Question: Sandhili Ltd . provides a defined contribution pension plan for its employees. Currently, the company has 4 5 full - time and 7 4 part

Sandhili Ltd provides a defined contribution pension plan for its employees. Currently, the company has fulltime and parttime employees. The pension plan requires the compary to make an annual contribution of per fulltime employee, and $ per parttime employee, regardless of their annual salary. In addition, employees can match the employer's contribution in any given year.

At the beginning of the vear, fulltime and parttime employees elected to contribute to their pension plan by matching the company's contribution. An equal amount of funds was withheld from the employtes' cheques to fund their pension contribution. Both the employees' and employer's contributions are sent to the plan trustee at year end.

Your answer is correct.

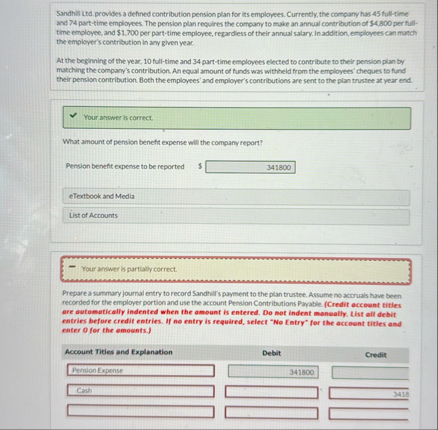

What amount of pension benefit expense will the company report?

Pension benefit expense to be reported

eTextbook and Media

List of Accounts

Your arower is partially correct.

Prepare a summary joumal entry to record Sandhil's payment to the plan trustee. Assume no acconals have been recorded for the employer portion and use the account Pension Contributions Payable. Credit acceant titles are autemetically indented when the ampunt is entered. Do not indent maneally. Llst all debit entries before credit entries. If no entry is required, select No Entry" for the account titles and enter for the emownts.

Account Tities and Explanation

Debil

Credit

Persion Expense

Cash

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock