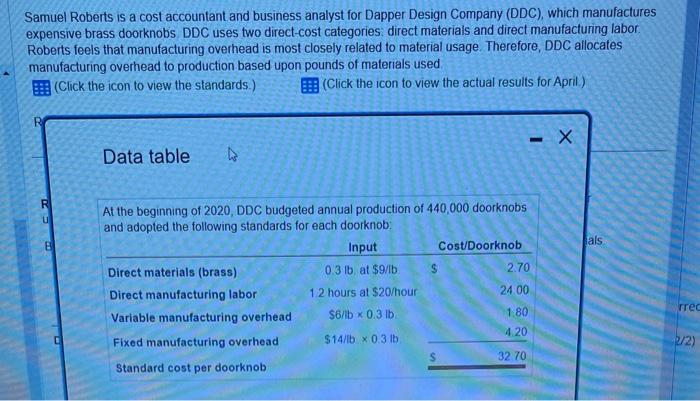

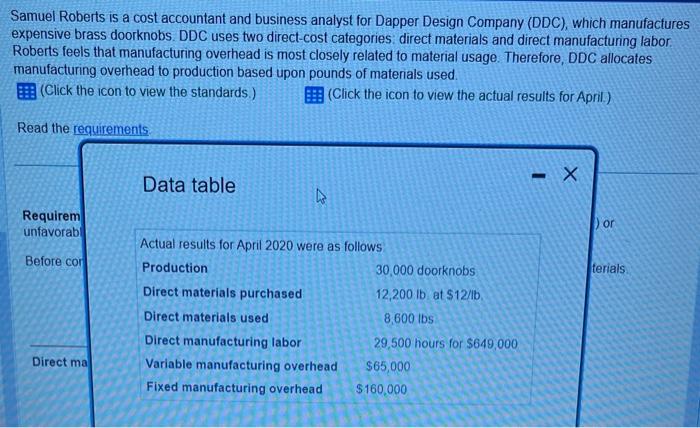

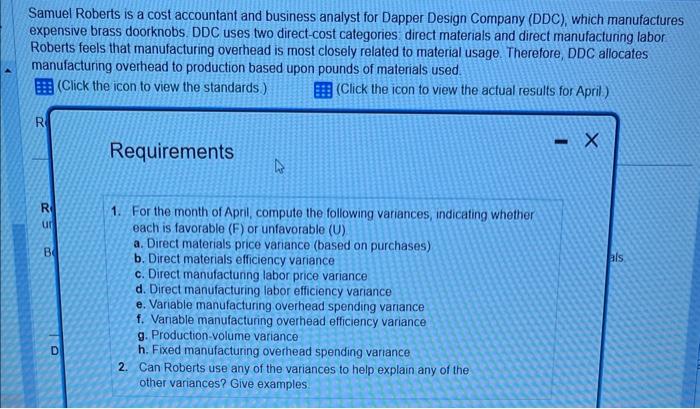

Samuel Roberts is a cost accountant and business analyst for Dapper Design Company (DDC), which manufactures expensive brass doorknobs DDC uses two direct-cost categories: direct materials and direct manufacturing labor. Roberts feels that manufacturing overhead is most closely related to material usage. Therefore, DDC allocates manufacturing overhead to production based upon pounds of materials used (Click the icon to view the standards.) I: (Click the icon to view the actual results for Aprii.) Data table At the beginning of 2020, DDC budgeted annual production of 440,000 doorknobs and adopted the following standards for each doorknob: Samuel Roberts is a cost accountant and business analyst for Dapper Design Company (DDC), which manufactures expensive brass doorknobs. DDC uses two direct-cost categories: direct materials and direct manufacturing labor: Roberts feels that manufacturing overhead is most closely related to material usage. Therefore, DDC allocates manufacturing overhead to production based upon pounds of materials used. (Click the icon to view the standards.) (Click the icon to view the actual results for April) Read the require Samuel Roberts is a cost accountant and business analyst for Dapper Design Company (DDC), which manufactures expensive brass doorknobs. DDC uses two direct-cost categories direct materials and direct manufacturing labor Roberts feels that manufacturing overhead is most closely related to material usage. Therefore, DDC allocates manufacturing overhead to production based upon pounds of materials used. Ei: (Click the icon to view the standards) (Click the icon to view the actual results for April) Requirements 1. For the month of April, compute the following variances, indicating whether each is favorable (F) or unfavorable (U) a. Direct materials price variance (based on purchases) b. Direct materials efficiency variance c. Direct manufactunng labor price variance d. Direct manufacturing labor efficiency variance e. Variable manufacturing overhead spending variance f. Variable manufacturing overhead efficiency variance g. Production-volume variance h. Fixed manufacturing overhead spending variance 2. Can Roberts use any of the variances to help explain any of the other variances? Give examples