file his income tax return for 2022

Samuel Jones is single and began working as a marketing analyst is 2022 His is preparing to file his income tax return for 2022 and has collected the following information Salary $45,000 Interest income $200 Itemized deductions $3,000 Standard deduction $12,950 Marginal tax brackets 10% $0-$10,275 12% $10,275-$41,775 22% $41,775-$89,075 24% $89,075-$170,050 What is Samuel's adjusted gross income?

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Samuels adjusted gross income AGI can be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Financial Planning

Authors: Randy Billingsley, Lawrence J. Gitman, Michael D. Joehnk

15th Edition

978-0357438480, 0357438485

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App