Answered step by step

Verified Expert Solution

Question

1 Approved Answer

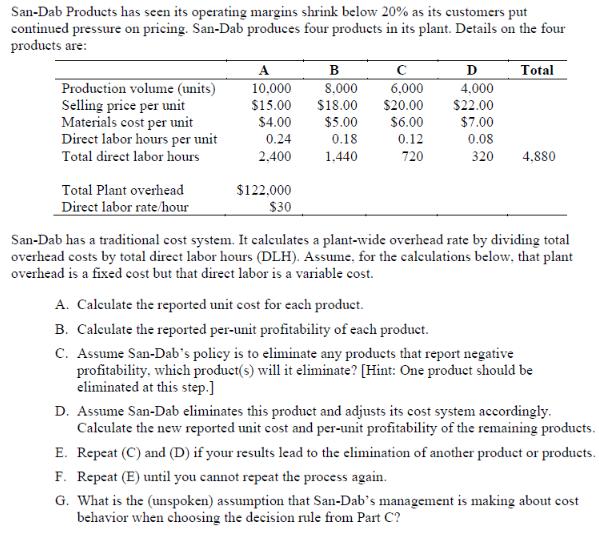

San-Dab Products has seen its operating margins shrink below 20% as its customers put continued pressure on pricing. San-Dab produces four products in its

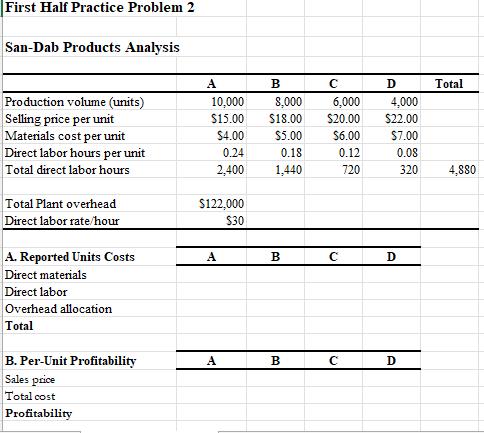

San-Dab Products has seen its operating margins shrink below 20% as its customers put continued pressure on pricing. San-Dab produces four products in its plant. Details on the four products are: Production volume (units) Selling price per unit Materials cost per unit Direct labor hours per unit Total direct labor hours Total Plant overhead Direct labor rate/hour A 10,000 $15.00 $4.00 0.24 2.400 $122,000 $30 B 8.000 $18.00 $5.00 0.18 1.440 6.000 $20.00 $6.00 0.12 720 D 4,000 $22.00 $7.00 0.08 320 4,880 Total San-Dab has a traditional cost system. It calculates a plant-wide overhead rate by dividing total overhead costs by total direct labor hours (DLH). Assume, for the calculations below, that plant overhead is a fixed cost but that direct labor is a variable cost. A. Calculate the reported unit cost for each product. B. Calculate the reported per-unit profitability of each product. C. Assume San-Dab's policy is to eliminate any products that report negative profitability, which product(s) will it eliminate? [Hint: One product should be eliminated at this step.] D. Assume San-Dab eliminates this product and adjusts its cost system accordingly. Calculate the new reported unit cost and per-unit profitability of the remaining products. E. Repeat (C) and (D) if your results lead to the elimination of another product or products. F. Repeat (E) until you cannot repeat the process again. G. What is the (unspoken) assumption that San-Dab's management is making about cost behavior when choosing the decision rule from Part C? First Half Practice Problem 2 San-Dab Products Analysis Production volume (units) Selling price per unit Materials cost per unit Direct labor hours per unit Total direct labor hours Total Plant overhead Direct labor rate/hour A. Reported Units Costs Direct materials Direct labor Overhead allocation Total B. Per-Unit Profitability Sales price Total cost Profitability A 10,000 $15.00 $4.00 0.24 2,400 $122,000 $30 A A B 8,000 6,000 $18.00 $20.00 $5.00 $6.00 0.18 0.12 1,440 720 B B D 4,000 $22.00 $7.00 0.08 320 D D Total 4,880

Step by Step Solution

★★★★★

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the reported unit cost for each product we need to consider the direct materials direct labor and overhead allocation A Reported Unit Cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started