Question

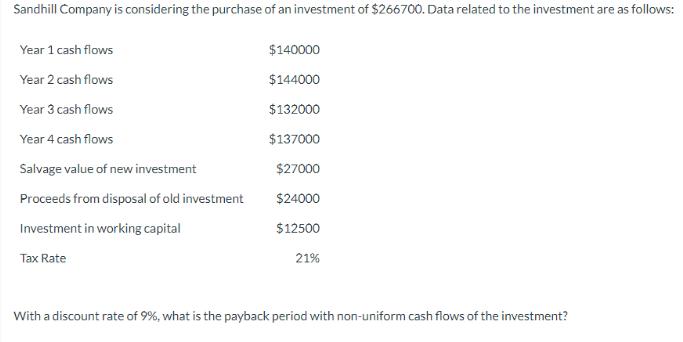

Sandhill Company is considering the purchase of an investment of $266700. Data related to the investment are as follows: Year 1 cash flows Year

Sandhill Company is considering the purchase of an investment of $266700. Data related to the investment are as follows: Year 1 cash flows Year 2 cash flows Year 3 cash flows Year 4 cash flows Salvage value of new investment Proceeds from disposal of old investment Investment in working capital Tax Rate $140000 $144000 $132000 $137000 $27000 $24000 $12500 21% With a discount rate of 9%, what is the payback period with non-uniform cash flows of the investment?

Step by Step Solution

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the payback period with nonuniform cash flows you need to find out in which year the cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Mathematics for Physical Chemistry

Authors: Robert G. Mortimer

4th Edition

124158092, 124158099, 978-0124158092

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App