Answered step by step

Verified Expert Solution

Question

1 Approved Answer

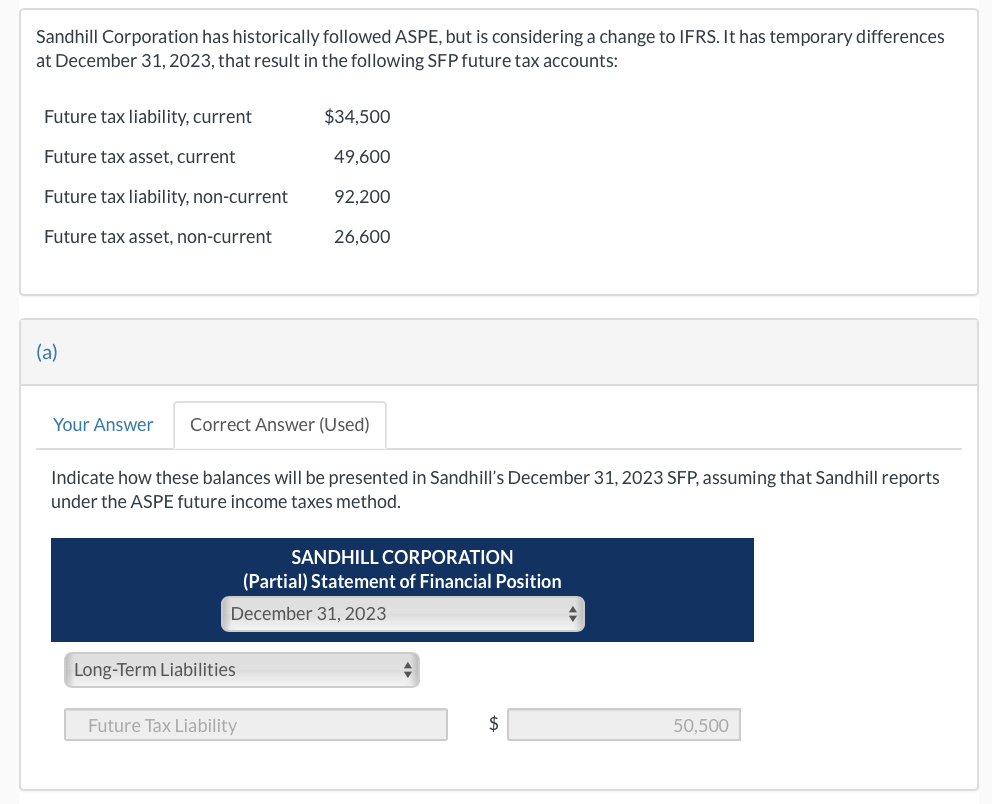

Sandhill Corporation has historically followed ASPE, but is considering a change to IFRS. It has temporary differences at December 31, 2023, that result in the

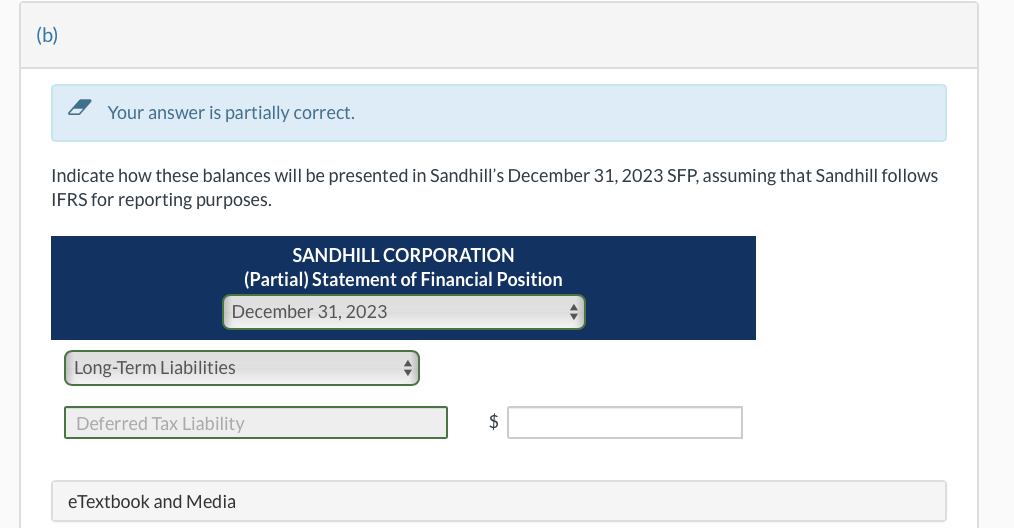

Sandhill Corporation has historically followed ASPE, but is considering a change to IFRS. It has temporary differences at December 31, 2023, that result in the following SFP future tax accounts: (a) Indicate how these balances will be presented in Sandhill's December 31, 2023 SFP, assuming that Sandhill reports under the ASPE future income taxes method. Your answer is partially correct. Indicate how these balances will be presented in Sandhill's December 31, 2023 SFP, assuming that Sandhill follows IFRS for reporting purposes

Sandhill Corporation has historically followed ASPE, but is considering a change to IFRS. It has temporary differences at December 31, 2023, that result in the following SFP future tax accounts: (a) Indicate how these balances will be presented in Sandhill's December 31, 2023 SFP, assuming that Sandhill reports under the ASPE future income taxes method. Your answer is partially correct. Indicate how these balances will be presented in Sandhill's December 31, 2023 SFP, assuming that Sandhill follows IFRS for reporting purposes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started