Answered step by step

Verified Expert Solution

Question

1 Approved Answer

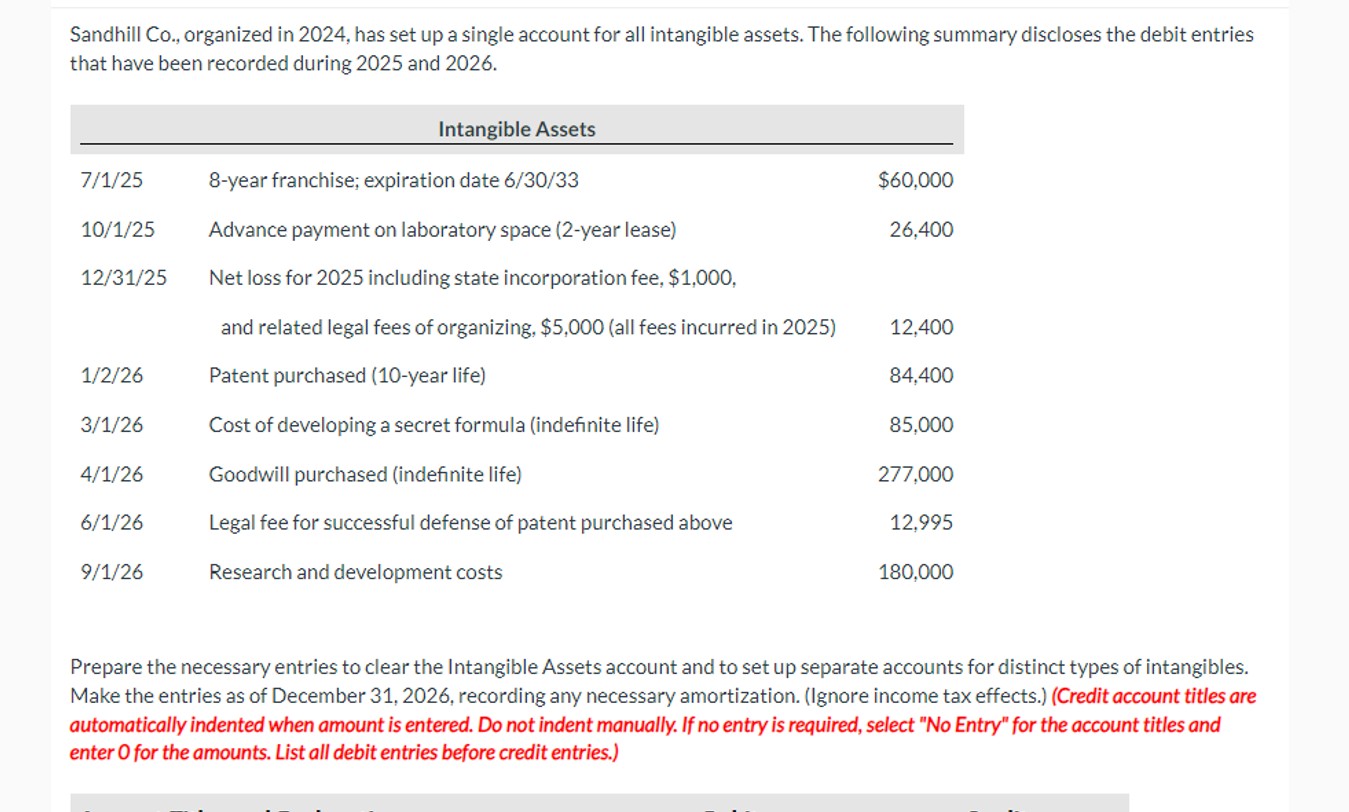

Sandhill Co., organized in 2024, has set up a single account for all intangible assets. The following summary discloses the debit entries that have

Sandhill Co., organized in 2024, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2025 and 2026. Intangible Assets 7/1/25 8-year franchise; expiration date 6/30/33 10/1/25 Advance payment on laboratory space (2-year lease) $60,000 26,400 12/31/25 Net loss for 2025 including state incorporation fee, $1,000, and related legal fees of organizing, $5,000 (all fees incurred in 2025) 12.400 1/2/26 Patent purchased (10-year life) 84,400 3/1/26 Cost of developing a secret formula (indefinite life) 85,000 4/1/26 Goodwill purchased (indefinite life) 277,000 6/1/26 Legal fee for successful defense of patent purchased above 12,995 9/1/26 Research and development costs 180,000 Prepare the necessary entries to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. Make the entries as of December 31, 2026, recording any necessary amortization. (Ignore income tax effects.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Sandhill Co., organized in 2024, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2025 and 2026. Intangible Assets 7/1/25 8-year franchise; expiration date 6/30/33 10/1/25 Advance payment on laboratory space (2-year lease) $60,000 26,400 12/31/25 Net loss for 2025 including state incorporation fee, $1,000, and related legal fees of organizing, $5,000 (all fees incurred in 2025) 12.400 1/2/26 Patent purchased (10-year life) 84,400 3/1/26 Cost of developing a secret formula (indefinite life) 85,000 4/1/26 Goodwill purchased (indefinite life) 277,000 6/1/26 Legal fee for successful defense of patent purchased above 12,995 9/1/26 Research and development costs 180,000 Prepare the necessary entries to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. Make the entries as of December 31, 2026, recording any necessary amortization. (Ignore income tax effects.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution As of December 31 2026 the following entries are necessary to clear the Intangible Assets account and set up separate accounts for distinct t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started