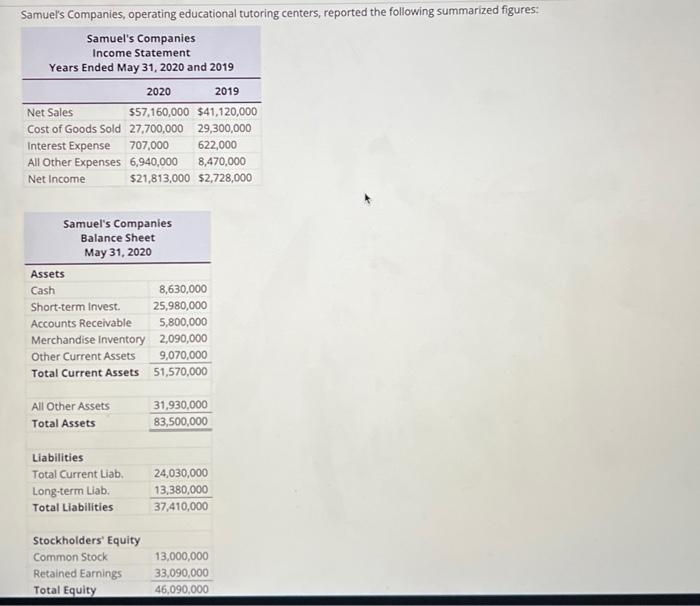

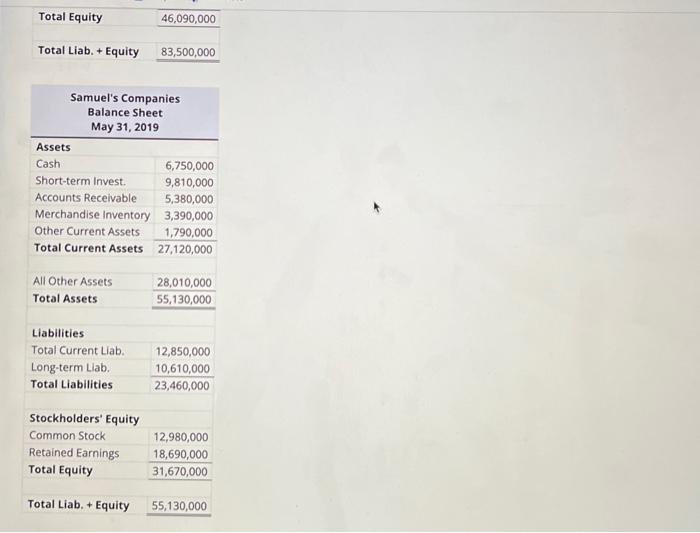

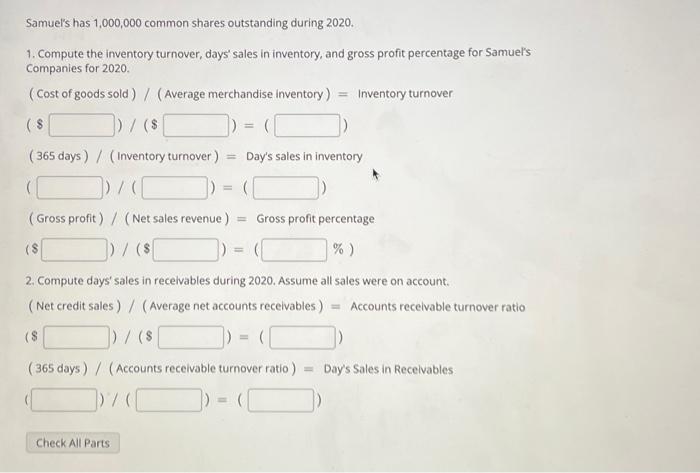

Samuel's Companies, operating educational tutoring centers, reported the following summarized figures: \begin{tabular}{lll} \multicolumn{4}{c}{\begin{tabular}{c} Samuel's Companies \\ Income Statement \end{tabular}} \\ \multicolumn{4}{c}{ Years Ended May 31,2020 and 2019} \\ \hline \multicolumn{4}{c}{2020} & \multicolumn{1}{c}{2019} \\ \hline Net Sales & $57,160,000 & $41,120,000 \\ Cost of Goods Sold & 27,700,000 & 29,300,000 \\ Interest Expense & 707,000 & 622,000 \\ All Other Expenses & 6,940,000 & 8,470,000 \\ Net Income & $21,813,000 & $2,728,000 \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{c} Samuel's Companies \\ Balance Sheet \\ May 31, 2020 \end{tabular}} \\ \hline \multicolumn{2}{|l|}{ Assets } \\ \hline Cash & 8,630,000 \\ \hline Short-term invest. & 25,980,000 \\ \hline Accounts Receivable & 5,800,000 \\ \hline Merchandise inventory & 2,090,000 \\ \hline Other Current Assets & 9,070,000 \\ \hline Total Current Assets & 51,570,000 \\ \hline All Other Assets & 31,930,000 \\ \hline Total Assets & 83,500,000 \\ \hline \multicolumn{2}{|l|}{ Liabilities } \\ \hline Total Current Liab. & 24,030,000 \\ \hline Long-term Liab. & 13,380,000 \\ \hline Total Liabilities & 37,410,000 \\ \hline \multicolumn{2}{|l|}{ Stockholders' Equity } \\ \hline Common Stock & 13,000,000 \\ \hline Retained Earnings & 33,090,000 \\ \hline Total Equity & 46,090,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Total Equity & 46,090,000 \\ \hline Total Liab. + Equity & 83,500,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{c} Samuel's Companies \\ Balance Sheet \\ May 31, 2019 \end{tabular}} \\ \hline \multicolumn{2}{|l|}{ Assets } \\ \hline Cash & 6,750,000 \\ \hline Short-term Invest. & 9,810,000 \\ \hline Accounts Receivable & 5,380,000 \\ \hline Merchandise Inventory & 3,390,000 \\ \hline Other Current Assets & 1,790,000 \\ \hline Total Current Assets & 27,120,000 \\ \hline All Other Assets & 28,010,000 \\ \hline Total Assets & 55,130,000 \\ \hline \multicolumn{2}{|l|}{ Liabilities } \\ \hline Total Current Liab. & 12,850,000 \\ \hline Long-term Llab. & 10,610,000 \\ \hline Total Liabilities & 23,460,000 \\ \hline \multicolumn{2}{|l|}{ Stockholders' Equity } \\ \hline Common Stock & 12,980,000 \\ \hline Retained Earnings & 18,690,000 \\ \hline Total Equity & 31,670,000 \\ \hline Total Liab. + Equity & 55,130,000 \\ \hline \end{tabular} Samuel's has 1,000,000 common shares outstanding during 2020. 1. Compute the inventory turnover, days' sales in inventory, and gross profit percentage for Samuel's Companies for 2020. (Cost of goods sold) / (Average merchandise inventory) = Inventory turnover ($)/($) ( 365 days) / (Inventory turnover) = Day's sales in inventory ()/()=() (Gross profit) / (Net sales revenue) = Gross profit percentage ($)/($)=(%) 2. Compute days' sales in recelvables during 2020. Assume all sales were on account. (Net credit sales) / (Average net accounts receivables) = Accounts recelvable turnover ratio (8)/(8)=() ( 365 days ) / (Accounts receivable turnover ratio) = Day's Sales in Recelvables